The Problem of Uncertainty

By Josh J. Miles

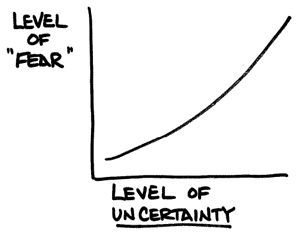

If you are like most humans, you thrive on certainty. Having a plan and seeing that plan come to fruition is a thing of beauty. However, most of us recognize that “even the best laid plans may go awry.” This is certainly true of the stock market. As we recently discussed, predicting the market outcomes over the short-term is difficult at best. Unfortunately, as uncertainty increases, fear rises at nearly the same rate. And fear in the markets triggers the same responses as if we were facing a mountain lion in the foothills (fight, flight or freeze).

For many of us, “fight” means that we feel the need to “do something.” In the mountain lion example, it may mean picking up a stick and waving it violently or throwing rocks. In the markets, it may look like trading in and out of stocks to satisfy the need to feel “in control.” Running from a mountain lion can be deadly. Let’s face it, none of us are outrunning a mountain lion and their instinct is to chase down their prey.

In the markets, selling can be attributed to the “flight” response. Selling is a knee-jerk, emotional response to the pain we experience from a loss. Remember, it has been shown that we experience the pain of a loss at twice the level we experience pleasure from an equally-sized gain.1 Selling can also be financially “deadly.” As we discussed in my previous post, missing just the 10 best days over the course of a market cycle can significantly reduce your long-term returns. This “emotion gap” is prevalent in other areas of our life as well. Thus, we tend to remember difficulties in our past at a much greater rate than we remember enjoyable times. These memories can lead us to other behavioral mistakes including making decisions based on anchoring (making decisions based on specific life experiences that may or may not have predictive value for future decisions).

Our last fear response, “freezing”, actually has some value for both, mountain lion encounters and the markets. Rather than explain the mountain lion experience, I will direct you to this actual encounter filmed in Utah by a man who kept his cool, kept eye contact and stayed calm (Mountain Lion Encounter).

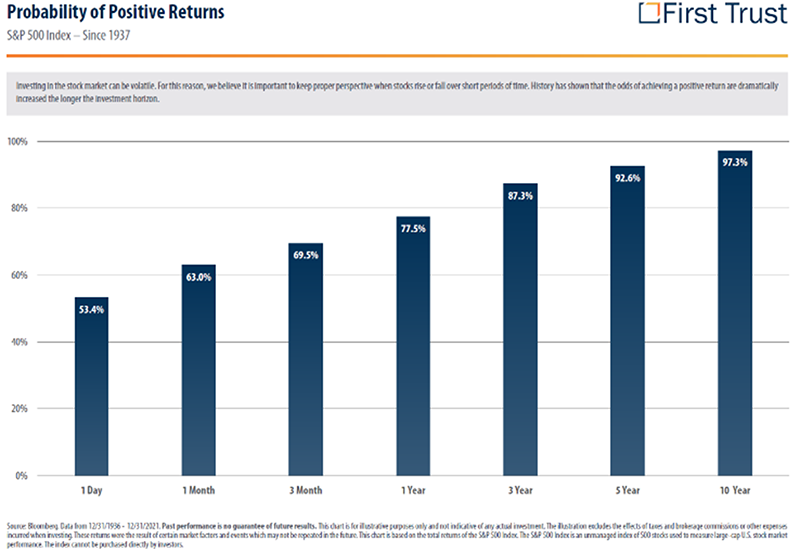

With the markets, the freeze response can be exactly what is needed as well. One caveat; before investing in the market, we have properly planned for your near-term cash flow needs by establishing your [0-3 year] bucket and emergency savings removing the “need” to sell at an inopportune time. That leaves the money not needed for [4-7 years] or [7+ years] invested which has over a 90% probability of providing positive returns2 over those time frames. The further out the goal, the higher that probability grows.

Remember, goal mapping, setting your financial goals and developing time-tested disciplines to address those goals over time (including saving money, establishing buckets, putting long-term money in stocks) is at the intersection of controlling the things you can control and things that matter!

American theologian Reinhold Niebuhr wrote a simple prayer that applies here: “God, grant me the serenity to accept the things I cannot change, courage to change the things I can, and wisdom to know the difference.” This holds incredibly true for our investment life.

Keep calm and carry on!

Sources:

- org > Vol. 211, NO. 4481 > The Framing of Decisions and the Psychology of Choice > Kahneman and Tversky

- Data from 12/31/1936 to 12/31/2021

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Josh Miles and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Holding stocks for the long-term does not insure a profitable outcome. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.