What's in a Name?

The debate behind what constitutes a recession and does it even matter?

By Josh J. Miles

“What's in a name? That which we call a rose by any other name would smell just as sweet.” William Shakespeare uses this line in his play Romeo and Juliet to convey that the naming of things is irrelevant.

July’s GDP report – showing the US economy shrinking at 0.9% annual rate1 – makes it the second quarter of negative GDP in a row. You will hear many pundits cite the rule-of-thumb definition that two quarters of negative real GDP growth equates to a recession. This is a misperception. We have also heard our politicians, on both sides of the isle, try to use their own definition to meet their own political agenda. Politics gets in the way of logic. Posturing takes sight away from the data.

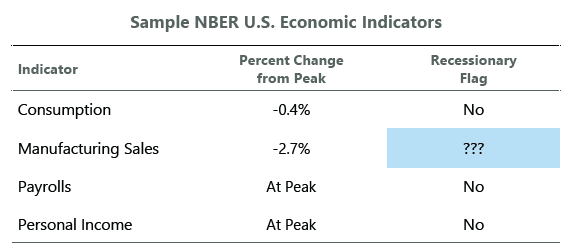

Are we in recession? It depends on who you ask. But there is only one group – the National Bureau of Economic Research (NBER) – that can officially date a recession. And they take into account much more than GDP numbers alone. In fact, the NBER defines recession as significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. A recession begins just after the economy reaches a peak of activity and ends as the economy reaches its trough.2

Despite a negative GDP reading in the first quarter and today’s report of negative GDP in the second quarter, many of the indicators the NBER monitors when evaluating the state of the economy remain healthy.

Source: Anatomy of a Recession. 6/30/2022

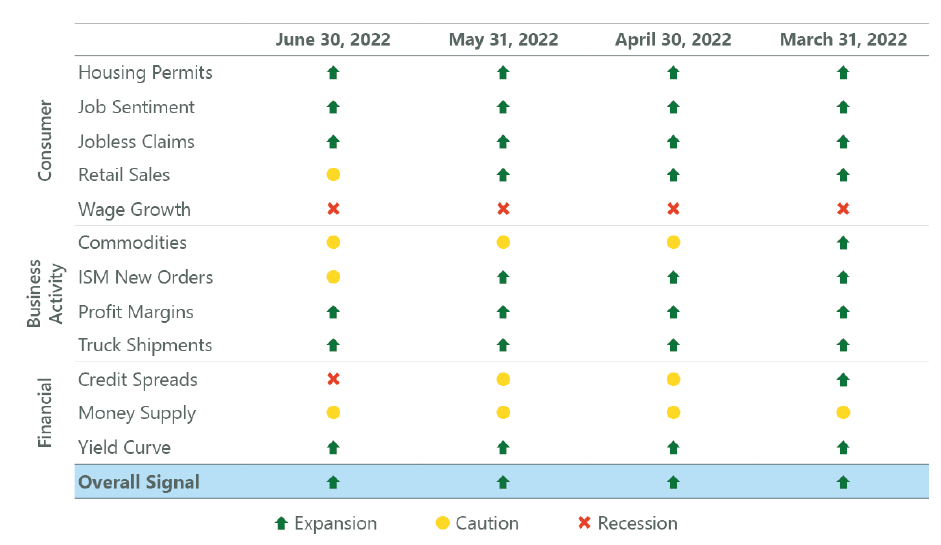

We have followed Clearbridge Investments’ (formerly part of Smith Barney Asset Management) recession dashboard for years. It tracks 12 variables that have historically forshadowed a looming recession. They are listed in the table below:

Source: Anatomy of a Recession. 6/30/2022

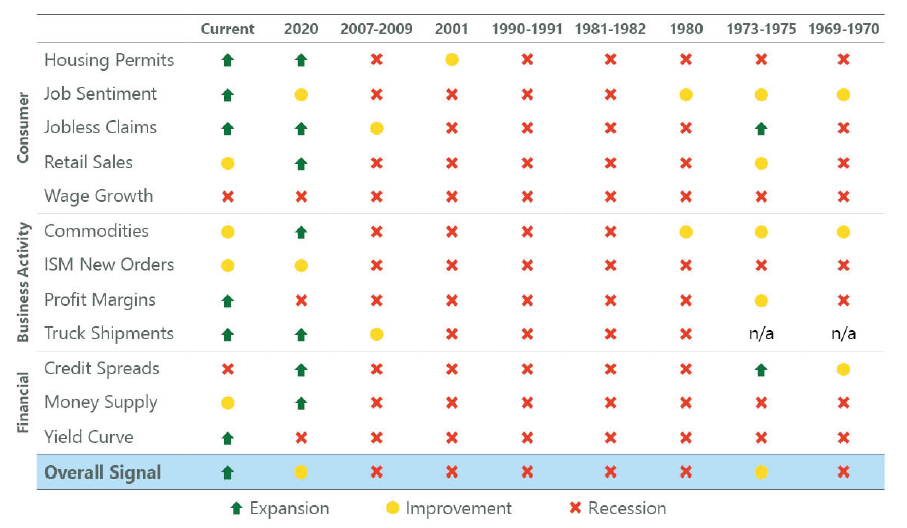

As you can see, we have moved from primarily expansionary in March to a more cautionary position today. But even now, after two successive negative quarters of GDP, we are still seeing expansionary numbers in six of the 12 metrics while only two are flashing recessionary. Below is how we stack up as of June 30th to previous recessions:

Source: Anatomy of a Recession. 6/30/2022

We can see that we are still in a much stronger economic position than the typical recessionary environment. For my part, I will leave the predictions as to whether we enter a full recession – or the Fed somehow manages a “soft-landing” by achieving their objective of bringing inflation while not inducing a recession – to the pundits as I cannot control that outcome.

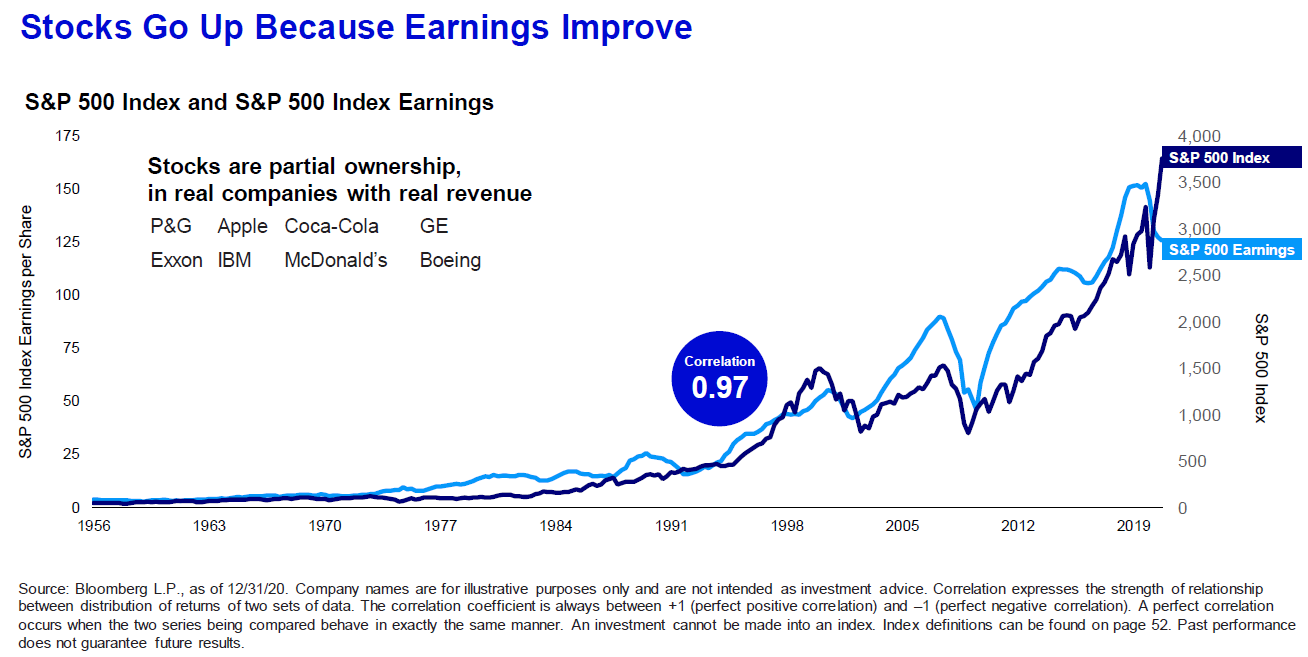

Rather than join the debate raging in Washington, within the Federal Reserve, amongst financial pundits or in coffee shops across the nation as to whether we are already in recession – I believe we should be focusing our attention and our energy on what this slowdown actually means to our portfolios. And more specifically, what areas of the market are likely to continue growing their profits through this slowdown – no matter what we call it.

As you can see in the chart2 above, there is a 0.97 correlation between a stock’s earnings and the growth of those earnings and its price and the growth in its price (1.0 being perfectly correlated). There are times of “dislocation” – when the emotions of fear or greed move price above or below its corresponding earnings – but over time the relationship between the two tends to move back into alignment.

Source: Anatomy of a Recession. 6/30/2022

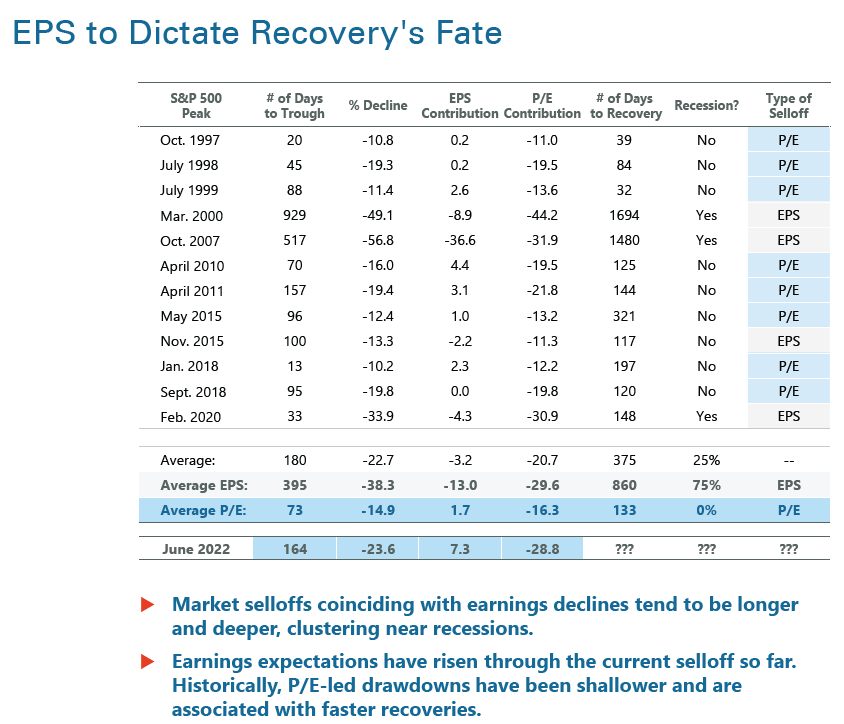

Looking at today’s market, we see that earnings are actually continuing to grow at a 7.3% clip. This means that the pullback has been almost entirely the market adjusting down price. This is very healthy in the long-run as it takes valuations back to more reasonable long-term numbers – setting up the market for the ability to continue its secular bull market move higher.

As of Friday, July 29th, 56% of S&P 500 companies have reported their Q2 2022 earnings. 73% of those companies have reported a positive earnings per share (EPS) surprise with 66% reporting an upside surprise in revenue. So far, the numbers suggest EPS has continued to grow at a 6.0% rate3. This has supported the rise in the markets we have seen over the course of July.

When we quiet the noise and focus in on things that matter (like corporate earnings) we can tune out all the financial chatter about recessions. Yet the debate rages on from the halls of Washington, to the Federal Reserve, to TV screens across the country. And it’s doing investors a disservice. For our part, we will continue to focus on things that matter that we can control – like owning quality companies that continue to grow their earnings.

Keep the faith and continue to flex your “patience muscles”!

Sources:

- 7/28/2022

- Clearbridge Investments. Anatomy of a Recession. June 30, 2022

- Earnings Insight. 7/29/2022

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Josh Miles and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Holding stocks for the long-term does not insure a profitable outcome. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.