What Lies Beneath: With the bull market in full swing, undercurrents may point to a more volatile 2025

With the bull market in full swing, undercurrents may point to a more volatile 2025.

I

We have had plenty of news over the past quarter to keep us from having restful sleep including election stress, continuing wars, and now trying to understand what to make of the new administration’s policies and their impact on our economy – more on that later. Much of what we are seeing on the global stage will have an impact on world economies and our markets. In these times, I tend to bury myself in research and historical deep dives into times where we saw similar global events to see how markets were impacted. However, I came across an extremely relevant historical event in a most unexpected way.

If you were to look at my bookshelf at home, it will be littered with books about economics, behavioral finance and authors who help us rethink the way the world works like Malcolm Gladwell, Michael Lewis or Nassim Nicholas Taleb (of Black Swan fame). However, my favorite reading pastime involves history, specifically World War II history. This interest has led me to read WWIl fiction like one of my favorite novels of all-time, All the Light We Cannot See written by Boise’s own Anthony Doerr.

On a recent trip to Seattle, we visited our favorite bookstore, Elliott Bay Books at the base of Capitol Hill. I picked up a book by Graham Moore, titled The Wealth of Shadows. The story is a historical thriller set during World War II, of course. The novel follows Ansel Luxford, a tax attorney who joins a secret U.S. Treasury Department team aiming to undermine Nazi Germany's economy. The team engages in economic warfare, using financial strategies to weaken the Nazi regime without direct military confrontation.

The story culminates at the Bretton Woods Conference in 1944, where Luxford and other key figures, including John Maynard Keynes, the great English economist, and the U.S. Treasury’s Harry Dexter White, play crucial roles. The conference aimed to establish a new international monetary system to ensure post-war economic stability and prevent future conflicts. The agreements made there led to the creation of the International Monetary Fund (IMF) and the World Bank, solidifying the U.S. dollar's position as the world's primary trade currency.

Moore's novel highlights the behind-the-scenes economic battles and the significant impact of the Bretton Woods Conference on the global economic order, emphasizing the U.S.'s emerging dominance in the post-war world.

II

2024 has been another blockbuster year for the U.S. stock markets. As of this writing, the S&P 500 is on track for back-to-back 20%+ returns. It is worth noting that the benchmark index has delivered back-to-back years of 20%+ gains just eight times since 1950. If the market's momentum holds, that could foreshadow a big move for the S&P 500 next year. Consider, in six of those previous eight back-to-back 20%+ years, the market rally continued into the third year, generating average returns of 12%.1

Currently, we are just over two years into the current bull market, which kicked off on Oct. 12, 2022. While every bull market is different, a look at the past can help provide context. The average bull market lasts just over five years or 1,866 days. The market bottom occurred just over two years ago, which suggests there's still upside ahead. Additionally, since its trough, the S&P 500 has gained roughly 68%. That pales in comparison to the average bull market, which delivers gains of 180%. The data suggests that we're still in the early days of the current rally.2

Before we sound the “All Clear,” the market in recent days may be telling us a different story. For example, the Dow Jones Industrial Average (DJIA) recently experienced its longest losing streak in 50 years, falling for ten consecutive sessions3. This streak, which ended on December 18, 2024, was the longest since 19743,4. During this period, the DJIA dropped by about 6%3. As of December 30th, only 64 of the 500 S&P 500 constituents was positive in December.5 This pullback comes on the heels of the post-election rally in growth stocks fueled by continued Fed easing in November and the thoughts that the new administration will be friendlier to corporate America (e.g. less regulation and lower corporate taxes).

III

We now turn our attention to 2025. As we’ve discussed in previous posts, forecasting the stock market is a very difficult proposition. We will, no doubt, be inundated by 2025 forecasts ranging from the “the biggest crash of our lifetime” as Harry Dent predicted for 2024 (clickbait headline courtesy of MoneyWise.com shown above) to the more bullish estimates coming from Oppenheimer, who predicts a 17%+ return (S&P 500 target of 7100) in 2025.5

Since the election, we have been pouring over research, economic data, and historical data to try to get a feel for how our economy, and more importantly, how corporate earnings will be impacted by the policies of the incoming administration. There are also some very strong secular trends that we believe can withstand some headwinds, like artificial intelligence (AI), but other areas of the market are more sensitive to monetary or fiscal policy changes.

Let’s take a moment to break down the potential headwinds and tailwinds for the markets in 2025:

Headwinds:

- Impact of Trump’s Policies on Inflation and Interest Rates:

- Trump’s proposed tariffs and tax cuts could increase inflation. For example, a 10% tariff on imports could raise personal consumption expenditures by 0.8 percentage points. Higher inflation could prompt the Fed to adopt a more hawkish stance, potentially leading to higher interest rates.6

- Immigration and Deportation:

- The growth of any country’s economy is based on the growth of its population. The cost, both monetarily and to the collective psychology of our immigrant population, will have an impact on our economy. Mass deportations could have a significant negative impact on our farms, ranches and building industries – to name a few.

- Stock Market’s Denial Over Inflation:

- Despite rising inflation, the stock market continues to march along near all-time highs. Investors are currently downplaying long-term risks in favor of short-term gains, but this could change once Trump’s policies are implemented. The Federal Reserve is expected to continue its data-dependent approach to rate decisions. While the market is now discounting two more quarter point moves lower in 20257, Trump’s policies, such as tariffs and tax cuts, could lead to inflationary pressures, potentially altering the Fed’s long-term plans.

- Housing Market and Mortgage Rates:

- Mortgage rates are expected to rise due to Trump’s fiscal policies. Despite his campaign promises to lower housing costs, tariffs on building materials and higher labor costs could drive up the cost of new homes. The 30-year fixed mortgage rate has already increased to an average of 7.01%8

- Economic and Fiscal Risks:

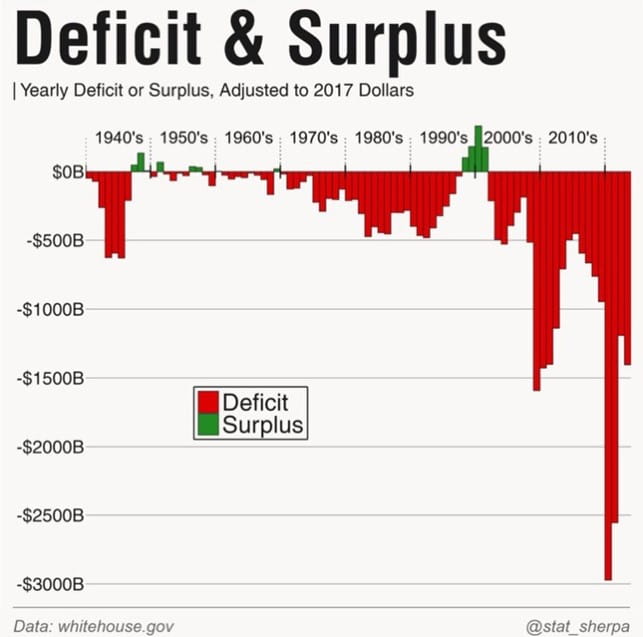

- The U.S. faces significant fiscal challenges, with a national debt of about $35 trillion (124% of GDP). Trump’s plans to extend tax cuts and impose tariffs could exacerbate these issues, leading to higher inflation and interest rates, which could slow economic growth.9

Tailwinds:

- Opportunities for Consumer Stocks:

- Trump’s fiscal policies, such as cutting individual tax rates and removing taxes on Social Security income, could put extra money in people’s pockets, benefiting consumer stocks. Some consumer stocks are already outperforming the indexes in anticipation of Trump’s return to the White House.

- Corporate Tax Cuts and Earnings:

- Taxes on companies producing goods domestically are expected to fall from 21% to 15% under Trump, potentially lifting corporate earnings by over 7%. Corporate earnings on the S&P 500 are expected to grow by 14.8% in 2025.10 This compares to an average of 6-7% over the past 20 years.11

- Small-Cap Stocks and Banking Sector:

- Small-cap stocks have reached new highs following Trump’s victory, and more gains could follow due to expectations of a robust economy. Regional bank stocks have also rallied, anticipating relaxed banking regulations and lower tax rates for domestic producers.

- Continuing Artificial Intelligence Arms Race:

- The investment in artificial intelligence (AI) is expected to be substantial in 2025. According to recent forecasts, global spending on AI is projected to reach approximately $500 billion.12 This significant investment reflects the growing importance of AI across various industries, including healthcare, finance, and technology.13

These takeaways highlight the current market optimism following Trump’s election victory, but also underscore the potential risks and uncertainties that could impact the economy and markets in the future. We will be watching data and developments as they unfold for clues on how to best position portfolios for the long-term.

IV

Now to what lies beneath this market and what may be contributing to the recent volatility. As we enter 2025, we see the U.S. debt issue and rising interest rates on U.S. securities as the biggest threat to the current bull market.

U.S. Debt and Its Impact on the Bull Market

Historical Context: Since the end of World War II and the Bretton Woods Agreement, the U.S. dollar has been the world's primary trading currency. This status is now at risk due to the growing U.S. debt burden and a recognition by world economies that it may be time to find an alternative.

BRICS Nations' Challenge: Brazil, Russia, India, China, and South Africa (BRICS) recently met in Cape Town to discuss alternatives to the U.S. dollar, aiming to reduce the dominance of Western economies, particularly the U.S. and the U.S. dollar.14

Government Borrowing Concerns: The Bank for International Settlements (BIS) has warned that government borrowing habits pose a significant danger to global economic stability. Senior official Claudio Borio recently emphasized the need for public-finance repair to prevent alarm among bond investors. The U.S. debt to GDP ratio is nearing 120% and is projected to match Japan-levels of debt over the coming decade.15

Rising Interest Costs: Over the past year, U.S. interest costs have surged due to higher rates on new and rolled-over debt. The Federal Reserve's rate hikes have led to increased borrowing costs, with the interest rate on 10-year Treasury bills rising from under 2% in early 2022 to around 4.5% by the end of 2024. In 2024, net interest costs for the U.S. government totaled $882 billion, and these costs are projected to nearly double over the next decade.16

Market Sentiment: Recent market behavior, such as the spike in Treasury yields and U.S. sovereign credit default swaps, indicates growing concerns about the sustainability of government debt. The BIS has repeatedly cautioned that public debt risks becoming unsustainable, urging countries to act to ensure fiscal sustainability before sharp adjustments in bond yields occur.

The U.S. debt issue, coupled with rising interest rates, poses a significant threat to the current bull market. If not addressed, these factors could undermine the U.S. dollar's status as the world's central trading currency and lead to broader economic instability and more specifically, threaten the recent dominance of the U.S. equity markets.

V

I recognize the tone of this note is focused on what could go wrong, but I would be remiss to not mention that our economy over the past three years has been able to grow in the face of significant headwinds including monetary tightening by the Fed, inflationary pressures and global conflicts igniting in Europe and the Middle East. With inflation in a much more manageable position, the Fed reversing course to being more accommodative and corporate investment into AI continuing at a breakneck pace – our economy is in a great position to produce growth well into 2025 and beyond.

As we enter the new year, we want to thank you for your continued trust in our team. As always, please reach out with any questions or concerns.

Happy New Year!

JOSH J. MILES, CPWA®, BFATM

Managing Director

Private Wealth Advisor

Financial Advisor

Notes:

3. yahoo.com: Stock market today: Dow logs longest losing streak since 1978 as stocks slide ahead of Fed decision

4. investopedia.com: Here’s Why the Dow Just Had Its Worst Slump in 50 Years

5. thebarronsdaily.com: December 30, 2024 Stock Market’s Epic Year Fizzles Out. Why There Are Red Flags for 2025.

6. Housingwire.com: Trump tariffs would result in homebuilder price increases

7. openingbelldailynews.com: Economic Outlook: Wall Street's most bullish firm shares 2025 forecast

8. bankrate.com: Majority of rates increase | Current mortgage rates, December 26, 2024

9. Bloomberg Economics. Note: Debt as a proportion of GDP

10. Benzinga.com: S&P 500 Ends 2024 23% Higher, Experts See Double-Digit Growth For 2025

11. Einvestingforbeginners.com: Historical EPS Data for the S&P 500 – 20 Years of Average YOY Growth

12. msn.com: Fed lowers key interest rate by another quarter point but sees just 2 cuts in 2025

13. goldmansachs.com: AI investment forecast to approach $200 billion globally by 2025 | Goldman Sachs

14. dw.com: BRICS leaders discuss dollar alternative – DW – 10/24/2024

15. pharmsource.org: Key Highlights from the 2024 BRICS Summit in Cape Town

16. pgpf.org: The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Josh Miles and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Holding stocks for the long-term does not insure a profitable outcome. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification. This is not a recommendation to purchase or sell the stocks of the companies pictured/mentioned. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. You cannot invest directly in an index. Index returns do not reflect any fees, expense, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future.

The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal.

Private Wealth Advisor is a designation awarded by Raymond James to financial advisors who have demonstrated mastery in anticipating and managing the expansive financial needs of high-net-worth individuals, families and organizations.