Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

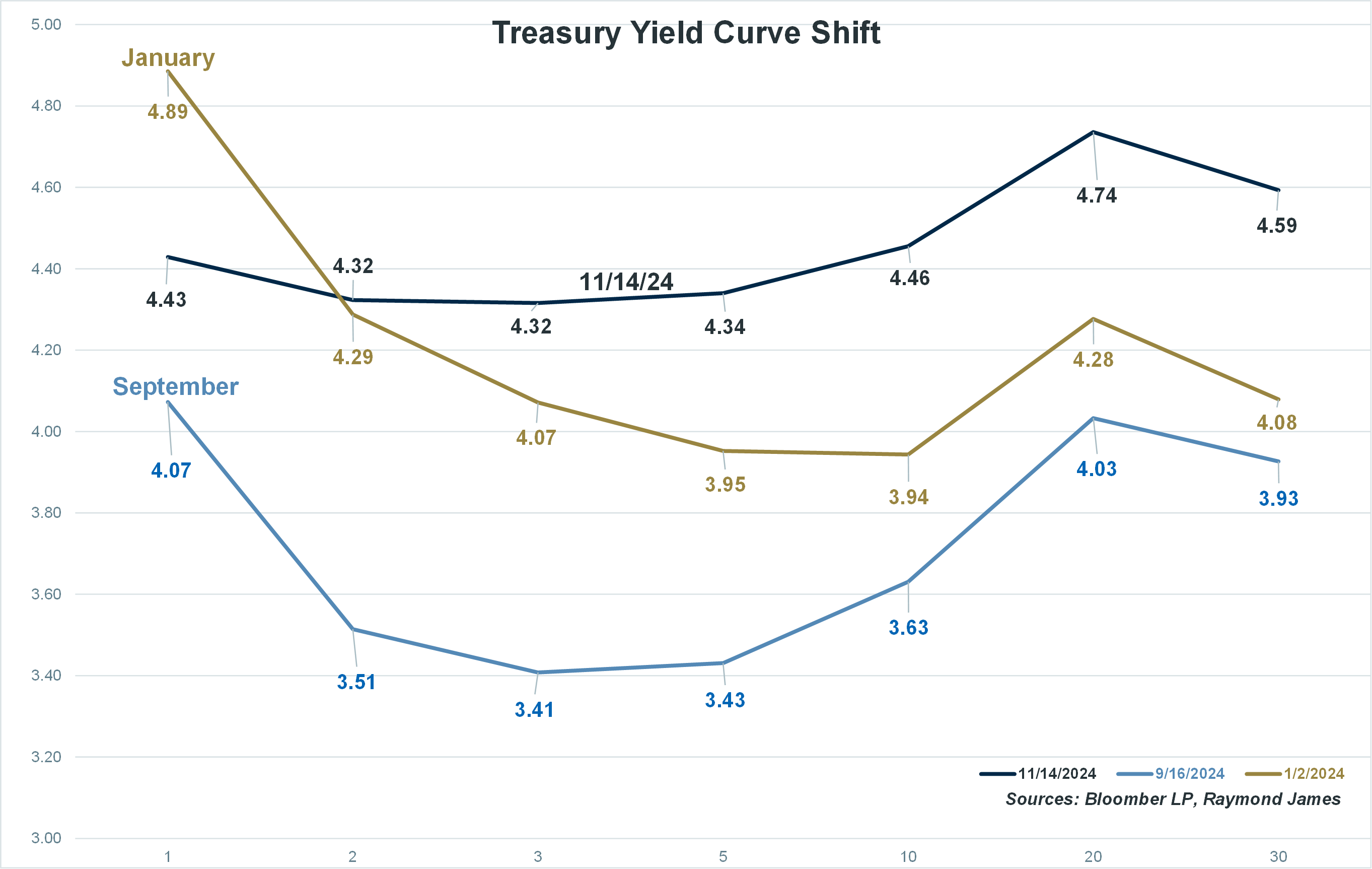

The Treasury yield curve has shifted appreciably all year long. In particular, the last few months have realized substantial rate changes. The shift in the Treasury curve is not isolated. The corporate curve is also changing. Once flat across all maturity points, the corporate curve boasts more of an upward-sloping shape through 10 years before flattening out. The steeper a curve gets, the greater the balance of reward (income) versus risk (duration/price) for investments that stretch further in maturity.

Click here to enlarge

Source: Bloomberg LP

The shape of fixed income product curves may influence how long-term strategies are implemented. Strategic bond plan implementation can sometimes mirror tactical bond strategy implementation, which seeks to take advantage of spot market moves relative to forecasts. The graph highlights how the Treasury curve has changed shape in 2024. The gold line represents how the Treasury curve looked at the start of this year. It was extremely inverted, with short-term maturities offering higher rates of return versus longer-term maturities. The general shape in September was unchanged; however, with each maturity exhibiting a much lower rate. The most dynamic curve shape change started around September (light blue line), evolving into the present Treasury curve shape (dark blue line). Except for maturities inside two years, the Treasury curve is now flat through the 10-year note, where it begins to take on an upward slope.

The timing is not coincidental. The Federal Open Market Committee, which meets eight times each calendar year, lowered the Federal Funds rate in September, the first rate cut since March 2020 when COVID pushed the Fed into a 21-month zero interest rate environment. The Fed lowered the Fed Funds rate by 50 basis points in September and 25 basis points in November. Their last meeting in 2024 is December 18. Should they follow with another 25 basis point cut, it is plausible for the Treasury yield curve to finally become “normal” or upward-sloping after two-plus years of inversion.

The markets are fluid, and so are fixed income strategic planning and implementation. Two evolving rate characteristics are essential considerations for the investment portfolio’s fixed income allocation: 1) the upward-rising curve slope that rewards additional risk with higher income, and 2) the fact that interest rates, in general, are higher than they have been in 17 years. The Fixed Income Solutions team is releasing its fourth quarter publication later this week, which will dive into fixed income strategies that exploit the current rate curve. Ask your financial advisor for your copy.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.