How much longer will it last?

The market and therefore office are closed today, February 15th in observance of Presidents’ Day.

Trying to predict how long this bull market will run is like answering the question how long is a piece of string? In fact, just asking this question can lead you to the conclusion that we are not there yet. The past 12 months, with all its unprecedented market moves, stimulus and commentary, makes it easy to think what’s moved tides in the past, will not do so in the future.

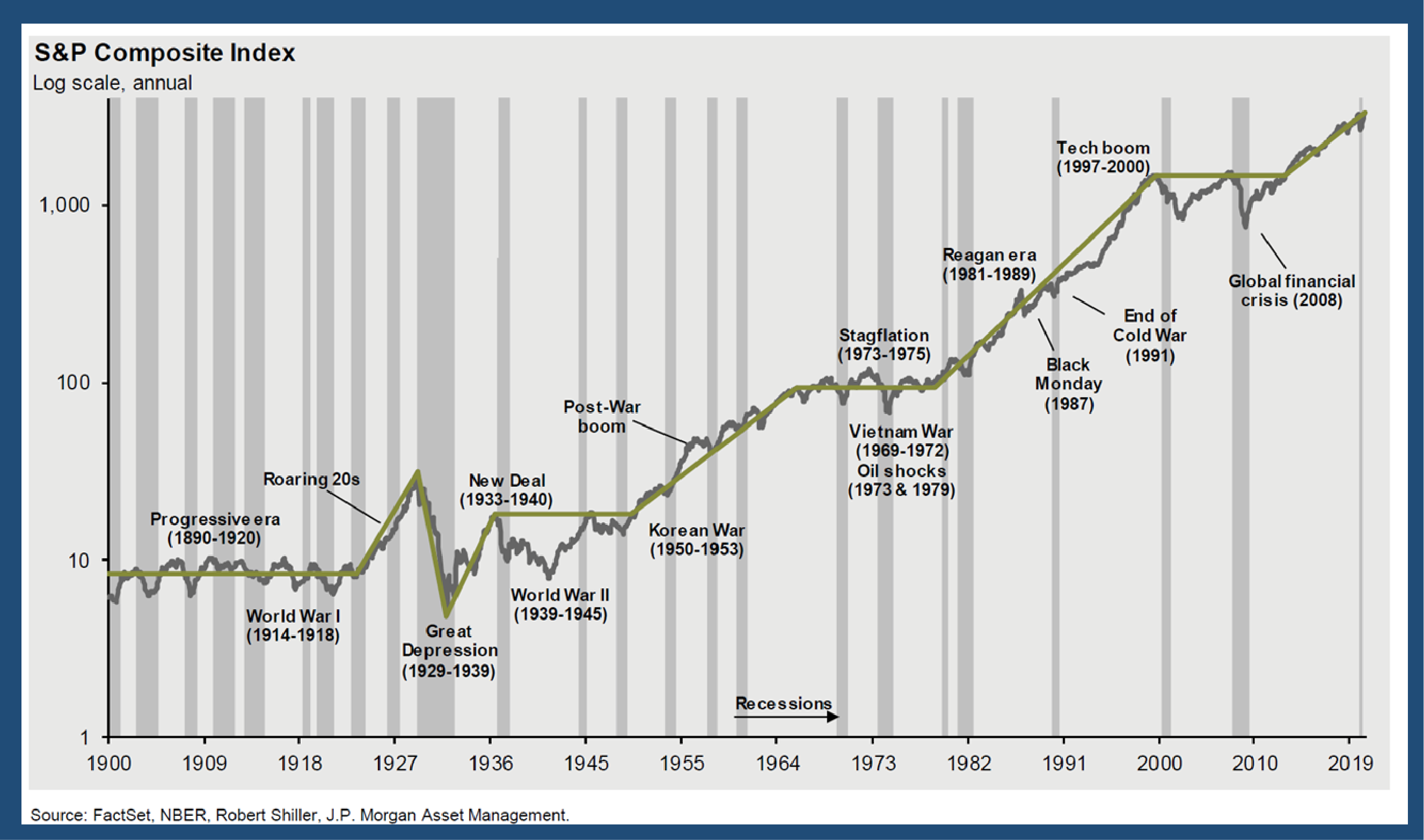

This pandemic was one of those “smack you out of nowhere” events that put the brakes on the global economy. It also accelerated growth sectors of the economy, forcing most of us to adopt technology that we may not have been quite ready for. With the benefit of hindsight, it’s apparent now that the Covid Crash, will likely be looked at by market historians the same way as the (Black Monday) 1987 crash was. In that case it was a 20% move in one day, which ultimately turned out to be the halfway point of 20+ year bull run.

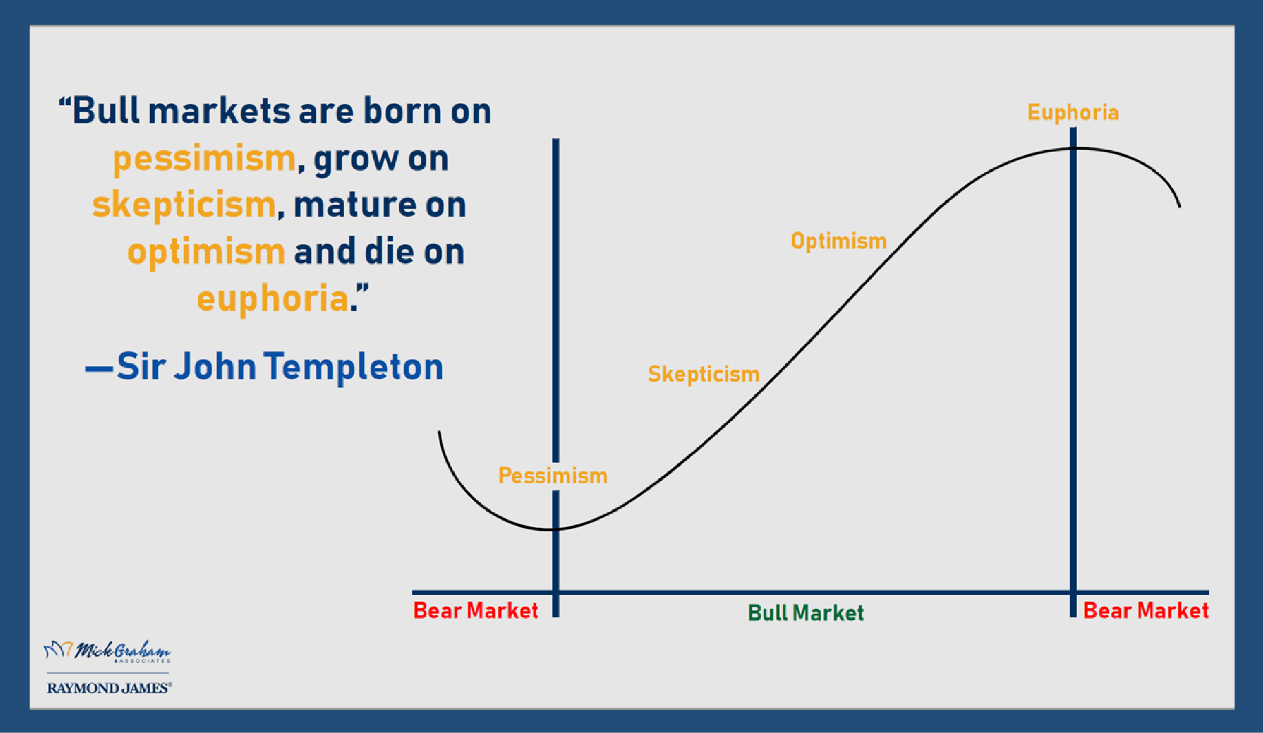

Therefore, to help us try to answer the question, forget the past 12 months, and go back to what has ultimately moved the markets over generations. Leverage the wisdom of those that have been through this before. I have a list of investors and portfolio managers that I respect and leverage their wisdom. From Uncle Ben Graham, to Warren Buffett, and Ken Fisher, I’ve taken many nuggets from the greats. However, the best quote is from Sir John Templeton. I’ve shown you this before, but it’s definitely worth revisiting now.

Bull markets die on Euphoria!!! Yes, technically what we went through in Feb/March of 2020 was a bear market and is technically described as the end of the bull run. I choose to look at 1987 as well as 2020 as a correction in the current bull run rather than the end.

As sentiment improves, it starts to become a bigger concern that we are heading towards euphoria. P/E multiples are at extreme levels and the markets keep making new highs seemingly every day. What would you call that if not euphoric? I say completely normal given where we currently sit. MASSIVE GLOBAL STIMULUS, companies that actually have earnings, as opposed to the previous bull market end.

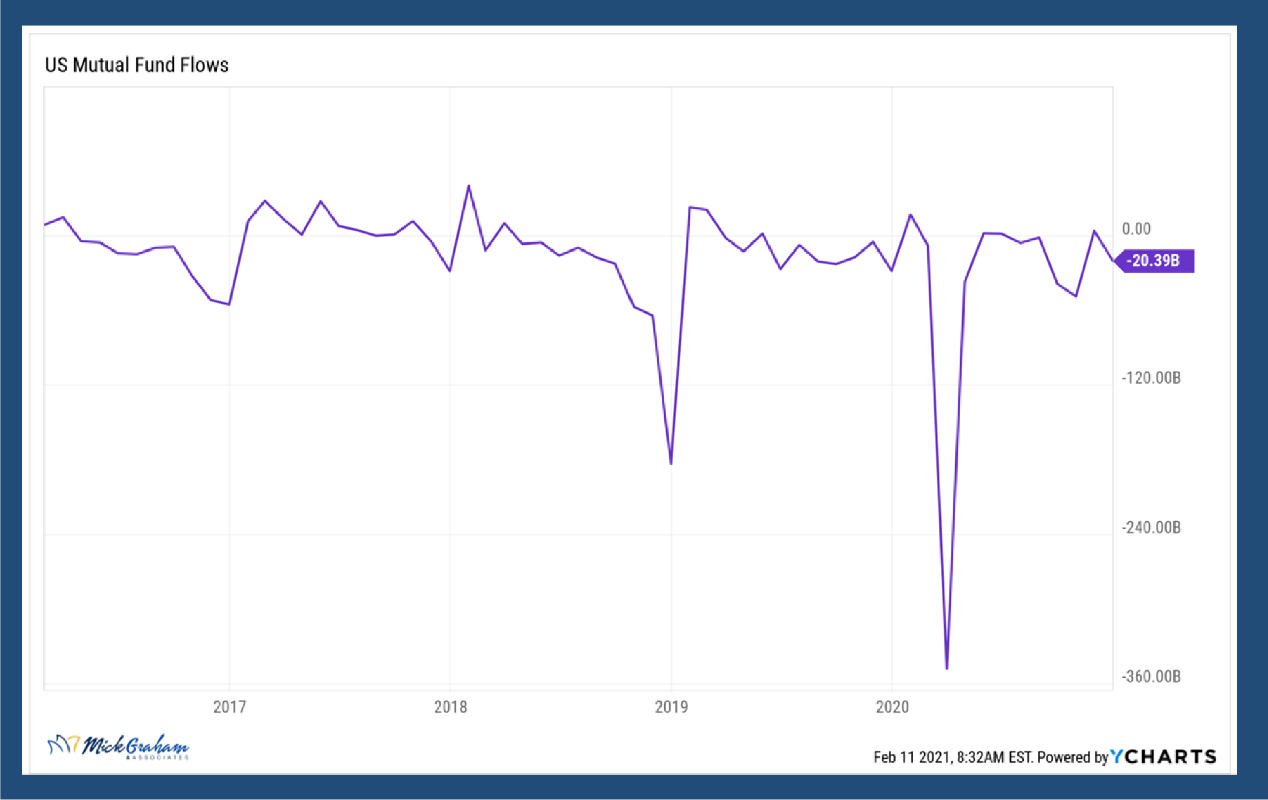

I classify euphoria as those times where you are saying, “I have to get in, I can’t keep missing out.” We measure this not only by investor and consumer sentiment, but by fund flows, and we are simply nowhere near that.

The Fed came out last week, confirming again the real unemployment numbers are north of 10%, and reiterated their easy money policy for a long time. I’ve said for some time that I think the next true bear market will be due to inflation, and we are nowhere near that.

So, for now, enjoy this ride, I believe it has a ways to go. As always there will be pockets of value and exuberance, look at these as opportunistically, rather than longer term signals.

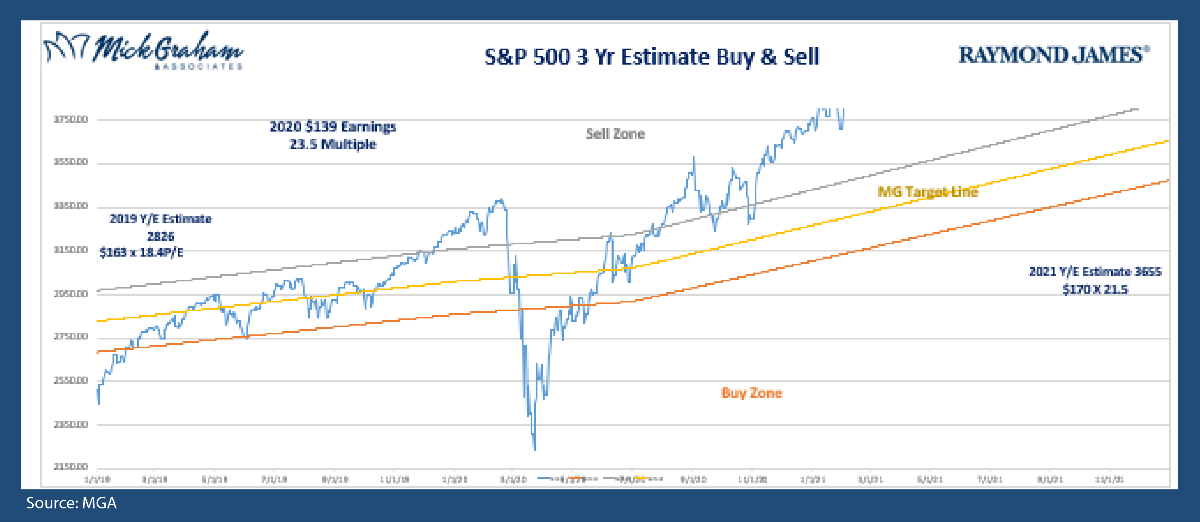

With that said, here’s the buy/sell.

As always, have a great week and feel free to call with any questions.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance may not be indicative of future results.