Value Investing

I was talking to a friend of mine the other day who was asking me about a stock that he purchased that had been going down in price since he started buying it. I told him if he still believed in the company long term he should buy some more. His response was one that I’ve been thinking about since that day. He said “Argh, it’s all just gambling”. Asking him more about if he thinks investing is like gambling he believed they were interchangeable.

People in my line of work cringe when we hear those types of comments. I went on to explain the difference between investing and gambling but it wasn’t until I told him about the Investors that I’ve followed, that he started to get the point.

The first investing book I read was by Benjamin Graham, who I feel was the grandfather of investing. To be honest I read his book mainly due to the fact we had the same last name and that we could be related in some distant sense. The book called “the Intelligent Investor” was first published in 1949 and is widely considered the book on value investing. Value investing means many things now, but at the time of Grahams writings it was meant to mean buying securities that appear underpriced based on reviewing the fundamentals of the company. Graham taught at Columbia Business School, which was one of my major motivators of wanting to attend the school to obtain my Certified Portfolio Manager designation.

Prior to his book and teachings, Graham graduated from Columbia in 1914, went to work for Wall Street firm Newburger, Henderson & Loeb as a messenger. Within 6 years he was a partner. It is stated that Graham personally lost everything in the crash of 1929, but his firm at the time (partnered with Jerome Newman) survived and eventually recouped the losses. In 1934 he co-authored a book called “Security Analysis” widely considered an investment classic. The Newman/Graham partnership boasted average returns of 17% per year for the next 22 years through the termination of the business in 1956.

Should you have invested $1,000 in 1934 and kept it there till the firm terminated then you would have pulled out $31,629 with annual compounding interest. I thought I’d run the numbers if that performance continued it would be worth $390,158,151.92 today. Sounds crazy till you hear what his disciple Warren Buffet had better numbers up through 2004 outperforming the S&P 500 by 12.24% during the years of 1980 to 2003 according to a 2005 paper by Gerald Martin and John Puthenpurackal.

My point is that since reading Uncle Bens book over 20 years ago, I became a sound advocate of investing. Buffet says it best, “Investing is the engine that drives capitalism, gambling is an ignorance tax”

Value investing has a track record and gambling has a hotline…

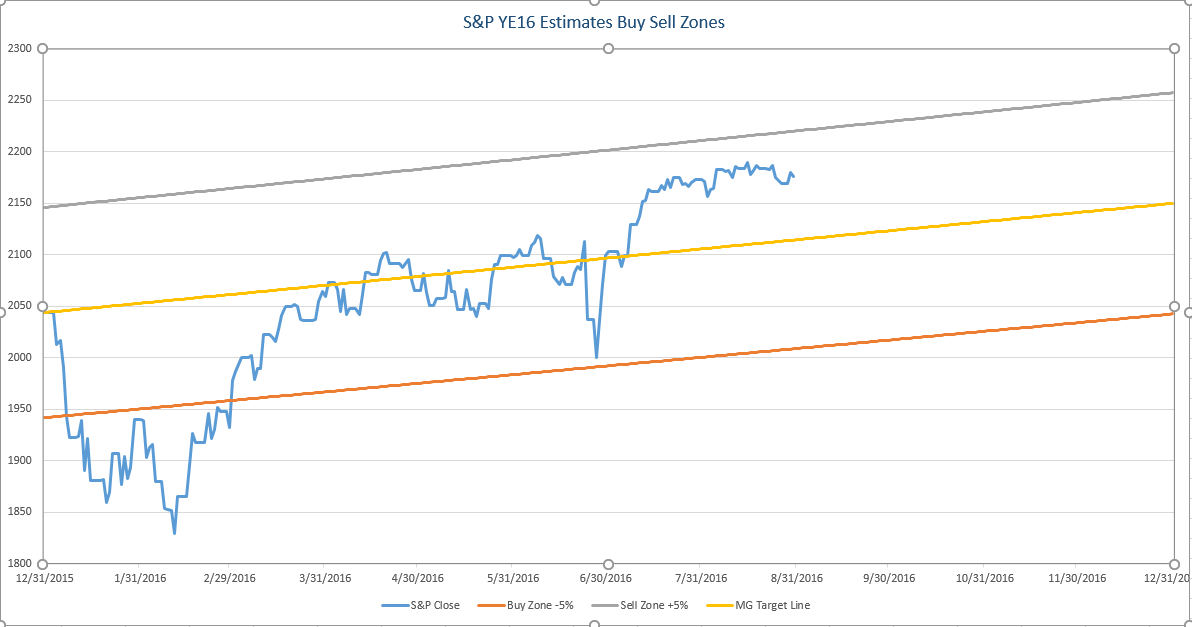

Here is our graph through 8/31

Source… Mick Graham & Associates, Standards & Poor’s

As always should you have any questions or concerns please don’t hesitate to call.

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.

Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment.