Bottoms & Bonds

I summarized this week’s article in audio format, if you’d rather listen than read, please click here.

Last week you heard about the 2 Trillion stimulus package designed to keep the economy going. Prior to that however, you saw unprecedented actions from the treasury. The Treasury basically said that they will expand their balance sheet “as much as necessary” to provide a “backstop” to the bond markets.

This is important to us, because the bond market, commonly referred to as “the safe place” to invest when compared to stocks, basically had liquidity dry up around the 19th of March. Let me give you a quick recap on the workings of the bond market, (skip ahead if I’m boring you).

When you buy a bond, you are “loaning” money to an entity. A Corporation, A Municipality, a State or the Federal Government. The U.S. Government being considered “guaranteed”, is the best credit, and all other entities move in credit rating down from the US AAA rating, commonly referred to as Treasuries. Municipals and State Governments are referred to as “Munis” and the interest on these bonds are not subject to federal taxation, and Public Corporations bonds are referred to as “Corporates”.

Interest Rates in normal environments move around based on supply/demand and fear/greed, well, all the same reasons the stock market move. The pricing of a bond, again in normal markets, will move based on the interest rate move. Think about it as a teeter totter (or seesaw for my fellow Aussies). If interest rates go down, the price of the bond goes up.

I buy individual bonds over investing in fixed income mutual funds or ETFs for many reasons, but mostly I believe their funds can have other factors that affect their price other than the assets it owns. Namely purchase and redemption pressures.

Ok so back to last week. Interest Rates being as low as they are now (10-year Treasury got down to 0.67% or 67 basis points). I thought it would be a good time to sell some bonds, as the price of the bonds we owned went up. I spent a few hours putting in orders for a bunch of bonds only to find they sat there all day without a bid. (Bonds trade unlike stocks, when you want to sell a bond, the trader will go the “the street” and give you the best offer for your bond). So, I naturally thought there was a technology issue, I usually only wait a few minutes to get a bond offer. I called the trader and asked what was happening, and he said there are no bids out there… What??? That’s impossible….The issue was there was no one buying anything. People were selling their portfolios and dumping everything including high quality bonds. This in essence froze the bond market and can only be classified as capitulation.

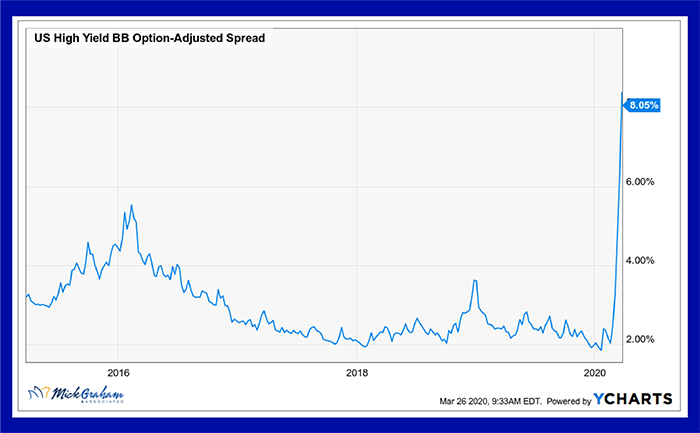

Step in, the Treasury. Starting to spend Billions buying bonds in the market to get liquidity flowing. This plan worked; however, spreads increased to a time that I have not seen since 2008. For instance, a bond maturing this year paying 3% last week that was pricing at $110, today that same bond is pricing below $100. That’s a HUGE move in what’s considered a “safe” market.

Why is it a concern to you? Well, if you are looking at your statement at the end of the month, you will notice that the bond pricing probably moved down a lot from the previous period.

However, this has also created opportunity. There are yields on bonds that were on offer last week that are in some cases were 4 or 5 times better than we were getting the week before. This has kept me busy trying to pick up bonds on sale. And I have to do this individually for each client. Apart from being time consuming, the bond market opens at 8am, so you want to be prepared before that which involves some early mornings.

As I write today, bonds have started to normalize, at least in the area of the better quality bonds. The credit spreads are still wide, however that’s normal in volatile times.

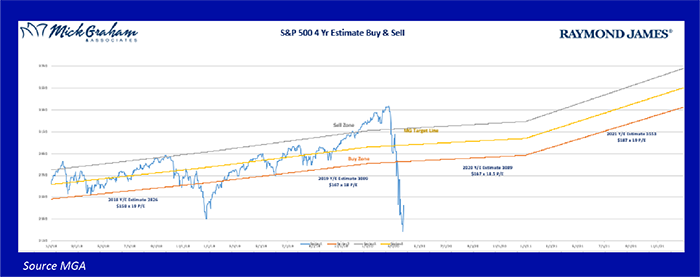

Well, is this the bottom?? No one has that answer, although every technician out there will tell you that you need to retest a low, I’m not so sure. Either way its not the right question to ask. I firmly believe that when we look back at this time of our lives in a couple of years, we will be looking at the price of good companies today and saying, “man that was cheap”.

My goal is to ensure that we are in the best position now to take advantage of that in the future.

In summary, these are the times that I earn my fee. It’s busy, but these times provide guys like me the best opportunity to stand out from the crowd. We will discuss how we performed as the quarter ends. Lastly, I will not close my office. I don’t think it should be an option. If you need to talk, I’ll be here.

With that here’s the buy/sell.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Mick Graham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.