Gold Stars

By Josh J. Miles

I think we all have different feelings about the gold stars that our 4th grade teacher gave us as a reward for completing a task (reading, multiplication tables, etc). C’mon – you remember that chart. It sat on the side wall, near the doorway and it reminded you every day, whether you were succeeding or failing. If you have a pulse, it had an impact on you. For my competitive mindset, it motivated me to work hard to stay near the front of that chart (though I could never get past Ian Woods – I remember him for exactly that reason – passing him was my goal – and it was a goal that was never realized).

In their paper published in 2016, Booth School of Business researchers Kaitlin Woolley and Ayelet Fishbach found that there is a key to goal setting and successfully achieving those goals. They found that people primarily pursue long-term goals, such as exercising or investing, to receive delayed rewards (e.g., improved health or the ability to retire comfortably). However, they found that the presence of immediate rewards is a stronger predictor of persistence in goal-related activities than the presence of delayed rewards.1 As a goals-based financial advisory team – we recognize that one of the most difficult tasks we have is helping our clients stay focused on those long-term goals through difficult times.

Diverse research across behaviors (including physical activity, education, and consumer behavior) suggests that goals both energize and direct behavior and create the frame through which a behavior is perceived and viewed.2 As discussed above, the ability to stay focused on that goal in the absence of immediate reward may be one of the largest hurdles we face as investors with lifetime goals. While the research may not have been complete back in 1981, Mrs. Griffiths (my 4th grade teacher) was on to the fact that those gold stars helped to keep us motivated to complete our times tables or read those additional pages.

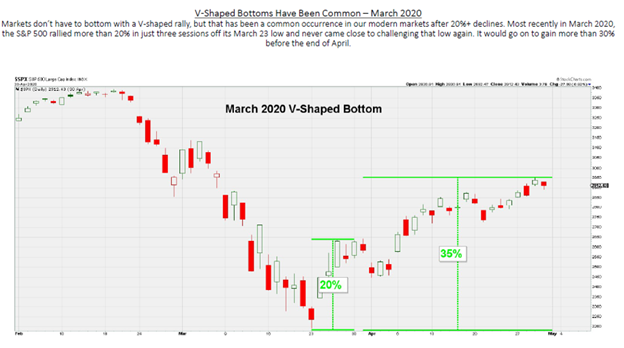

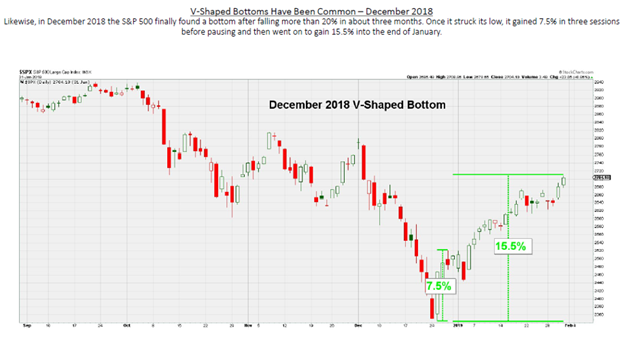

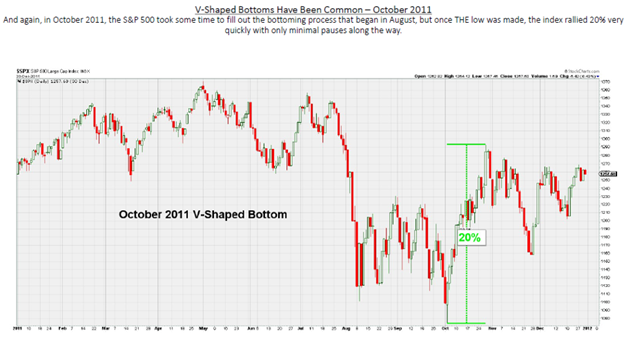

The market also likes to give gold stars. As Jeff Saut pointed out in his November 28th morning note, “the S&P 500 has rallied from its October 13th low of 3491 into last Friday’s closing price of 4026.12. That’s a gain of 15.3%, which would be a pretty good yearly gain.” In looking back at past market downturns, the market has given some gold stars to those investors who were patient and kept their focus on the long-term goals. To wit, see the following:

I have two key take aways when I review these market bottoms and recoveries.

First, we have had only four (including 2022) greater than -20% pullbacks since the September 11th attack and ensuing recession in 2002 (covering 20 years). Of which, one was the COVID-induced drawdown in 2020 that lasted less than 5 months and the other two were in 2008 and 2009 during the Great Financial Crisis (GFC). That is only one every 5 years, on average.

The second takeaway is that once the market realizes the bottom is in – it is too late. As previously noted by the Saut Strategy team, we have just experienced a 15% recovery in the markets and most of us do not feel any better for it (because psychologically – we are comparing our current values to our water-stained chalk marks from the 2021 market highs). Looking at the other declines highlighted above, we see that moves between 15% - 40% are possible in a very short amount of time. Those are gold stars for the patient investor.

Now, let’s not allow our biases to get the best of us. We have two major biases to confront when markets are volatile:

Recency Bias: a predisposition for investors to recall and emphasize recent events and/or observations. A person exhibiting this bias will extrapolate recent patterns into the future where no pattern exists. At this time, it can be easy to assume the market will continue to fall further (and it still may). However, looking at prior declines, the market has always recovered to make new highs in the future.

Anchoring Bias: Investors, in general, are often influenced by purchase points or arbitrary price levels (like recent highs or recent lows) and tend to cling to these numbers when facing questions like, “should I buy or sell this investment?” Or in planning, “should I take this trip or not?” Suppose that your portfolio is down 25% from the high it reached last year. Frequently a person with this bias will resist selling or doing what is planned until the market gets back to the level they are anchored to. This bias is not based on rationality but a point in time that may not have any influence on the decision needing to be made.

While we haven’t received much positive reinforcement in 2022, the most recent recovery should remind us that the markets do have a long-term bias to the upside. Let’s take our immediate reward (+15% / gold star) for what it is – a reward for good behavior – and look forward to better days ahead. If you have any immediate cash needs or have had a change in plans – please be sure to contact us so we can make sure your plan and buckets are properly aligned.

Warm Regards,

Notes:

- Kuhl J. A functional-design approach to motivation and self-regulation: the dynamics of personality systems and interactions. In: Boekaerts M, Pintrich P, Zeidner M, editors. Handbook on Self-Regulation. San Diego (CA): Academic Press; 2000. p. 111–69.

- Kaitlin Woolley and Ayelet Fishbach, authors. Immediate Rewards Predict Adherence to Long-Term Goals. Personality and Social Psychology Bulletin. Volume 43, Issue 2.

- Chart Source: Saut Strategy 2022

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Josh Miles and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Holding stocks for the long-term does not insure a profitable outcome. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification. This is not a recommendation to purchase or sell the stocks of the companies pictured/mentioned. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. You cannot invest directly in an index. Index returns do not reflect any fees, expense, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future.