On Again, Off Again

On again, off again. These China trade talks remind me of the relationship I had with my first ever girlfriend. The first thing I typically do when I wake up in the morning is check what the futures look like, and check to see if any market moving news that could set the tone of the day. I feel like I’m in a bad episode of Groundhog Day, with one day trade talks have stalled and the next day they’re back on. The worst part is this thing could drag out for a looong time.

I believe the noise gets worse when we do not have anything else to report. Thank goodness we have earnings starting to report this week. The mantra “no news is good news” is true when you think about your adult kids (meaning if they don’t call that means they’re doing ok, not asking for money, and haven’t changed their Facebook relationship status). However, it’s not the case when it comes to politics or the equity markets. Communication departments of all political parties and branches of government strategically place news so they can control the “cycle” on a consistent basis. I’ve heard from a previous White House staffer, “You either control the media, or they will control you,”. As for the markets, when news is quiet, the media still needs to produce column inches that get eyeballs, to get more eyeballs than your competitors you create more fear. I long for the day when the morning news comes on and the anchor says, “Things are looking great, it’s a beautiful day, go breath some fresh air and enjoy the day!!!” It’s not going to happen, and we all need to expect this is a part of the investing landscape.

I believe the noise gets worse when we do not have anything else to report. Thank goodness we have earnings starting to report this week. The mantra “no news is good news” is true when you think about your adult kids (meaning if they don’t call that means they’re doing ok, not asking for money, and haven’t changed their Facebook relationship status). However, it’s not the case when it comes to politics or the equity markets. Communication departments of all political parties and branches of government strategically place news so they can control the “cycle” on a consistent basis. I’ve heard from a previous White House staffer, “You either control the media, or they will control you,”. As for the markets, when news is quiet, the media still needs to produce column inches that get eyeballs, to get more eyeballs than your competitors you create more fear. I long for the day when the morning news comes on and the anchor says, “Things are looking great, it’s a beautiful day, go breath some fresh air and enjoy the day!!!” It’s not going to happen, and we all need to expect this is a part of the investing landscape.

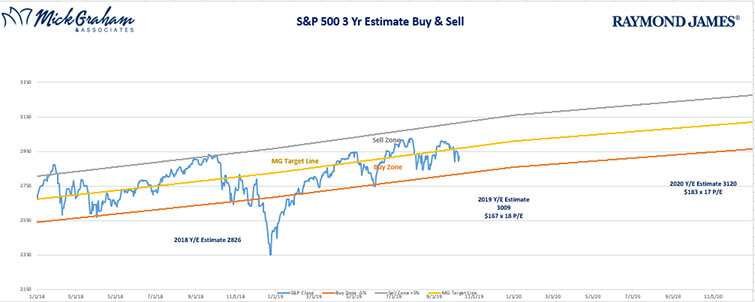

You’ve heard me say it many times….it all comes back to earnings, and what multiple you are prepared to pay for those earnings. I was just looking at the buy/sell sheet this morning, and the data point I always seem to be fascinated with is, despite what’s in the news, or how bad it gets, the market mostly trades within a range of that fair value model. Despite ongoing trade disputes, the Fed, Democratic rhetoric, Iran and oil disruptions, Brexit and a new British PM, and our Twitter in Chief creating market moving events several times a day.

(The fair value is a prediction of what the earnings will be at the end of each year, as well as what is an appropriate multiple based on the economic cycle). I believe opportunities arise when we trade outside the range. I’m currently working on a back tested buy/sell, that goes back 50 years or so, and I hope to be able to get that out to you in a week or so. My belief is that will prove my theory; however, that’s the beauty of research, you never know till you know.

Although the data I read is suggesting that growth is slowing, in my opinion it’s not signaling recessionary signs. I still believe that we have many years left to run in this bull market, and the current fear in the markets is a bullish indicator.

Looking forward to talking to you about earnings in the coming weeks. As always should you have any questions or concerns please feel free to give me a call.

Source: MG&A

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the author and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.