What's Been Working

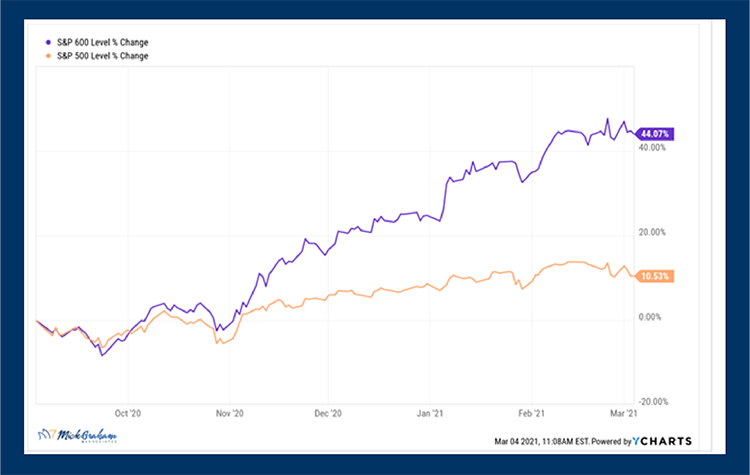

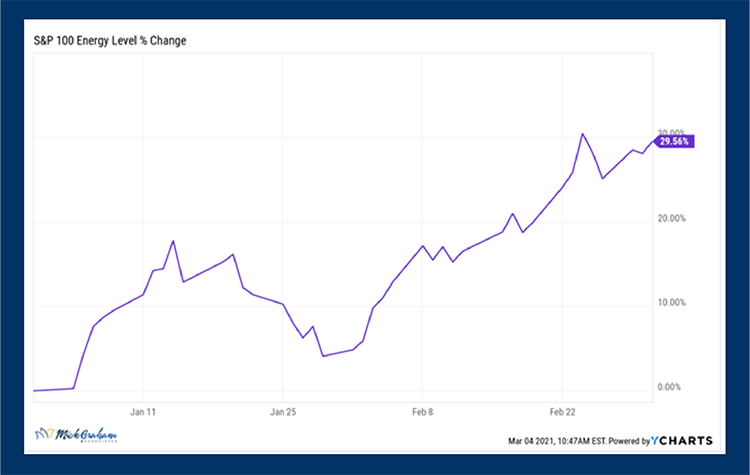

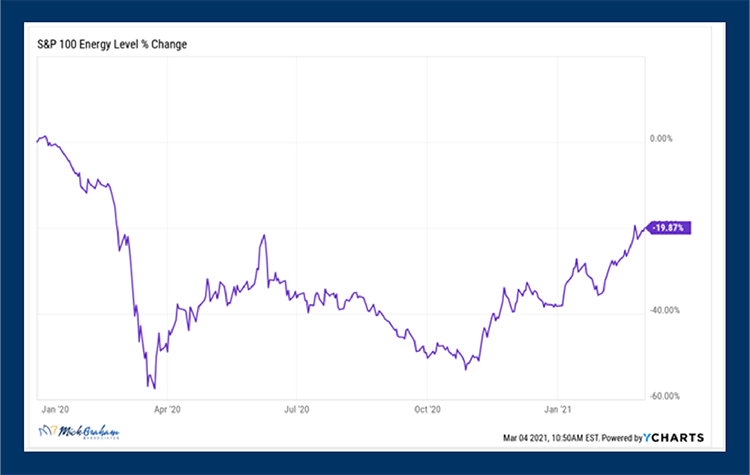

As we have now turned the calendar to March this market has really rewarded what did not work last year. Small Caps have outperformed large caps, sectors like energy and financials have been the huge winners this year.

This can leave the glass half empty crowd asking, “how much longer can this run?”. There are many voices adding to this crowd, including some very large money managers, including a particular two that I really respect. While this has caught my attention, I’m just not able to move to this camp.

Although the outperformance from the beat down sectors has been outstanding, there is still some ground to make up to get back to where they were previously. Energy for one is still -20% since the start of the drop in January of 2020.

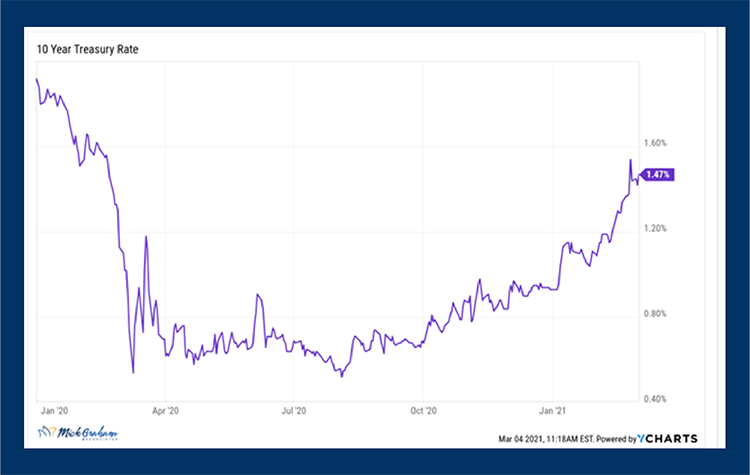

Interest rates have been the headline grabber here recently. Yields on longer term bonds (10 Year) have seen a pretty big move this year, moving from under 1% at the start of the year, to right around 1.5% last week. If you’ve watched the business networks recently there are undoubtedly headlines stating the market is moving down based on higher yields and vice versa. Although I acknowledge that this may indeed be the fact in a short-term scenario, higher yields are ultimately a sign of a healthier economy.

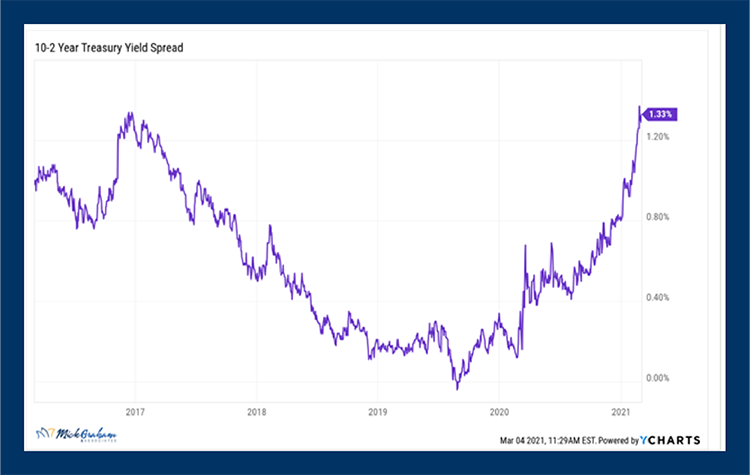

With the fed controlling short term rates and stating they will be keeping them low for an extended period, and the rise in the mid to long term rates, providing the platform for the economy to operate on its own without government intervention. When there is a nice spread between short- and long-term rates, it gives banks the incentive to loan to companies that would not otherwise be able to borrow when times are tight. The steeper the yield curve, the more banks make in lending. Banks borrow short term and loan long term and keep the difference. We have not had a normalized yield curve for years now, and there are many out there talking like it’s a problem.

I for one would like to see the overall economy walk by itself without the proverbial government training wheels. There will be short term volatility due to the expectation of more money being pumped into (or out of) the economy, however longer term (which is the world we play in) I believe having a normalized yield curve provides the best opportunities for investors.

It’s not fake money, it’s not wall street bets, it’s fundamentals, and that makes sense to me.

In summary, we may end up going through a consolidation phase now. It would be perfectly normal for this to produce a 5-10% pullback and still maintain the longer-term upward trend. If this in fact happens, we will be looking to increase our equity positions. Too much liquidity to think anything different.

With that here’s the buy/sell

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Mick Graham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.

Investing in small cap stocks generally involves greater risks, and therefore, may not be appropriate for every investor.

Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

The S&P 600 is an index of small-cap stocks managed by the S&P. It tracks a broad range of small-sized companies that meet specific liquidity and stability requirements. This is determined by specific metrics such as public float, market capitalization, and financial viability among a few other factors.