The Wonder of Tax Deferral

There are two main reasons we invest in our retirement plans, whether it’s a 401k, IRA, Simple IRA, SEP IRA or a Roth. First, because automation is the secret of wealth creation. You have a deduction made from your paycheck (automatically), it’s sent to your plans custodian (automatically), and it gets invested into what you selected (automatically). Taking an action item out of our hands and having it happen automatically takes all the stress out of it and removes the human factor that can lead to something being overlooked. Two other areas of automation I’d like you to consider is Auto Escalation, (increasing your contribution percentage at the start of every new year) and auto rebalancing, (having your portfolio rebalance at least yearly).

There are two main reasons we invest in our retirement plans, whether it’s a 401k, IRA, Simple IRA, SEP IRA or a Roth. First, because automation is the secret of wealth creation. You have a deduction made from your paycheck (automatically), it’s sent to your plans custodian (automatically), and it gets invested into what you selected (automatically). Taking an action item out of our hands and having it happen automatically takes all the stress out of it and removes the human factor that can lead to something being overlooked. Two other areas of automation I’d like you to consider is Auto Escalation, (increasing your contribution percentage at the start of every new year) and auto rebalancing, (having your portfolio rebalance at least yearly).

The second reason is that the IRS encourages you to do it. In an albeit miniscule attempt on the governments behalf to reduce the burden on benefit programs, the IRS allows you (in most cases) to deduct your contribution and defer paying taxes (up to the specified limits) to retirement plans with the exceptions of Roth IRAs (which I will cover in more detail a little later).

The deduction for your contributions is what’s called an above the line deduction. This means you can take it regardless of whether you itemize or take the standard deduction. This deduction lowers your taxable income by the amount of your contribution. There are some exceptions to being able to claim the deduction such as one spouse having access to a 401k plan and your Adjusted Gross Income exceeds annual limits. If you have any questions, you should consult your tax professional, it’s easy to figure out for each person.

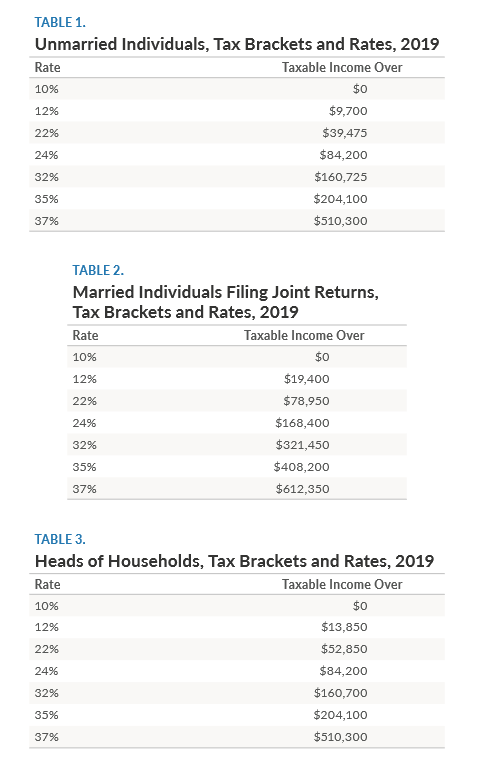

The deduction aside, the next best part about your retirement plan (except for Roths) is that it grows tax deferred. It’s not tax free, you ultimately pay taxes on it, however the aim is that you pay the taxes on it when you retire, and your income is not as high, so you benefit from the lower tax scales.

Source: TaxFoundation.org

Let’s say for instance that you’re a married, and between your wife and yourself, you make $100,000 and you take the standard deduction of $24,000 and you made a $12,000 401k contribution.

First deduct your 401k Contribution $100,000 - $12,000 = $88,000

Second take the standard deduction ($24,000) = $64,000

Now go through the tax scales 10% x $19,050 (1,905)

12% of 19,050 – 64,000 (5,394) = ($7,299) Taxes

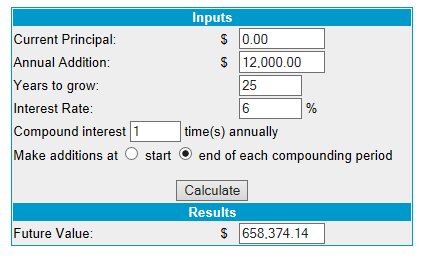

Let’s say you did this, and nothing changed for 25 years. With a 6% return each year you would have $658,374, which you would use to supplement your income in retirement, along with social security and any additional savings you made through that time. The beauty here is that you have a choice on what you withdraw to ensure you live the life you want, but also control your tax situation.

This is a hypothetical example for illustration purposes only. Actual investor results will vary.

Source: MoneyChimp.com

Now due to the ability to defer taxes, I often recommend to clients to be more aggressive with your retirement plans than your investments that are outside, such as brokerage accounts and/or bank accounts. The S&P 500 has over its history returned 9.9%, and if you maintain that inside your retirement account that additional growth you receive, will not be taxed till you draw income from the plan, so take advantage.

Now for Roth 401ks or Roth IRAs. A Roth is a special retirement account where you pay the taxes on the money that goes in now, however all future withdrawals are tax free. Roths are especially appealing to younger people who may pay lower taxes now while starting their careers and can benefit from the Roth by letting it grow for years or decades. The other exemptions Roths have that differentiates them from regular IRAs or 401ks is at some stage the IRS code forces you to start withdrawing from your retirement accounts. The government wants their pound of flesh, so they’re not going to let you keep it there untaxed forever, however with a Roth, you’ve already paid the tax on that money, so they can’t tax it again so they don’t care if you leave it in the plan. The current age for the forced withdrawal is 70 and a half. (Yeah, I’m not sure who came up with that number either.)

There are several bills in the house currently to update the tax code when it comes to retirement. Social Security has so many stresses on it that it is forecast to go bankrupt in around 14 years, (which funnily enough is when I become eligible for it). Most of these changes are to encourage more people to save for their own retirement and that “should” make it more beneficial to make contributions, but we will see.

All you need to do to start benefiting from Automation (a secret of wealth creation), and the tax benefits of retirement plans, is earn income. If you do this and still have questions, please give me a call.

Mick Graham, CPM®, AIF®

Branch Manager RJFS

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and investors may incur a profit or a loss. 401k plans are long-term retirement savings vehicles. Withdrawal of pre-tax contributions and/or earnings will be subject to ordinary income tax and, if taken prior to age 59 ½, may be subject to a 10% federal tax penalty. Roth 401k plans are long-term retirement savings vehicles. Contributions to a Roth 401k are never tax deductible, but if certain conditions are met, distributions will be completely income tax free. Unlike Roth IRAs, Roth 401k participants are subject to required minimum distributions at age 70.5. Rebalancing a non-retirement account could be a taxable event that may increase your tax liability. Contributions to a traditional IRA may be tax-deductible on the taxpayer’s income, tax-filing status, and other factors. Withdrawal of pre-tax contributions and/or earnings will be subject to ordinary income tax and, if taken prior to age 50 ½, may be subject to a 10% federal tax penalty. Roth IRA owners must be 59 ½ or older and have held the IRA for five years before tax-free withdrawals are permitted. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally representative of the U.S. stock market. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns.