Hybrids & Convertibles But We're Not Talking Cars

As promised last week, I will devote this week to the hybrid securities that are on offer to the retail investor. By the term “Hybrid” it would essentially mean a combination of the asset classes that we went over last week. Stocks, bonds, cash, currencies, commodities and real estate. I will also touch base on the massive derivative market that you may know under the title of Options.

Convertibles

A convertible security is an investment that can be changed from one form to another. The most common use is through a capital raise trough a bond that pays a percentage of interest. At maturity the bond can then be converted to stock rather than paying back the principal value. This by nature is a true combination of a stock and a bond.

The conversion price is usually preset, meaning before you purchase the bond you will know what price conversion will take place. The conversion price is usually at a level higher than the current price, and the interest payment is usually below what the market will dictate for the company’s current credit rating. For example, company A wants to raise $1 Million in a 10-year bond offering. The interest rate for a bond based on the company’s credit rating would be 7%. The CFO decides to do a convertible bond as he can issue this bond at a 5% interest rate, saving the company around $20,000 per year of interest payments. The companies current share price is $5 and at maturity the conversion price is $8. This gives the investor the opportunity to receive an interest payment and potential for upside if the stock price is higher at maturity than the set conversion price.

Preferred Securities

A preferred stock is a class of ownership in a corporation. It generally has a higher claim than the common stock. “Preferreds” as they are known generally have a dividend that is fixed and, in most cases, higher than the standard dividend, that must be paid out before dividends to the common shareholder.

Shareholders of preferreds generally do not have any voting rights. The price of these types of assets are usually priced at $25 and mostly trade within a few dollars of this figure. Price appreciation is somewhat capped, based more so on the rate that is being paid against current interest rates.

For example, Company B may issue 1 Million preferred shares at a rate of 6.5%. If the credit rating of the company gets stronger or interest rates are lower than the $25 price of the security might rise, because that 6.5% rate seems appealing. The opposite is true if the credit rating of the organization declines or interest rates rise.

The terms of these securities is generally long term. When I first purchased my first preferred security the terms were 20 years plus. Today, a lot of preferreds issued are perpetual, meaning they have no end date. They generally have a call date to give the company an option to redeem these securities if it becomes favorable for the company to do so.

Market Linked Investment

A market linked investment, commonly also called a structured investment, is essentially a specialized bond whose performance is linked to a specific index (such as equities, sectors or commodities) over a set period of time. Mostly these products act as a combination between protection of principal and the potential for accelerated return, or a growth or income orientation.

I say it’s essentially a bond as these notes are issued by financial institutions, and your risk aside from the index that the note is linked to, is the credit worthiness of the issuer. You’re loaning money to the issuer and instead of getting an interest rate as a return (like what a normal bond would do), they go into the derivative markets to create whatever note they are trying to produce.

Each market-linked note contains its own unique risk factors that should be studied carefully prior to investing. Overall objectives, risk tolerance and asset allocation should be reviewed to determine which investment options might be suitable for an investor's portfolio. Market-linked notes are long-term investments, and all terms are honored at maturity. Since the products are meant to be held until maturity, the value of the investments in the interim may be worth less than the initial investment, irrespective of the market-linked payout at maturity Market-linked notes are not suitable for all investors. Investors should read all applicable offering documents before investing. Investors should carefully review the risk factors section in the relevant offering documents. Market-linked notes are complex financial instruments, and product features may greatly vary from product to product. Always thoroughly understand the product features and risks before investing.

For more information about the market-linked investments please click here.

Options

For some ridiculous reason, our regulators don’t allow me to discuss options, despite being able to use them as part of my strategy. Here’s a link to some info on options that’s been pre-approved. https://www.raymondjames.com/options-video

All of the above “Hybrids” have both pros and cons. Just like each of us have different goals, the structure and nature of these types of investments can achieve different objectives. I’ve said that my job aside from managing money for my clients is to educate them on the process and discipline of investing, and these vehicles can play a part on a diversified portfolio.

Touching on other news, we went through $22 Trillion of debt last week. I’ve written previously why you shouldn’t be as concerned with the debt as most media heads will tell you. I’m not advocating for government debt, or excessive spending, however there are some fundamental errors when people consider the overall effect of debt and how that will affect both the return from investments and a countries economic health. Click here to see the article. Also see the chart we made showing debt vs. Dow Jones Industrial Average.

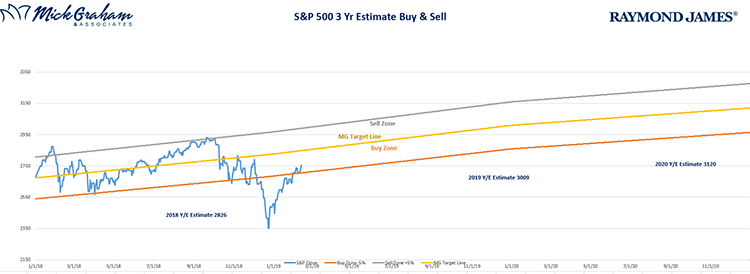

With all that said…. Here’s the buy sell

Source: MG&A

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Preferred stocks combine risks of both bonds and stocks. Preferred stocks are interest-rate sensitive and market conditions will affect their price. Dividends are not guaranteed and must be authorized by the company’s board of directors. All preferred securities carry the risk that the issuer will default or be unable to make timely payments of interest and principal. Highly rated preferred securities are presumed to have less credit risk than lower rated preferred securities. Credit risk can significantly impact preferred security holders since they are paid after bondholders. Alternative investments involve substantial risks that may be greater than those associated with traditional investments and are not suitable for all investors. These risks include, but are not limited to: limited liquidity, tax considerations, incentive fee structures, potentially speculative investment strategies, and different regulatory and reporting requirements. Investors should only invest in alternative investments if they do not require a liquid investment and can bear the risk of substantial losses. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. Commodities and currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising. Real estate investments can be subject to different and greater risks than more diversified investments. Declines in the value of real estate, economic conditions, property taxes, tax laws and interest rates all present potential risks to real estate investments. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow”, is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal. Index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification. The investment profile is hypothetical, and the asset allocations are presented only as examples and are not intended as investment advice. Please consult your financial advisor if you have questions about these examples and how they relate to your own financial situation. This hypothetical report is not indicative of any security performance and is based on information believed reliable. Future performance cannot be guaranteed and investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Options involve unique risks, tax consequences and commission charges and are not suitable for all investors. When appropriate, options should comprise a modest portion of an investor's portfolio. No statement within this document should be construed as a recommendation to buy or sell a security or to provide investment advice. Prior to making any options transactions, investors must receive a copy of the Options Disclosure Document which may be obtained from your financial advisor, from cboedirect.com/Resources/Intro.aspx or by contacting Raymond James at 880 Carillon Parkway, St. Petersburg, FL 33716. Supporting documentation for any claims (including any claims made on behalf of options programs or the options expertise of sales persons), comparison, recommendations, statistics, or other technical data, will be supplied upon request.