VIX & the Beltway

I've written a few times in the past couple of months that volatility has been at an all-time low, and that we should expect to see the change in the coming months. Last week was a good example of how quickly things can turn, with headlines around Russian officials, meetings in the White House and notes from meetings between the FBI director and president, sending the market into a tizzy. The VIX index which is an index calculated and published by the CBOE or Chicago Board of Exchange, was at a 20 low, measuring just over 10. It's commonly referred to as the "fear index" and as a measure of implied volatility on the S&P 500 index. After Wednesday sell off that quickly jump to 15, 46% jump in one day.

Again, this feels like a good time to say, "it's all about earnings". The market today is generally based on expectations of earnings in the future.

I heard our old Merrill Lynch strategist Rich Bernstein on CNBC last week talk about his reasonings for the level of low volatility. He felt quantitative easing (QE) we’ve seen over the past seven or eight years have flooded the market with cash and volatility happens when you get a drying up of the liquidity. I totally agree, and we still have corporations with record amounts of cash on balance sheets and looking for ways to best utilize that capital, which in my opinion will keep the market flooded with liquidity for some time to come.

In my opinion, the U.S. markets and economy have a great track record and resilience despite Washington. I'm not going to say that the pro-growth agenda hasn't helped the markets in the last few months but I think both sides of the aisle want to get some type of tax reform done and whatever tax rate they finally settle on will likely be well received. I've always argued that corporations will make money in any environment you just need to tell them what the playing field looks like.

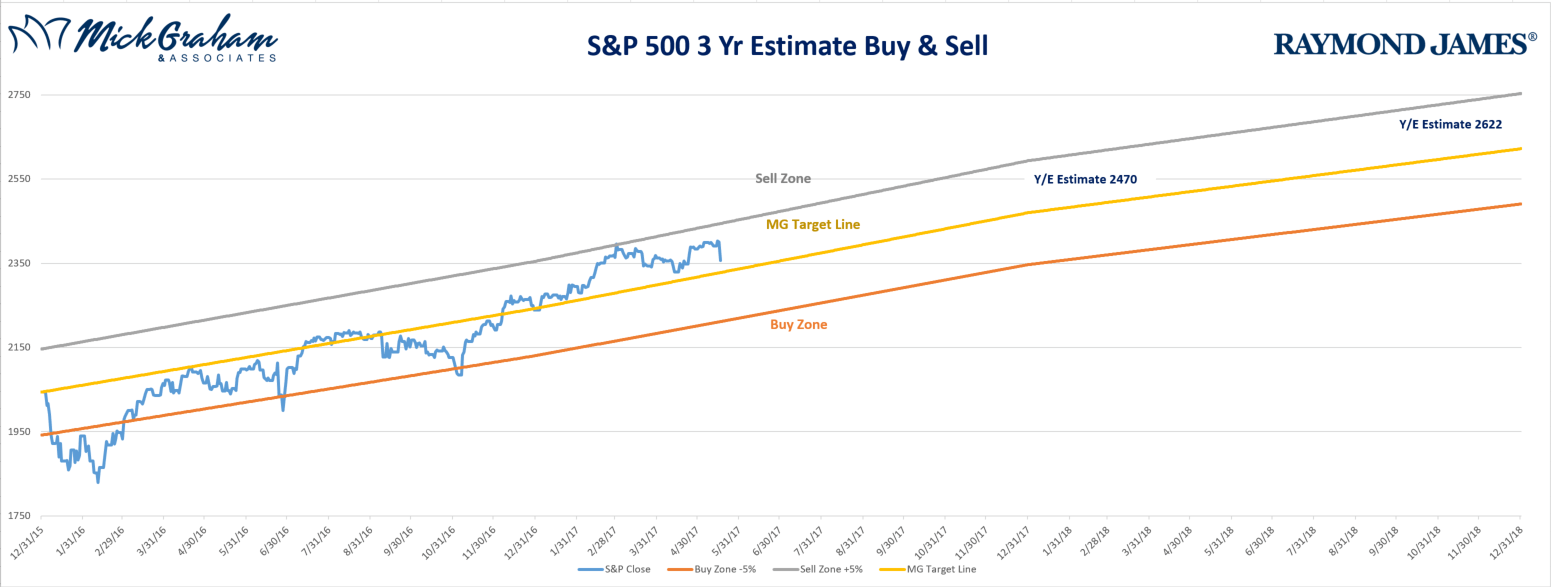

Here's the buy sell for this week.

Source: MG&A

We are toward the end of Q1 earnings and it looks like we are around 15% above Q1 of 2016 slightly above our expectations.

In summary, it’s likely we will get many more days like last Wednesday in the future and it's normal in any market cycle. As always should you have any questions or concerns don't hesitate to call.

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. VIX is the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. It is a widely used measure of market risk.