1st Quarter Review Target Date Funds

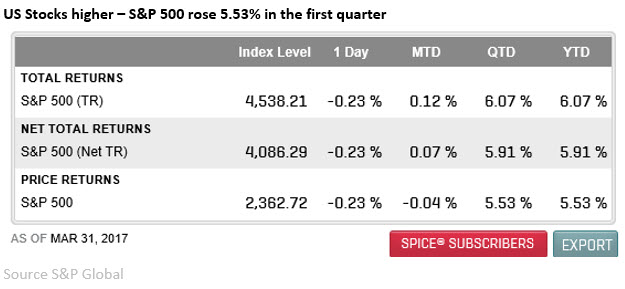

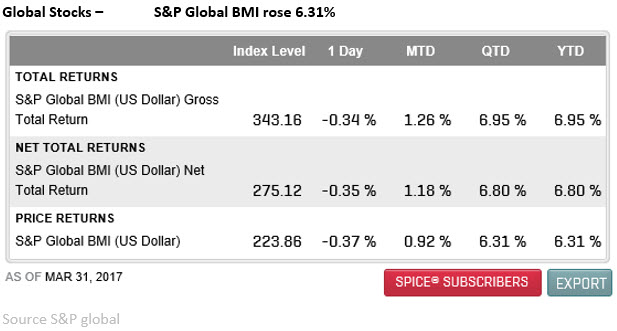

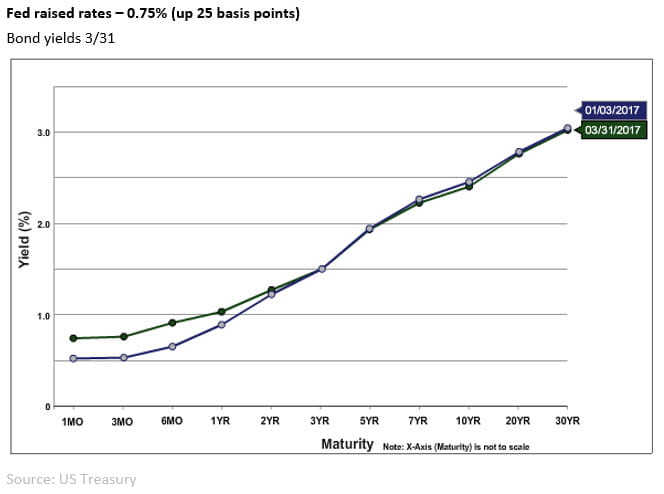

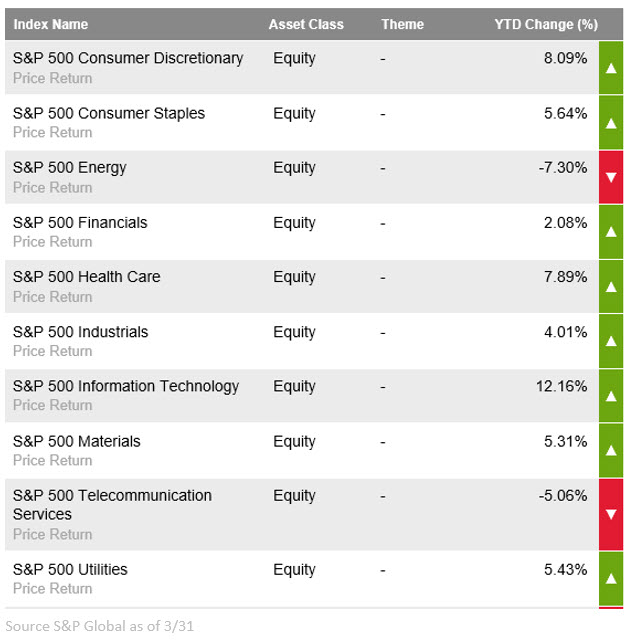

Equity Markets (both Domestic and International Indexes) posted some great returns in the first quarter. The quarter witnessed the swearing in of the 45th President, the second Fed rate hike in 3 months. I always encourage participants in 401K plans to take stock (pardon the pun) each quarter to measure their returns against an index. (See below for index returns for the 1st quarter)

I want to devote this article to Target Date Funds. Most 401K plans today provide an option for participants to invest in these “hybrid” type of investments. They are designed to match a participant’s retirement date with the idea that your investment risk tolerance becomes more conservative as you get closer to retirement. This philosophy is a sound one since time heals wounds and if you have a long period of time before retirement then you will have a greater time period to recover from a market down turn. If, however you have less than 5 years to retirement then your ability to bounce back especially if you will be drawing money from these investments, will be reduced.

You may see something that looks like this in your investment options menu.

2020 Fund

2025 Fund

2030 Fund

2035 Fund

2040 Fund

2045 Fund

2050 Fund

(56% Stock – 44% Bonds)

(64% Stock – 36% Stock)

(72% Stock – 28% Stock)

(80% Stock – 20% Bonds)

(87% Stock – 13% Bonds)

(90% Stock – 10% Bonds)

(90% Stock - 10% Bonds)

This is a hypothetical example provided for illustrative purposes only. Every plan’s investment offerings will differ.

Now the first thing I tell anyone lucky enough to have a 401K is that they should participate. The second thing is to make it automatic, and this is exactly what target date funds are designed for. So, if you’re like many and you don’t know much about investing, and don’t want to know much about investing then this may be a good option for you.

They do however have a higher cost generally than selecting the funds yourself. There is usually a fee for the underlying funds they invest in plus a fee to manage the allocations, so just be aware of what that fee is. Now a few basis points of additional fees do not sound like much however the compounding affect can be substantial in the long run. Additionally, these funds put everyone in the same age group in the same risk tolerance, given that we all have different goals and tolerances this can be problematic. Lastly, they rebalance on a time line, and not through market conditions which I’m not a huge fan of. Sometimes it’s good to let things run rather than selling them based on a calendar. But as I said above, it’s much better to be in these than in nothing at all.

The days of relying on your company to fund your retirement are slowly coming to an end, and the fact you’re in a 401K probably means that you are responsible for ensuring your retirement is funded, so it’s time to get educated on the subject.

If you want more information on this or any topic on investing, please feel free to review my blogs on the website or give our office a call.

Regards

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The S&P Value Index is a market-capitalization-weighted index developed by Standard and Poor’s consisting of those stocks within the S&P 500 Index that exhibit strong value characteristics. The Barclays Capital US Aggregate Index is an unmanaged market value weighted performance benchmark for investment-grade fixed rate debt issues, including government, corporate, asset backed, mortgage backed securities with a maturity of at least 1 year. The S&P Global BMI (Broad Market Index) , which comprises the S&P Developed BMI and S&P Emerging BMI, is a comprehensive, rules-based index measuring global stock market performance. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Every type of investment, including mutual funds and target date funds, involves risk. Risk refers to the possibility that you may lose money (both principal and any earnings) or fail to make money on an investment. Changing market conditions can create fluctuations in the value of a mutual fund or target date fund investment.

Investors should carefully consider the investment objectives, risks, charges and expenses of mutual funds and target date funds before investing. The prospectus contains this and other information about mutual funds and target date funds. The prospectus is available from the fund company or retirement plan sponsor and should be read carefully.