When Cash Can Be King

The past few weeks I’ve had a lot more bonds called and/or matured in the portfolios I manage than I can remember in a long while. There are a few reasons for this, however the most compelling reason would be the extraordinary offerings that were available when the bond markets froze in late March.

Unlike an equity market that moves, and places bids and offers together and has the capacity to move several percentage points to make a trade, the good old bond market is not used to that type of volatility. So, in March when many investors were attempting to dump their portfolios the bond market technically froze, leaving some with the inability to sell their bond assets.

The Fed quickly stepped in to buy not only bonds, (as it has done in previous hard times), but also bond mutual funds and ETFs. An unprecedented step at that time.

Bonds Started to Falter. Then, the Fed Came to the Rescue. - The New York Times (nytimes.com)

Although that allowed liquidity to flow, it did not stop the slide in prices for all of the bond assets. There were yields on offer for 6- and 9-month durations that were as high as we have seen since the 80’s. Taking advantage of that was in hindsight one of the best opportunities in the bond market that I have seen.

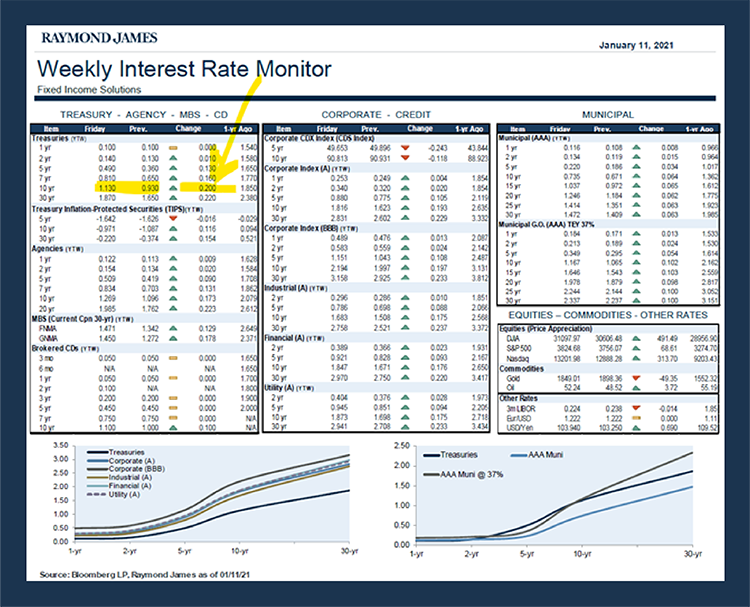

Skipping forward to today, the problem is an abundance of cash that needs to be deployed back into the bond market. However today, unlike the times of 9 months ago, we have a steeper yield curve, culminating in the 10-year treasury that has moved up, substantially in the past few weeks.

Remember, when yields are increasing it means the price of your bond will go down accordingly. Like a teeter-totter, or see-saw from where I come from. Stay with me for a little bit longer!!!!

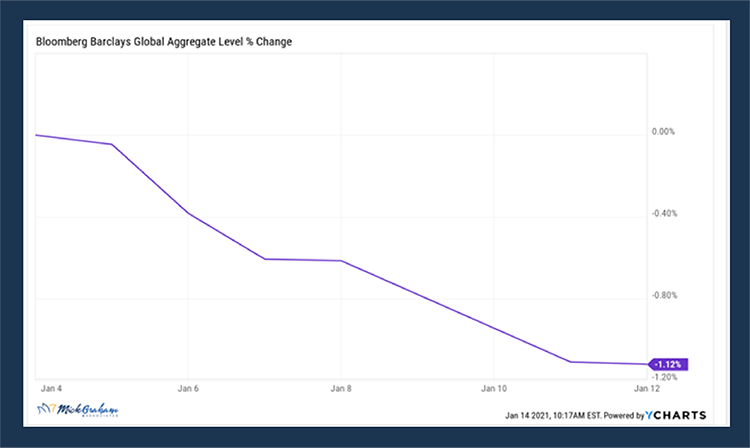

What I’m ultimately trying to say is that a small move in rates upwards, can create a scenario where if you deployed the cash and purchased a bond say on January 4th, that you would have lost an entire year’s return in yield, in just a few days. The chart below is on the Barclays Aggregate Global Index, you can see in just a few days that the price of the index went down around the same amount as the yield on a 10-year treasury.

Now, I argue it doesn’t matter as much if you are invested in individual bonds, as you will get par value back at maturity and get what ever yield was on offer when you purchased it. However, just by missing these few days in the bond market, you can now increase your total return by the 40 basis points or more a year, just due to the move in the past few days.

Therefore, as the title of this note says, sometimes cash can be king, but that reign is generally short lived. Now remember, I’m just talking about the cash that is set for your fixed income allocation, not the amount set aside for your equity allocation. That’s a different kettle of fish all together and is more often than not the focus of these notes. Today however, I wanted to give you some insight to my world as bond maturities unfold, and cash builds. If you have a cash build up, I don’t want you to think that it’s a reflection of my overall market perspective, its only related to the fixed income side, and I believe this period will be relatively short lived.

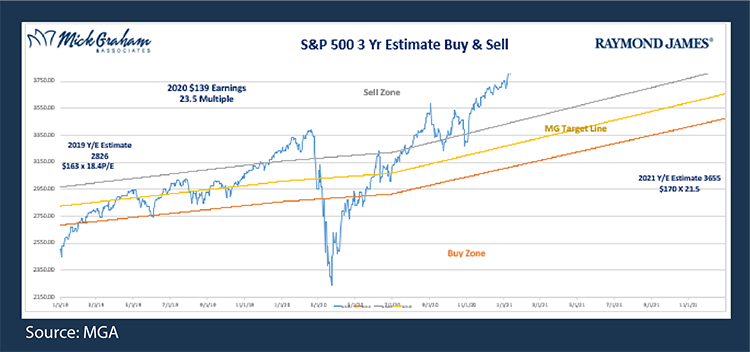

With that said, here is your weekly Buy/Sell, that I still have not changed as I fight with myself on a 2022 Earnings number and P/E. As always should you have any questions or concerns, please feel free to call.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Mick Graham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.