Why Didn't We Sell?

Putting downturns into perspective.

“Why didn’t we sell?” Good question. It needs an answer.

But before I answer that question, I would like to tackle the source of the question itself, hindsight bias. Hindsight bias, also known as the knew-it-all-along phenomenon or creeping determinism, is the common tendency for people to perceive past events as having been more predictable than they actually were. People often believe that after an event has occurred, they would have predicted or perhaps even would have known with a high degree of certainty what the outcome of the event would have been before the event occurred. Hindsight bias may cause distortions of memories of what was known or believed before an event occurred and is a significant source of overconfidence regarding an individual's ability to predict the outcomes of future events.1

In the sports world, hindsight bias presents itself around the water cooler on Mondays – thus the “Monday morning quarterback” conversations about the poor play call that would have changed the game. Or, “I knew that upset was going to happen!” After the fact, it is very easy to see how a particular outcome came to be (because we experienced it).

Think back to the big game (XLIX) between the New England Patriots and the Seattle Seahawks in 2015. For those who are not big football fans, let me set up the key moment of this game. The Patriots had scored 14 unanswered points in the fourth quarter to take a 28-24 lead over the Seahawks with just over two minutes remaining in the game. The Seahawks, led by quarterback, Russell Wilson and running back, Marshawn “The Beast” Lynch, drove to the New England one-yard line with seconds remaining in the game.

Sidenote: The Seahawks fielded the #1 rushing attack in the league and Marshawn Lynch finished the 2014 regular season with over 1,306 rushing yards and a league leading 13 rushing touchdowns.

Given this knowledge, it was obvious the Seahawks would run “The Beast” into the endzone for the game-winning touchdown. Right? Not so. Seahawks head coach, Pete Carroll opted to throw a short pass that was intercepted by the Patriots and ended the game. Hindsight bias exploded. Monday morning quarterbacks were all a-flutter with the obvious conclusion that Coach Carroll only needed to run the ball to win the game.

Once we experienced the failed outcome, it is easy to speculate about the alternative solutions. In the heat of the moment, the entire world assumed the Seahawks would run the ball. They were the best running team in the league! Coach Carroll’s play call would have been called “brilliant” if it had resulted in the winning touchdown – because he did the opposite of what everyone expected. Hindsight is 20/20, but let’s not mistake that for knowing the best path forward – in the moment.

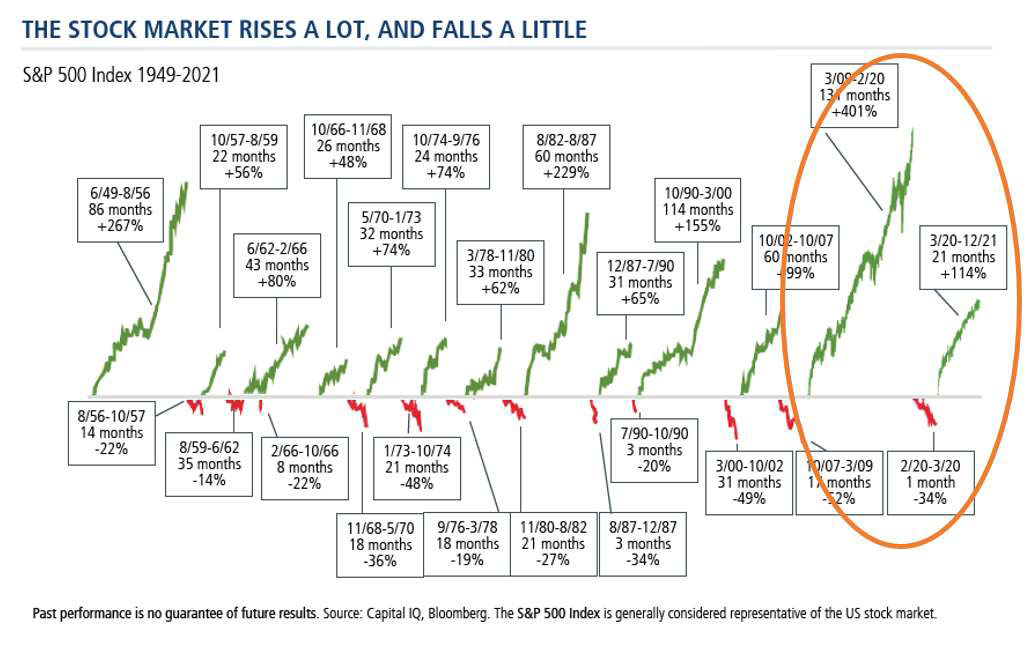

Getting back to the question at hand – “Why didn’t we sell?” – comes down to perspective. For the past decade, the market has been bought with each dip. In fact, from the March 2009 low, the market gained over 401% over the next eleven years without experiencing a -20% decline.

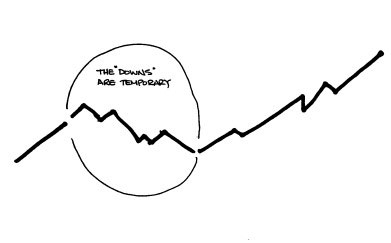

Not until the COVID induced shutdowns, did the market experience a bear market (defined as a market that declines greater than 20%). As we all can easily recall, that “bear” only lasted one month before the market began its “V-shaped” recovery and grew +114% over the ensuing 21 months. Taking an even broader view of the S&P 500 since 1949 in the graphic above2 , we can see that the “downs” tend to be much shorter than the “ups.” Or simply put, the downs are temporary.

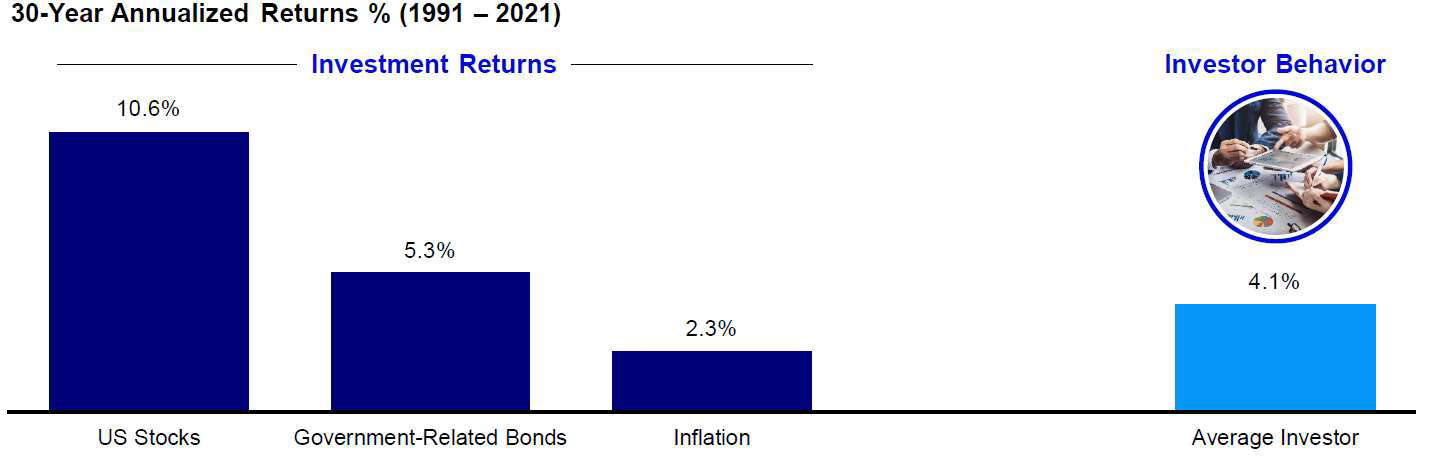

DALBAR, Inc., a leading financial services market research firm ran a study of investor returns from 1991 to 2021. What they found through their research is the average investor underperformed the overall stock market by over 60%3 .

The study looks at investor behavior by examining fund flows into and out of stock and bond funds. What they found was that investors tended to pile into stocks after they had shown sizeable gains and then sold those funds after they experienced down periods. And then they repeated that same process during the inevitable recovery of the markets over time.

The study looks at investor behavior by examining fund flows into and out of stock and bond funds. What they found was that investors tended to pile into stocks after they had shown sizeable gains and then sold those funds after they experienced down periods. And then they repeated that same process during the inevitable recovery of the markets over time.

We know we need to “buy low” and “sell high” to be a successful investor. But research shows that what we do is closer to the opposite. If we make these mistakes just a couple of times over our investing lifetimes, we can seriously jeopardize our most well-laid plans. There is an enormous difference between compounding your assets at 4.1% versus compounding your assets at 10.6%. Using the “Rule of 72,” (which takes 72 and divides it by the assumed interest rate to get the number of years it will take to double your money) a 4.1% return would take over 17.5 years to double your money. A 10.6% return would double your money in less than 7 years. Our behavior matters!

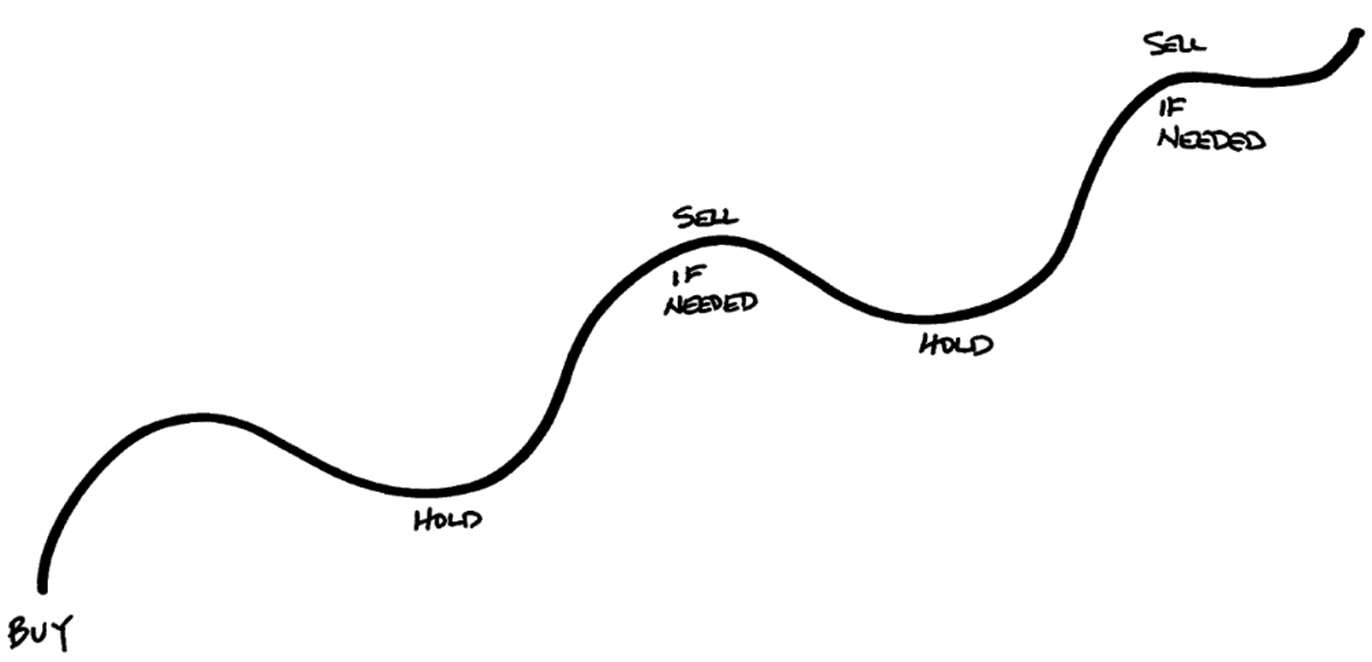

We did not sell because we did not have to. By properly setting aside and protecting money you know you will need to support your goals over the next three years, we have built an emotional “moat” around our long-term assets. We do not need those funds today. We will need them in the future – and we need them to outpace inflation. Stocks, over the long-run, have shown that they are one of the best places to grow your assets. They are also the one of the most volatile over the short-run. This is why we have the 0-3 year bucket – to give us the ability to simply hold our investments during the down periods which, as shown above, tend to be short in duration relative to the longer up periods. The discipline then looks like the following:

- Set aside the next three years of expected outflows

- Buy quality companies with the rest

- Tuck them away

- Hold them through the temporary downs

- Sell some when the markets are positive to refill the 0-3 year bucket (as needed)

- Repeat

For those of you who are emotionally spent, you should be. This has been the longest downturn we have had to experience since the Great Financial Crisis (2007-2009). It has been exhausting.

I am confident that we will see better days ahead because we use hindsight to see that the markets have historically overcome much more than we are experiencing today. I encourage you to have faith that our economy – and that of the world – will return to growth over time. The companies you own will be participants in that coming growth. The market has endured years of war, assassinations, the Cuban missile crisis, countless recessions, the global financial crisis, September 11th – and each time, the downs have been temporary and the ups have continued to forge new highs.

I am confident that we will see better days ahead because we use hindsight to see that the markets have historically overcome much more than we are experiencing today. I encourage you to have faith that our economy – and that of the world – will return to growth over time. The companies you own will be participants in that coming growth. The market has endured years of war, assassinations, the Cuban missile crisis, countless recessions, the global financial crisis, September 11th – and each time, the downs have been temporary and the ups have continued to forge new highs.

Keep the faith and please reach out to us with any questions!

Warm Regards,

Notes:

1. Wikipedia.com – definition of Hindsight Bias

2. Source: Serenity Now 2022. Q2 Market Update. Calamos Investments.

3. Source: Bloomberg LP 12/31/91-12/31/2021. Average asset allocation investor return is based on an analysis by DALBAR, Inc., which utilizes the net of aggregate mutual fund sales, redemptions, and exchanges each month as a measure of investor behavior. Indices shown are as follows: US Stocks are represented by the S&P 500 Index, Government-Related Bonds are represented by the Bloomberg US Aggregate Bond Index, Inflation is represented by the Consumer Price Index. Indices are unmanaged and cannot be purchased directly by investors. Index performance is shown for illustrative purposes only and does not predict or depict the performance of any investment. See appendix for index definitions. Past performance does not guarantee future results.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Josh Miles and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Holding stocks for the long-term does not insure a profitable outcome. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification. This is not a recommendation to purchase or sell the stocks of the companies pictured/mentioned. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.