The Uncertainty Tariff

How the 2025 Trump Tariffs Are Impacting Sentiment

April 8, 2025

I

The recent announcement of the 2025 Trump tariffs has sent shockwaves through the global financial markets, even before their implementation. The S&P 500 experienced its worst weekly loss since March 2020, plummeting by 9.1%1 (week ending April 4, 2025). This dramatic downturn highlights a critical issue: the uncertainty surrounding the tariffs is causing more pain than the tariffs themselves.

Market Reaction to Uncertainty

The Dow Jones Industrial Average fell by 7.9%, and the Nasdaq Composite Index dropped by 10.0%1. All 11 sectors of the S&P 500 closed lower, with the Energy sector leading the decline at -14.1%, followed by Technology at -11.4%, and Financials at -10.3%1. This broad-based sell-off underscores the pervasive anxiety gripping investors.

The Trump Administration’s decision to increase the effective tariff rate from 2.5% to over 20%1 has raised the specter of a recession and a bear market. The lack of clarity about the end game of these tariffs is exacerbating market fears. Investors are not just worried about the immediate economic impact but are also grappling with the uncertainty of future policy directions.

The Role of Uncertainty in Economic Sentiment

Federal Reserve Chair Jerome Powell emphasized that the impacts of the tariffs are likely to be larger than expected, with significant uncertainty remaining1. This uncertainty is not just about the tariffs themselves but also about the broader economic policies that might follow. Powell noted that while the tariffs could lead to a temporary rise in inflation, there is a possibility that the effects could be more persistent1.

The uncertainty is causing businesses to hold back on investments and hiring, fearing that the economic environment could deteriorate further. This hesitation is reflected in the broader economic indicators. For instance, U.S. factory activity contracted in March for the first time this year, and prices accelerated sharply for the second consecutive month1.

The Broader Economic Impact

The tariffs have already led to significant market volatility. A Guggenheim Asset Management report highlighted that the market sold off hard on the news of the new tariff scheme1. The fear of a recession and a bear market has increased dramatically, with safe-haven assets like the 10-year Treasury note seeing yields fall to their lowest since last October1.

China’s retaliatory tariffs of 34% on all U.S. goods1 have further fueled market anxieties. The tit-for-tat tariff war is creating a vicious cycle of uncertainty and economic disruption. The lack of a clear strategy or end game from the Trump Administration is making it difficult for businesses and investors to plan for the future.

The Psychological Toll of Uncertainty

The psychological impact of uncertainty cannot be overstated. When businesses and consumers are unsure about the future, they tend to pull back on spending and investment. This behavior can lead to a self-fulfilling prophecy where the fear of economic downturn leads to actions that cause an economic downturn.

The National Retail Federation projected that despite the uncertainty around tariffs, retail growth in 2025 might remain positive2. However, this projection is contingent on the assumption that the tariffs will not lead to a prolonged economic slump. The real danger lies in the prolonged uncertainty, which can erode consumer and business confidence over time.

Conclusion

The 2025 Trump tariffs are a stark reminder of how uncertainty can wreak havoc on economic sentiment. The lack of a clear end game is causing more pain than the tariffs themselves. As businesses and investors navigate this uncertain landscape, the need for clear and consistent policy direction becomes ever more critical. Without it, the economic toll of uncertainty will continue to mount, potentially leading to a deeper and more prolonged economic downturn.

II

How Are We Responding?

In times of fear and uncertainty, the most common question we are asked is how we are responding to the current events. As a trained Behavioral Financial Advisor, I recognize that just “doing something” in times of anguish can help us sooth our sense of being “out of control.” However, doing something for the sake of scratching an emotional itch can feel good in the moment, it may not be the right thing to do for the longer-term.

Portfolio Management

Our job as your portfolio manager is to respond (not react) to changes in the economy, individual company outlooks and most importantly, how these changes may impact the earnings of the companies we hold. As many of you will notice, the cash positions in your actively managed portfolios have increased as our disciplines have triggered sales of individual companies as the markets deteriorated. It is our discipline not to immediately replace those positions, thereby not staying fully invested, while the overall market is still moving lower.

The Horse Race

There will be a recovery in the markets at some point. We think of this time like a horse race. If the next race is an 18-month race, we are looking for the best 10-15 horses to put into the starting gate. Each one with their own strengths and benefits that could make them the next winner. Not unlike a skilled horse trainer, we are combing through the market for companies that have strong market positions, healthy balance sheets and valuations that have come down to a point where they are attractive. You will begin to see the new positions show up in your accounts as the market settles down and we get some clarity as to when the next race may begin.

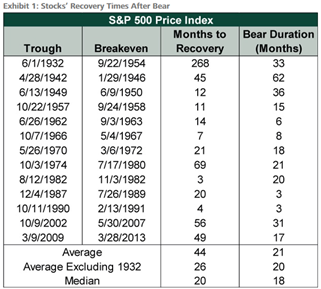

For now, we are not in a hurry. We are confident that our 0-4 year buckets will get us to the next market recovery as history has suggested. As you can see from Exhibit 1, removing the Great Depression, our average recovery time from a 20% decline (bear market) is 26 months.

What may be more encouraging, is the performance we see coming out of these drawdowns. Larry Adam, in his morning “Up and Adam” report on April 8th had the following observation:

“Yesterday, the VIX reached 50 intra-day, the highest level since March 2020. Although this indicates heightened market ‘fear,’ periods of extremely volatility have historically led to opportunities for long-term investors. Since 1990, when the VIX exceeds to, the S&P 500 has averaged a 32% return over the following 12 months and has been positive 99% of the time (with the only negative occurrence in 2008). Despite the likelihood of more volatility, the risk/return profile of U.S. equities over the next 12 months appears more favorable.”

To follow up the data presented above, Exhibit 2 shows the stock returns 12 months after the next bull market begins and it suggests an average return of over 40% (excluding the Great Depression returns from June 1932’s trough).

As of the market’s close on April 8th, the S&P 500 index has lost approximately 12% in the past four trading days alone (dropping from 5667 at April 2nd’s close to 4982 at the April 8th close). This type of loss is not unprecedented as we saw a similar reaction as recently as 2020 during the COVID pandemic. However, this waterfall move down has kicked out most of our momentum positions and left us with our core holdings.

While we are still navigating the lack of clarity from the current administration’s policies, we are building our list of quality companies that have fallen prey to indiscriminate selling and that we find compelling as new entrants into the starting gates of the next horse race.

Summary

In conclusion, our approach during these uncertain times is measured and strategic. We are not rushing to make changes but are instead carefully evaluating the market and identifying strong companies that are well-positioned for the future. By maintaining discipline and focusing on long-term growth, we aim to navigate through this period of uncertainty and emerge stronger on the other side. Our commitment is to ensure that your portfolios are well-prepared for the next market recovery, leveraging historical insights and current market conditions to make informed decisions.

Please continue to reach out with your questions and concerns. Times like these are when we are prone to make our biggest mistakes and together, I am confident we will get through this!

JOSH J. MILES, CPWA®, BFATM

Managing Director

Private Wealth Advisor

Financial Advisor

Sources:

- com: The impact of tariffs is coming. Which households will Trump's new plan cost most? https://www.msn.com/en-us/money/markets/the-impact-of-tariffs-is-coming-which-households-will-trumps-new-plan-cost-most/ar-AA1CaJSl

- com: Tariffs To Have Little Impact On Prices And Growth, Retail Federation Projects https://www.forbes.com/sites/pamdanziger/2025/04/04/national-retail-federation-projects-tariffs-to-have-little-impact-on-prices-or-industry-growth/

Exhibit 1: Global Financial Data, Inc. and FactSet, as of 3/31/2020. S&P 500 Price Index, 12/31/1925 – 3/31/2020. Table counts months as 30.5 days and rounds to the nearest full month.

Exhibit 2: Global Financial Data, Inc. and FactSet, as of 3/31/2020. S&P 500 Price Index, 12/31/1925 – 3/31/2020.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Josh Miles and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Holding stocks for the long-term does not insure a profitable outcome. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification. This is not a recommendation to purchase or sell the stocks of the companies pictured/mentioned. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. You cannot invest directly in an index. Index returns do not reflect any fees, expense, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future.

The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal.

The CBOE Volatility Index (VIX), often referred to as the "Fear Index," is a real-time market index that represents the market's expectations for volatility over the coming 30 days. It is derived from the prices of S&P 500 Index options with near-term expiration dates. The VIX is widely used by investors to gauge market risk, fear, or stress when making investment decision.

Private Wealth Advisor is a designation awarded by Raymond James to financial advisors who have demonstrated mastery in anticipating and managing the expansive financial needs of high-net-worth individuals, families and organizations.