Pockets of Exuberance

Bye Bye Baby…….one of the great quotes by Bob Carpenter from the Washington Nationals when a Nationals batter hits the ball out of the park. I think it’s the best way to say goodbye to 2020.

I’m writing this on New Year’s Eve morning, with one trading day left, the market returns this year (at the start of the final trading day), have given an above average year. The S&P 500 is up over 17.5%, while the S&P 500 Growth index is up over 32%. To say it has been a wild ride to achieve these results is an understatement. Over the past 10 years there has been 59 occasions were the S&P 500 finished either up or down 3% from the previous days close. In 2020 it happened 28 times…….

Playing devil’s advocate on this, you could say that 2020 was a recession year and there was not another recession year in the past 10 so you would expect volatility, and you’d be right. It wasn’t that long ago I was writing stating that the lack of 1-day movements of 1% or more was frightening. Little did we know that we would be hit with a pandemic that has killed so many, crushed small business and provided unprecedented global stimulus. I can still remember the start of the year when things were flying high, debating with myself. “The market is typically the ultimate pre-pricer of all commonly known things seemed to be, so what could affect it is something that hits us that no one sees coming.” Covid-19 has to be the definition of that.

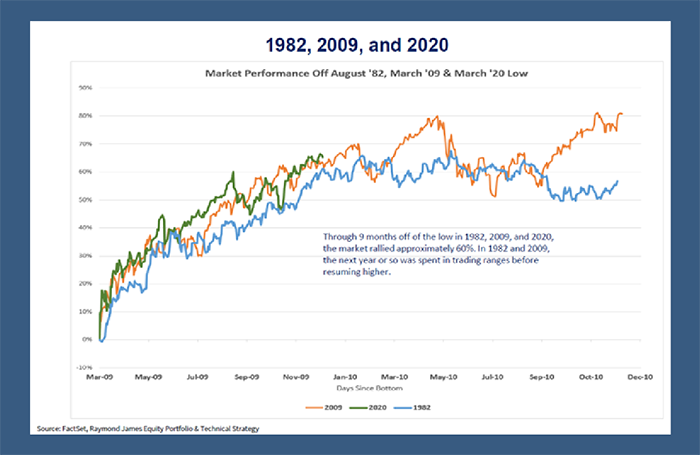

Accepting what has happened, let’s take a look at how this recovery measures up against the past couple. I’ve shown you the chart below before, but I find it very interesting how things seem to follow the same trends. A quick look would tell you, if we are following the same trend as the two previous, that we may have some limited upside, (at least for a period of the year).

I’ve advocated for a while now that I believe the shift will be from the mega cap names, that have generally performed so well in this recovery, to smaller capitalized companies. I believe it’s very possible to have the major indexes give flat or even negative returns for a time period while pockets of the market can do well. The main reason being the major indexes are market cap weighted so a bigger portion of the return of the index is greatly dictated by the biggest companies. Generally speaking, if they don’t do well, the overall index won’t do well.

So, with pockets of exuberance, come other pockets of opportunities. The fun will be identifying which pocket to put the capital in, and I’m really looking forward to the challenge.

I want to thank you again for your trust in us in 2020. It was probably the most interesting year I’ve had in the business; however, it also gave us the opportunity to show our value. Not just from a performance standpoint, but also a personal one.

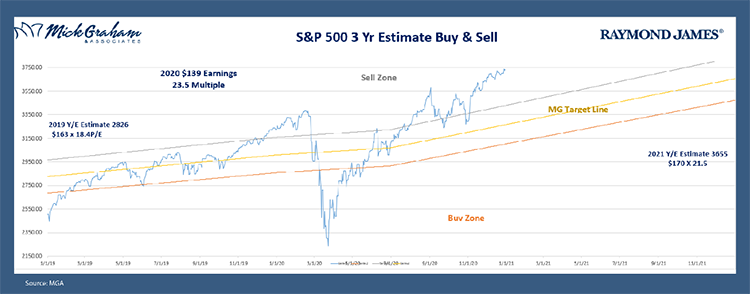

From my tribe to yours, Have a Happy, Safe and Prosperous 2021. Here’s the buy/sell.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Mick Graham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.