Experiencing Turbulence

Perspectives during times of terror

By Josh J. Miles

I

I can still feel the rush of excitement as the wheels of our jumbo jet screeched upon the Malpensa airport runway. The sun had arrived in northern Italy just ahead of us. As we taxied to the terminal, we could see the morning light shining on the majestic snow-covered Italian Alps. It was my first time traveling abroad and I was dripping with anticipation.

The trip came about somewhat serendipitously. Living in Portland at the time, my wife came downtown to the office to have coffee with me and mentioned that she needed to get away from the rain. The rainy season had started early that year and had not shown any signs of relenting. Only minutes before leaving the office to meet Erica, my good friend Paula, a prolific adventurer, came into my office to tell me about an amazing airfare she found from Portland to Europe.1 By the time our coffee date was done, we had booked our flights to Milan.

The planning happened quickly – by way of a Rick Steves’ Italy Handbook. For the young or uninitiated, Rick was the guru of all things travel before the internet. His handbooks were your literary travel guide because the guy had been just about everywhere, and had all the tips and tricks you would need to make your trip interesting, safe and successful.

II

In his book, The Undoing Project, Michael Lewis writes about two psychologists who worked together at Hebrew University in Israel. The pair introduced the notion of cognitive bias in 1972 and then wrote a groundbreaking paper2 on prospect theory in 1979 that crossed over into the world of economics and finance. Their work is credited for establishing the discipline of Behavioral Finance.

Why do we care about this? Because the work they did helped us to reject the former idea of the “rational investor.” Under the rational investor theory, market participants weigh their prospects for losses equally to their prospects for gains. What Daniel Kahenman and Amos Tversky introduced through their extensive research – remember, they were psychologists, not economists – was that investors have an asymmetric response to gains and losses.

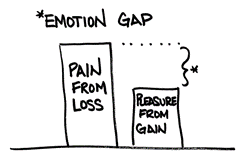

Their work explained why we feel the way we do when we experience a loss. Now don’t get me wrong, a rational investor who experiences a loss feels that loss. What was so insightful from their work was that we feel the pain of losses at a much greater intensity than we feel the joy of gains.3 In fact, their work showed that we actually experience loss at twice the intensity as we feel gain.

I call this the “Emotion Gap”4 because investing is emotional. As you can probably assume, I have been having many more conversations about the performance of investments in 2022 than I did in 2021 (when the market had rallied tremendously off the March 2020 bottom) due to the very fact that losses hurt. And they hurt much more than gains feel good.

III

Looking back on our trip to Italy, we have fond memories. Driving our tiny rental car down the steep, winding road into Vernazza – one of the Cinque Terra villages built into the cliffs above the Mediterranean Sea. Sitting in the window of our centuries old hotel room in Florence orverlooking a piazza near the Accademia Gallery that holds Michelangelo’s statue of David. Watching the sun set as we strolled in St Mark’s Square in Venice. However, what I remember most was the terrifying flight we experienced on our trip to Milan.

About halfway through our trip from New York to Milan our captain came on the intercom to tell us that we need to take our seats and fasten our seatbelts. This is not uncommon for a transatlantic flight. The captain then explained they would seek to fly through the turbulence at a higher altitude in an effort to avoid the worst of it. Almost immediately after our captain stopped speaking we hit an air pocket.

What I remember of this event was that my stomach almost exited my body through my mouth. It felt as though we were in a freefall. When the plunge ended, the plane shook as if we had hit the ground. Screams were heard throughout the cabin. I could not tell if my voice was part of the chorus or not because the blood had completely drained from my body – leaving me in a temporary state of shock.

Then, the calming voice of our pilot came on again and said, “Well, we didn’t quite get above it did we? We should expect another 5-10 minutes of bumps, so please stay seated and keep your seatbelts fastened. Please know that this is not unusual and we will continue to do what we can to make it as smooth as possible. We should be back to calm skies soon.” The confidence he exuded calmed me down almost immediately. Especially when my rational brain was able to process how many times he has likely encountered this type of turbulence in his career.

As much as I loved our adventure, those few terrifying seconds still rise to the top of my list of memories of that trip.

IV

When we run a financial plan, we do it for several reasons. First, it provides us the answer to one of the most nagging questions we all have – “Are we on track to meet our goals?” It also shows where we land on the “live now – save for later” continuum. If we are not saving enough, it helps define actions we can take to get us on track. If we are ahead of our goals, we have the ability to do more now, while we are still young and healthy.

As an advisor, the financial plan is critical to long-term success and that is why we are so diligent about walking every client through the goal-mapping process. The financial plan provides the data needed to make better decisions. One of the key takeaways we learn from the financial plan is when you will need money. The timing of the expected outflow determines the amount of volatility that asset can or should experience.

Through the use of historical probabilities, we can then build portfolios that can more effectively satisfy the dual mandate of protecting assets (for near-term outflows) while also growing assets to outpace inflation and taxes to help cover future outflows. These probabilities provide the basis for our asset allocation discipline which assigns your assets to investments based on when you will need money.

This is what we call Probability Investing. We aim to protect three years of expected outflows (plus emergency funds) with a capital preservation mindset. Essentially, we will give up growth to ensure that the dollars we need during that time period are there when you need them.

Having three years’ worth of assets set aside allows the rest of our assets to be invested for growth. As you can see from the chart5 below, stocks over a rolling 1-year period can be very volatile (highest one year gain of +47% and lowest 1-yr loss of -39%).

But if we move out to rolling 5-yr periods we see a different story. When we look at stocks versus bonds, for example, you see that they experienced very similar downside risk over their worst 5-year period (-3% for stocks and -2% for bonds). What we derive from this data is that we can have similar downside risk to bonds while picking up the growth in stocks the longer we own stocks. In fact, looking at 20-yr rolling periods, the worst period in stocks was half of the best period for bonds!

The problem with the markets is that we do not know what lies ahead. Sure, these historical numbers are great, but the future will be different. Our view is that where we cannot control outcomes, we want to put ourselves and our clients in the postion to have the probabilities of success on our side. Stocks may increase the liklihood of positive returns with time. As you can see, rolling 5-year periods in the S&P 500 show gains over 92% of the time. As you increase the time, your probabilities increase.

V

We are experiencing our own share of turbulence in the market. After the nice relief rally we had from mid-June to mid-August, these last few weeks have felt like we hit an air pocket as we have retested the June lows. In times like this, our team is your steady-voiced pilot who has a firm grip of the controls, has a team on the flight deck helping monitor the instruments and directing you to your final destination. You do need to step into the cockpit and try to land this on your own. And, your financial plan is your Rick Steve’s Handbook. It will help make your trip interesting, safe and successful.

Anyone who is currently invested in the markets is feeling some level of fear. We have a very high level of uncertainty in the markets right now – inflation, supply chains, mid-term elections, rate hikes, increasing possibility of a recession and more. As uncertainty increases, our level of fear also increases. It is how we handle this fear and uncertainty that will ultimately determine our long-term success.

I wanted to title this post, “Managing Turbulence.” What a huge misnomer that would have been. You cannot manage it, you experience it! We are in this together with the knowledge that historically, volatility is temporary and the market will inevitably reach new highs in the future. For the time being, keep your seatbelts buckled and we will be back to calm skies soon.

Best Regards,

Notes:

- For those of you who know Paula, know that she was 20 years ahead of Scott’s Cheap Flights!

- March, 1979 https://www.jstor.org/stable/1914185

- The shape of the value (utility) function in prospect theory. The asymmetry of the function corresponds to loss aversion. Source: https://en.wikipedia.org/wiki/Amos_Tversky#Academic_career

- Adapted from sketch by Carl Richards. Behaviorgap.com

- JP Morgan Asset Management. Guide to the Markets – US. Data as of February 28, 2022. Returns shown are based on calendar year returns from 1950-2021. Stocks represent the S&P 500 Shiller Composite and Bonds represent Strategas/Ibbotson for periods 1950-2010 and Bloomberg Aggregate thereafter. Growth of $100,000 is based on annual average total returns from 1950-2021.

- A Field Guide to Lies. Daniel J. Levitin

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Josh Miles and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Holding stocks for the long-term does not insure a profitable outcome. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification. This is not a recommendation to purchase or sell the stocks of the companies pictured/mentioned. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.