Lessons from the Court

B Y J O S H J. M I L E S

I

In a recent commencement speech, eight-time Wimbledon champion Roger Federer noted that despite winning almost 80% of his 1,526 matches, he only won 54% of the points. His message is powerful: Perfection is impossible, and that after each point you must quickly learn and then move on, “Because it frees you to fully commit to the next point and the next point after that, with intensity, clarity, and focus.” Federer’s true strength was overcoming short-term noise and setbacks to remain focused on the long-term signal of winning.1

Roger Federer’s insight resonates not only in tennis but also in the world of investing. Let’s draw parallels between his wisdom and the stock market:

- Winning Matches vs. Winning Points: Federer’s impressive match win percentage highlights that winning individual points doesn’t guarantee overall victory. Similarly, in investing, daily market fluctuations (the points) don’t always determine long-term success (the match).

- Perfection Is Impossible: Federer acknowledges that perfection is unattainable. Investors should recognize that predicting every market move accurately is equally impossible. Instead, focus on consistent strategies and adaptability.

- Learning and Moving On: After each point, Federer learns and moves forward. Investors should do the same—learn from market events, adapt, and stay committed to their long-term investment plan.

- Intensity, Clarity, and Focus: Federer’s mindset applies to investing too. Stay focused on your financial goals, maintain clarity about your strategy, and invest with intensity—even during market noise.

- Long-Term Signal: Federer’s strength lies in focusing on the long-term signal (winning matches). Similarly, investors benefit from staying committed to their portfolio despite short-term setbacks.

II

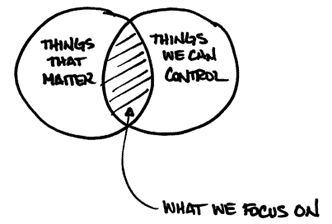

Our simplistic way to understand Federer’s wisdom is to digest the following Venn diagram which is prominently displayed in our offices to remind us that some things are simply out of our control (perfection is impossible), especially when it comes to the markets. This leads us to narrow our focus on the things that matter (with intensity, clarity and focus) and to build disciplines that keep us focused on successful long-term outcomes. This is our role in your financial lives – so you don’t have to “train” every day but instead go out and do the things that your financial security affords you to do.

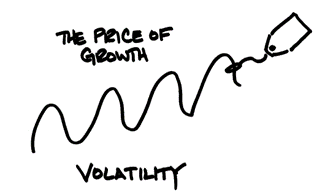

So, whether on the tennis court or in the stock market, it’s about resilience, adaptability, and keeping your eyes on the ultimate goal. During times of volatility, like we are seeing over the last few days, it is our role to help you to overcome emotion and keep you focused on your individual long-term goals.

Remember, the price of growth is volatility. Please reach out to us if you have any questions and thank you for your continued trust in our guidance.

Warm Regards,

Notes:

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Josh Miles and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification.