Election Day

And the seductive allure of pessimism

Election Day – it has changed. It may still hold the ideological feeling of pride that accompanies the “I Voted” sticker we wear as we leave the polling station, but there are other feelings. It seems that the last several years have been defined by a fear of America slipping into the political abyss. One that undermines democracy itself. The extreme tails of either party are given the microphones while the purple majority – Republicans and Democrats who truly want the best for the whole of America but just have different ideas on how to get there – are drowned out. The outcomes will be contested before the first vote is cast. The rhetoric will turn antagonistic as the loudest voices capture the headlines as news outlets know pessimism and fear attracts eyeballs.

As former president, Richard Nixon, said in 1975, “People react to fear, not love--they don’t teach that in Sunday school, but it’s true.”President Nixon knew what the case has been for hundreds of years – that there is an intellectual allure to pessimism.

In his book, Weaponized Lies: How to Think Critically in the Post-Truth Era, author Daniel J. Levitin breaks down how easily we are deceived by statistics and figures. We are surrounded by fringe theories, “fake news” and pseudo-facts. It's becoming harder to separate the wheat from the digital chaff. How do we distinguish misinformation, distortions, and outright lies from reliable information?

As an example, we need to look no further than the numerous political adds that run right before any election. Many of which use outright fearmongering – quoting loosely derived statistics trying to sway our vote.

Levitin groups his field guide into two categories—statistical misinformation and faulty arguments—ultimately showing how science remains the bedrock of critical thinking. The challenge is understanding that there are hierarchies of source quality and bias that distort our information feeds via every media channel, especially social media. We may expect newspapers, bloggers, the government, and Wikipedia to be factually and logically correct, but they often are not. We need to think critically about the words and numbers we encounter if we want to make rational decisions based on this data. This means checking the plausibility and reasoning—not passively accepting information, repeating it, and making decisions based on it.

The aforementioned pessimism has turned into one of America’s favorite pastimes. It doesn’t take long for this outlook to take hold of our youth. Take, for example, Brooklyn high school senior, Chanie Ghorkin’s, poem that recently attracted a lot of attention:

Today was the absolute worst day ever

And don't try to convince me that

There's something good in every day

Because, when you take a closer look,

This world is a pretty evil place.

Even if

Some goodness does shine through once in a while

Satisfaction and happiness don't last.

And it's not true that

It's all in the mind and heart

Because

True happiness can be attained

Only if one's surroundings are good

It's not true that good exists

I'm sure you can agree that

The reality

Creates

My attitude

It's all beyond my control

And you'll never in a million years hear me say

Today was a very good day1

Pessimism is seductive. As Kahneman and Tversky pointed out in their groundbreaking research on behavioral finance, pessimism is rewarded by a corresponding increase in emotion. We feel negative outcomes at nearly twice the emotional response as we feel positive outcomes. Of course, our political parties know this as well.

In a society that is already preoccupied and fueled by “snippet” information that can be conveyed in 280 characters, it is easy to evoke fear without providing real data. Fearmongering and the use of half-truths are the tools of today’s politics. “A half-truth is even more dangerous than a lie. A lie, you can detect at some stage, but half a truth is sure to mislead you for long,” Anurag Shourie wrote in his novel, Half a Shadow. This is true in our political arena – but it is also the case in investment journalism.

The investing newsletter industry has profited from the knowledge that we are drawn to pessimism and that we assign a higher intellectual value to predictions of doom and gloom. John Stuart Mill, an English member of parliament, wrote in the 1840’s: “I have observed that not the man who hopes when others despair, but the man that despairs when others hope, is admired by a large class of persons as a sage.”2

It is the rare newsletter writer that takes the optimists’ viewpoint. Even well-respected industry magazines have used these bold, pessimistic views to their advantage. In 1979, BusinessWeek famously announced “The Death of Equities.” This was the last time that inflation was running hot and then Fed Chair, Paul Volcker was beginning his fight against inflation by raising rates. As we know all too well, fighting the Fed – or owning stocks through a rate hiking cycle – can be difficult. But, by 1982, Mr. Volcker was successful in bringing down inflation and the market started one of the longest bull markets in history – leading to a nearly 7000% gain since then.3 “Not bad for a corpse,” as Bloomberg reported in a recent follow up to the original BusinessWeek article.

Optimism may not sell, but ignore it at your own peril.

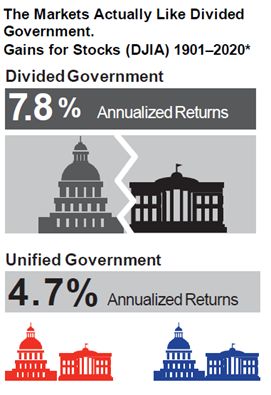

First, let’s discuss politics as it relates to the stocks. If you are voting for better returns ahead, you should hope for a divided government. As you can see from the graphic below4, the Dow Jones Industrial Average (DJIA) has averaged 7.8% when we have gridlock (divided government). That is over 3% better than when one party holds the Executive Branch and the Legislative Branch of government (unified government).

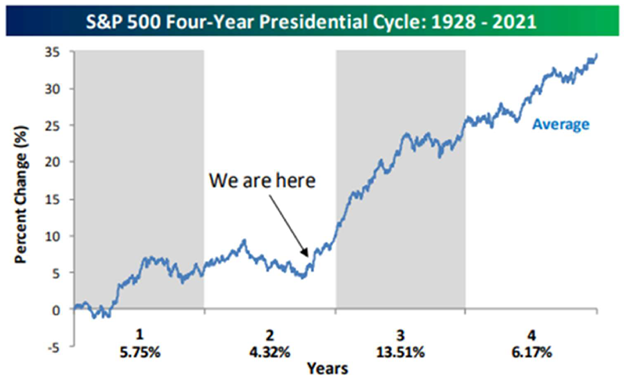

Regardless of today’s political outcome. The stock market is entering the historically best 12-month period of the presidential cycle (see chart below5):

The middle part of year two of the four-year Presidential Cycle has historically seen the worst performance (the period we just passed), but the last two months of year two and the first half of year three have typically seen a big upside move (with the whole of year 3 averaging 13.51%). Now, history does not necessarily repeat itself, but it often rhymes.

As for the future of our country, which we recognize will be led by the next generation, like Chanie Ghorkin, who may vote for the first time this fall – I once again leave you with her poem. This time, I will simply ask you to read it from the bottom line to the top line.

Today was the absolute worst day ever

And don't try to convince me that

There's something good in every day

Because, when you take a closer look,

This world is a pretty evil place.

Even if

Some goodness does shine through once in a while

Satisfaction and happiness don't last.

And it's not true that

It's all in the mind and heart

Because

True happiness can be attained

Only if one's surroundings are good

It's not true that good exists

I'm sure you can agree that

The reality

Creates

My attitude

It's all beyond my control

And you'll never in a million years hear me say

Today was a very good day

Perspective matters – and I am optimistic our future is in good hands.

Warm Regards,

Notes:

1. https://www.cbsnews.com/newyork/news/worst-day-ever-poem-goes-viral/

2. Adapted from the book The Psychology of Money. Morgen Housel

3. https://www.moneymorning.com.au/20220503/the-death-of-equities-is-inflation-killing-the-stock-market.html

4. Data Source: Bloomberg LP, 12/31/2021. Graphic Source: 2022 Compelling Wealth Conversations – Invesco. 12/31/2021

5. Source: Bespoke Investment Group

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Josh Miles and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Holding stocks for the long-term does not insure a profitable outcome. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification. This is not a recommendation to purchase or sell the stocks of the companies pictured/mentioned. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. You cannot invest directly in an index. Index returns do not reflect any fees, expense, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future.