Spring Update

I don’t take saying this lightly, but it finally seems safe to say that Spring has Sprung (knock on wood)! Here are a few updates from us as we move into this next phase of the year:

- We prioritize scheduling client review meetings in the Spring to go over your investments and to catch up on what you have going on in your Meetings can be scheduled over the phone, Zoom or in-person depending on what you prefer. If we don’t have the opportunity to meet with you this Spring, know that we’ll be making calls to clients in the second half of the year to check in. Please give the office a call at 262-691-4000 to schedule your review meeting.

- We’re planning another client appreciation event this summer, mid to late July, and we hope to have a formal announcement out to you by the end of May. Stay tuned for further details if you’re interested in attending!

- We will be doing a Social Security webinar over Zoom at 12:00PM on Wednesday, April 30th. This is open to anyone who is interested in joining and we’ll be emailing invitations to register for it on Wednesday, April 2nd.

- Family and friends of yours are welcome to receive these periodic mailings that we send out! If you know of anyone close to you who may be interested in receiving our mailings, please let us know so that they can be added to the list.

- I’ve wanted to make it a point to begin including some tidbits about the markets and the economy that I’ve written with each of these mailings. On the following pages, you’ll find some insights into the stock I recognize that this subject can be a bit dry and not everyone enjoys reading about numbers, but I hope you’ll find something interesting in these from time to time!

Thank you for taking the time to hear from us, and we look forward to hearing from you! It is an honor and a privilege to serve you.

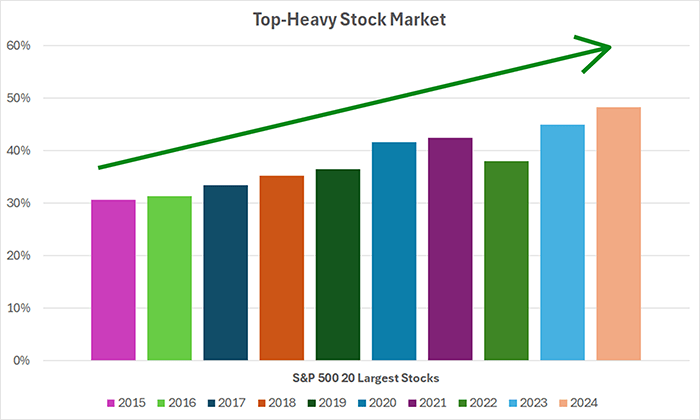

Chart Source: Joel Merritt, with data from https://www.finhacker.cz/top-20-sp-500-companies-by-market-cap/

The S&P 500 is an index of 503 US stocks that is generally considered to be a good representation of the US stock market. The chart above shows the percentage of all of the money invested in S&P 500 companies that was invested in the 20 largest companies at the end of each of the past 10 years. At the end of 2024, over 48% of all of the money invested in S&P 500 companies was invested in the largest 20 companies. Yes—this means that there was nearly as much money invested in the largest 20 companies as there was invested in the other 483 companies combined! Back at the end of 2015, the total money invested in the largest 20 companies was 31% of all of the money invested in S&P 500 companies, by comparison. Over the past decade, the US stock market has become much more "Top-Heavy."

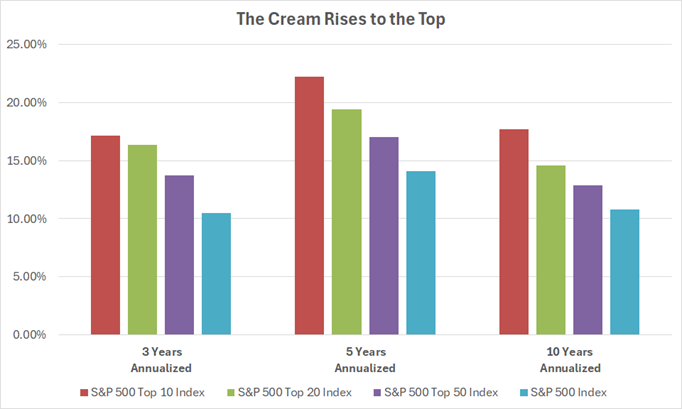

Chart Source: Joel Merritt, with data from https://www.spglobal.com/spdji/en/index-family/equity/us-equity/ #indices all performance figures are as of March 6, 2025

Not only have more dollars been invested in the largest companies in the S&P 500 over the past decade, but the performance of the largest companies has followed suit. The chart above shows the annualized performance of the largest 10, 20 and 50 companies in the S&P 500 as well as that of the entire S&P 500 over the past 3, 5 and 10 years. The largest 10 companies in the S&P 500 have outperformed the largest 20; the largest 20 have outperformed the largest 50 and the largest 50 have outperformed the entire index. It doesn't matter which way you slice the performance—whether over the past 3, 5 or 10 years—the stocks of the larger companies have consistently outperformed the smaller companies. Seeing as bigger companies have produced better returns, the old adage "The Cream Rises to the Top" has been fitting for the US stock market.

Investment advisory services offered through Raymond James Financial Services Advisors, Inc. Merritt Wealth & Retirement Advisors, Inc is not a registered broker/dealer and is independent of Raymond James Financial Services. Any opinions are those of Joel Merritt and not necessarily those of Raymond James. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.