IPOs: Hot or Not?

We are starting to get a flood of IPOs or Initial Public Offerings hitting the market. IPOs are the ultimate display of capitalism, where founders of the company, sell shares of that company to monetize their ownership and raise capital for future endeavors.

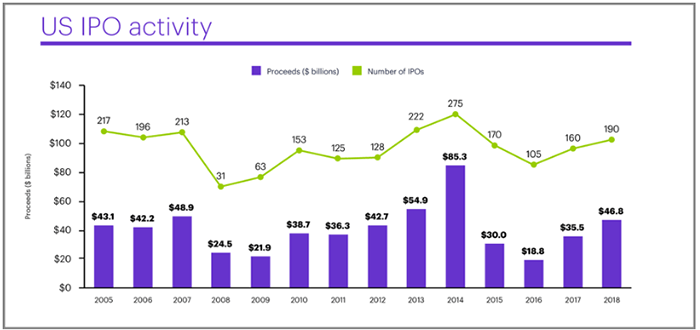

March 29’s listing of LYFT marked the first of many big-name companies looking to float their shares, followed by Pinterest and Zoom on April 28.. Other big names that are believed to go public this year include, Airbnb, Peloton, and Uber. In 2019 there are around 225 companies expected to go public. The most since 2014. What’s more impressive is that this year is estimated to raise around $100 Billion according to Renaissance Capital, the highest in recent history.

Source: E*TRADE

IPOs historically been a “sexy” tool to participate in. This dates to the pre-2000 tech bubble when companies went public based on an idea, and in some instances doubled, tripled or more right at the first trade. Back when I started in the business, I had clients tell me that you know you were a good client if your broker gave you shares in IPOs. The big investment banks all compete to initially be the main underwriter, as the fees are enormous, and can get somewhere in the vicinity of 8% of the amount given to the company. Using Lyft as an example, the company sold 32.5 million shares @$72.00 which raised around $2.3 Billion dollars. Using a fee of 5% that’s $117 Million in investment banking fees. That figure certainly helps the earnings of the investment bank. From there other firms vie to participate in selling these shares, attempting to share in these spoils.

What we are concerned with however is, are IPOs worth participating in. I’ve always argued that if everyone does there job properly, the price that the offering should be around 10% of the real value of the company. This however rarely, if ever works out to be the case. There are just too many variables. Bankers try to place a valuation on company, owners obviously want the most they can get, and institutions fight over their piece of the pie, thus ramping up the hype.

Source: Renaissance Capital

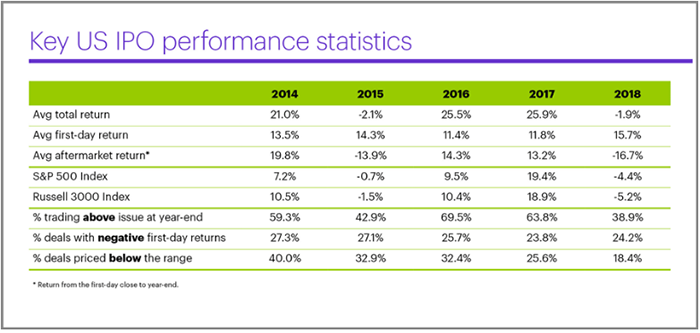

As the stats above will highlight, participating in IPOs is more of a trading game than a buy and hold strategy. The average first day return for 2018 was 15.7%, however from the end of that first day to the end of the year was (-16.7). Now a lot of that can be placed on the last quarter near 20% decline in the overall stock indexes but looking through the graph above you can see there is not much upside on end of first day to year’s end. This highlights to me that there are opportunities in getting in the initial offering but looking to follow the price closely to attempt to hit the high rather than buying on the IPO and holding indefinitely. Let the numbers all settle out and value the new company the same as you would any other in your portfolio.

Now I am a fan of what Jim Cramer calls “Mad Money”. If you have a small percentage of your investible assets designed to play this game, then go have some fun, however as I would tell you if you’re going to Vegas, go in with what you are prepared to lose.

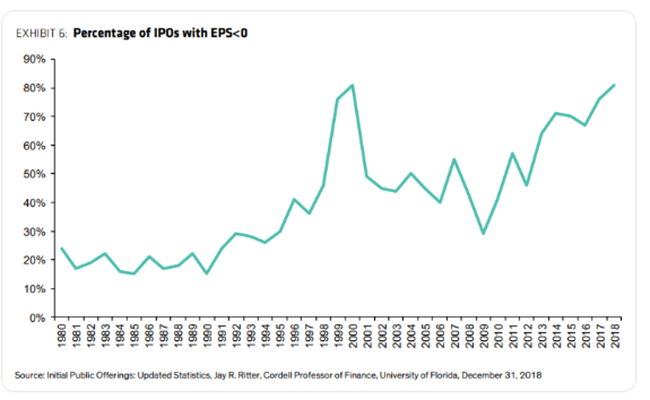

The biggest concern I see in the IPO market is that we are low at the highest level of all time of companies hitting the public markets with negative earnings. Yes, as now we have surpassed the 2000s, investing in companies that lose money. This is concerning to me on a few different measures that I won’t bore you with, other than to say the bull markets end with Euphoria.

In summary, don’t worry if you’re not participating in the IPO market. I’m not sure all the hype is worth the risk. If you are set on this strategy however, there are other ways to participate that I believe can help reduce some of the volatility. You can invest in companies that have supplied venture capital to the company about to go public. In the case of Alibaba, commonly referred to as the Chinese Amazon, (that went public back in 2014), Yahoo Inc, had provided seed capital, and at the time of the offering owned approximately 24% of Alibaba. There are also several funds that follow newly formed public companies; however, they are all very different and you should do your homework on them.

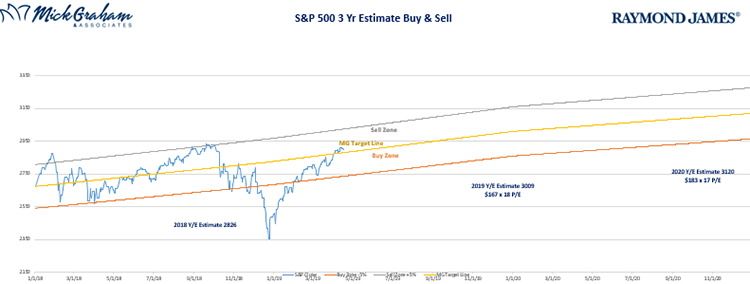

With that here’s the buy/sell

Source: MG&A

Any opinions are those of the author and not necessarily those of RJFS or Raymond James. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.

Raymond James Financial Services, Inc., its affiliates, officers, directors or branch offices may in the normal course of business have a position in any securities mentioned in this report. Investing involves risk and investors may incur a profit or a loss. Investments mentioned may not be suitable for all investors. Please consider the potential risks involved before investing in IPOs. There is no assurance any of the trends mentioned will continue or forecasts will occur.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index.