The Grinch Who Stole Christmas

By Josh J. Miles

We can debate which version of the “The Grinch” we like best (the original animated version or the live action Jim Carey version) but both are must-see holiday viewing in our home. Watching this year, I could not help but make the correlation to the financial markets. It sure feels like the Grinch entered our homes and sucked the joy out of the season and the markets.

As we get ready to close out the year, we will begin to hear about market price targets and projections for 2023. Specifically, this is the time when strategists from various firms come out with year-end targets for the S&P 500 index. There are so many variables that go into the price of individual stocks – not to mention macro issues like interest rates, inflation, geopolitics and future monetary policy decisions. While there is some value in the exercise, the difficulty of the task is shown by the wide range of estimates that have already begun to be shared within Wall Street firms. As we wrote about in our post over the summer, The Fallacy of Forecasting, forecasting the stock market is a near futile proposition. However, walking through the math that goes into these estimates can be a helpful exercise as we identify the risks we must consider going into 2023.

One of the most important factors in estimating where the market may trade is forward earnings estimates. As we have discussed previously, the direction in earnings and future prices are highly correlated (0.97 since 19571).

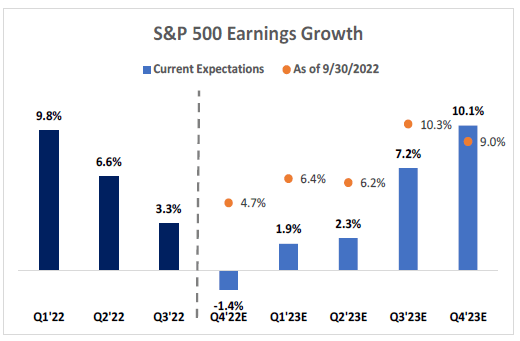

Earnings growth has been slowing in the first three quarters of 2022 and Raymond James is currently estimating that we will see earnings actually be lower in Q4 2022 than they were in Q4 2021. As you can see from the chart below,2 current estimates have come down steeply from the estimates at the end of September.

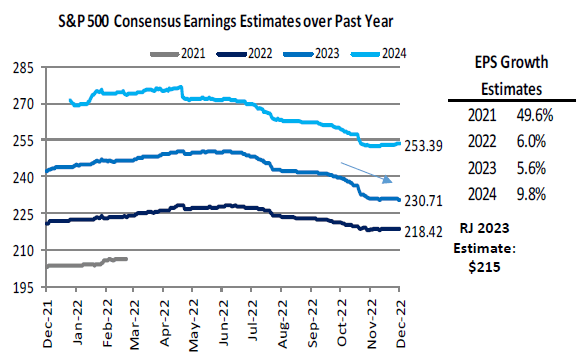

According to Tavis McCourt, Raymond James Institutional Equity Strategist and his team, we see 2023 aggregate earnings for the S&P 500 coming in around $215. The aggregate estimates of Wall Street strategists are still estimating earnings coming in around $230 (see chart below2).

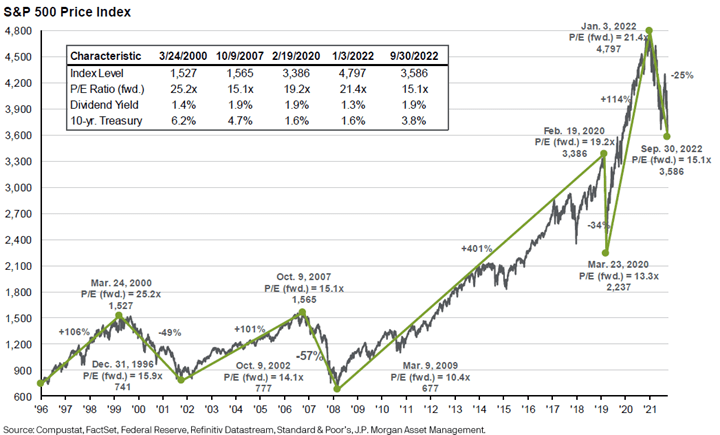

Once we have an idea of earnings estimates, we need to assign an appropriate Price/Earnings ratio (P/E). In the chart below, we can see that P/E multiples have ranged from 10.4x (2009 low) to 25.2x (the Dot.com bubble highs in 2000) over the past 25 years. The 25-year average P/E is 16.84x.

If we take Raymond James’ estimate of $215 of earnings for the S&P 500 and multiply it by the 25-year average P/E of 16.84x, we get a price target of 3620 on the S&P 500. As of Friday, December 16, 2022 the S&P 500 closed at 3852. This target would imply a 2023 decline of nearly 6%. Taking the street estimate of $230 and the 25-year average P/E we get a price target of 3873. Essentially a breakeven from where we closed on Friday.

This exercise is simplistic as we are not taking into account large factors that influence P/E multiples such as inflation, short- and long-term interest rates and Fed policy. As this exercise is meant to help put price targets in perspective, let’s look now at what strategists are predicting for 2023. Actual price targets from Wall Street firms range from a low of 3675 to a high of 4500.3 This is the widest range of estimates we have seen since the Great Financial Crisis in 2009.

The inherent problem of forecasting lies in the known unknowns. We must recognize the various possible outcomes of significant events in the world including China and its continued struggle with COVID-related shutdowns, the Ukraine war, global central banks and their response to the global economic slowdown and inflation. The aggregate, of which, is simply impossible to know. And this is but a small list of variables we must consider. Each of which has various possible outcomes.

The other problem of price targets lies in the fact that they lend themselves to behavioral biases like overconfidence, illusion of control and anchoring. When a target is so specific – down to the single digit, it gives the illusion of certainty. History shows these targets are rarely correct and when they are – the same strategist is rarely correct in successive years.

A famous example of this is the story of Elaine Garzarelli. While working as a stock analyst and fund manager at Shearson Lehman, she became known for predicting Black Monday, the stock market crash of 1987. In 1988, Garzarelli's fund was the worst-performing fund among growth stock funds. From 1988 to 1990, Garzarelli's fund underperformed the S&P 500 average by about 43 percent.4 The idea that even a broken clock is right twice a day comes to mind. If you make enough predictions, ultimately you will be close to correct at some point! On that note, we will be providing our outlook for 2023 in our upcoming Year-End Review and 2023 Outlook newsletter in early January. Needless to say, we will not be providing any S&P 500 price targets.

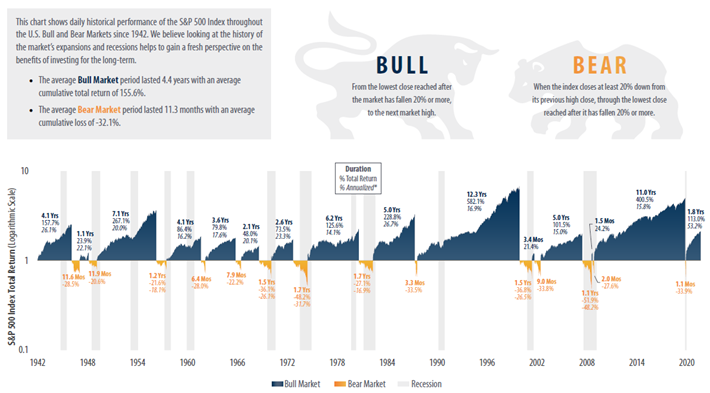

In the meantime, I will leave you with following chart that helps put all this into a bit wider perspective. As you can see, going back nearly 80 years, the average bull market lasts 4.4 years while the average bear market lasts 11.3 months. While we do expect more volatility in the months ahead, when we look at where we may be in 2024 and beyond it is easier to assume a new bull market may be well under way.

As you take in this chart5 and see that bull markets historically last over four times as long as the bears, it may remind you – like it did me – that the Grinch only temporarily stole Christmas. Remember, he gave all the gifts back and Christmas was had by all! History has shown that when the Market Grinch strikes, it is only a matter of time before he gives us back our gains. So, keep the faith and have a wonderful holiday season!

Warm Regards,

Notes:

- Source: 2022 Invesco – Compelling Client Conversations.

- Source: Raymond James Institutional Equity Strategy 2023 Outlook, December 13, 2022

- Source: Bloomberg LLC. As of Dec 6, 2022

- Source: Excerpted from Wikipedia.com

- Source: First Trust Advisors L.P., Bloomberg. Daily returns from 4/29/1942 - 12/31/2021. *No annualized return shown if duration is less than one year. Past performance is no guarantee of future results. These results are based on daily returns–returns using different periods would produce different results. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. This chart is for illustrative purposes only and not indicative of any actual investment. These returns were the result of certain market factors and events which may not be repeated in the future.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Josh Miles and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Holding stocks for the long-term does not insure a profitable outcome. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification. This is not a recommendation to purchase or sell the stocks of the companies pictured/mentioned. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. You cannot invest directly in an index. Index returns do not reflect any fees, expense, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future.