Clear sentiment on interest rate direction

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

We did an internal survey among our associates, attempting to get a feel for their views on various economic and fixed income topics. Any survey result concerning the future can net inexact results but nonetheless reveal general sentiment. Attitude, outlook, and opinions can help shape the market.

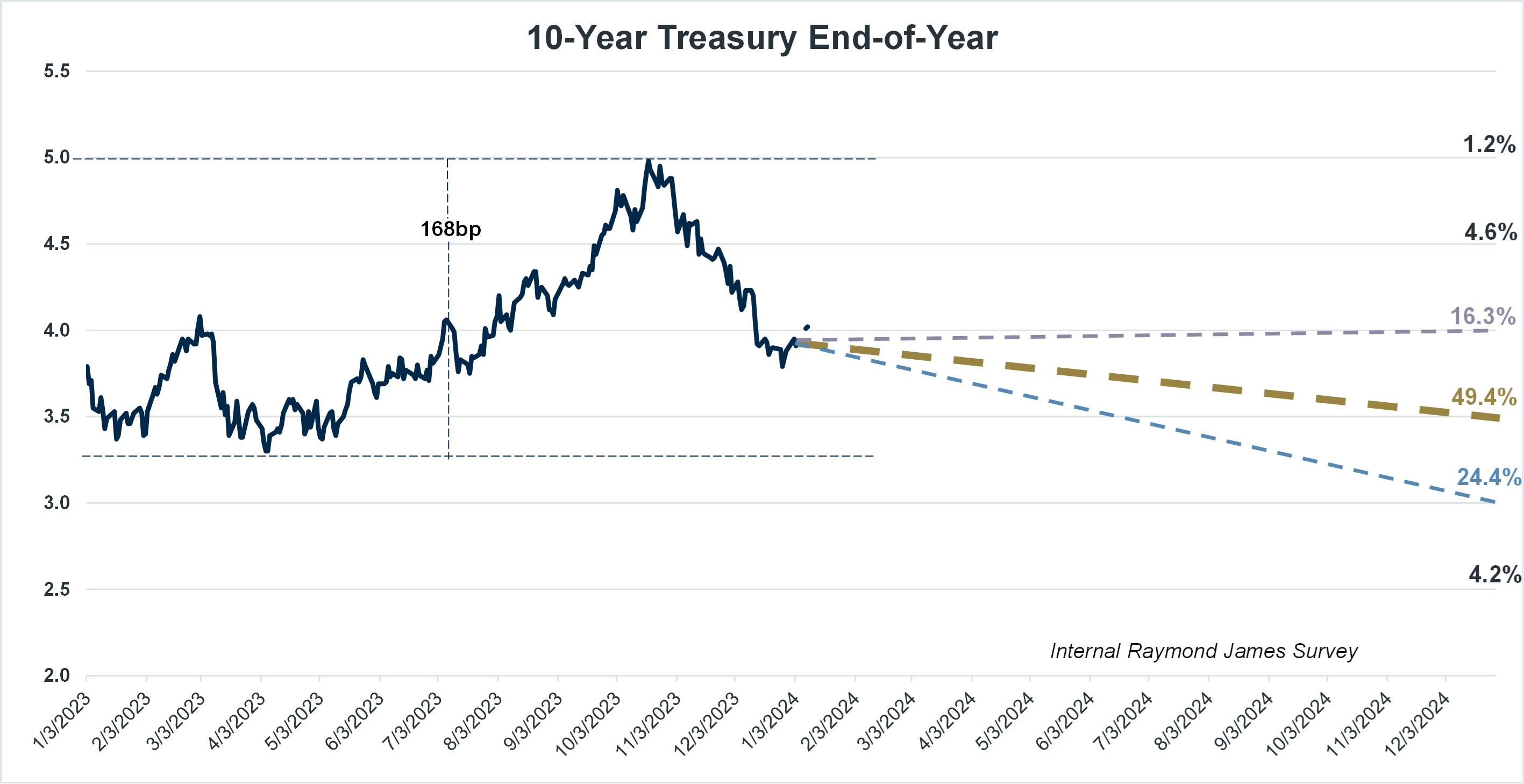

One of the questions asked was where the 10-year Treasury rate was headed in 2024. The graph’s solid blue line depicts the 10-year Treasury path during 2023. The dashed lines reflect the anticipated year-end landing. It is noteworthy that 78% of the sentiment feels that interest rates will be lower by year’s end and when you include those that think interest rates will be the same or lower it climbs to 94%. Less than 6% of financial advisors anticipate higher interest rates.

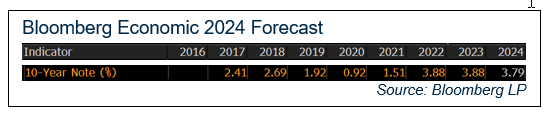

Bloomberg provides an Economic Forecast composed of chief economists from major money centers, brokerage firms, and prestigious universities. The results are consistent in that 90% of the economists predict the 10-year Treasury to be about the same or lower by the end of 2024. (orange numbers actual; white number forecast)

Bloomberg also provides data on the World Interest Rate Probability. The data reflects the probability of future Fed Funds moves based on how Fed Funds futures are trading in the market. As of this Tuesday morning, the Fed Funds (short overnight money rate) futures market is reflecting a 150 basis points drop by the end of 2024.

The pattern is distinct. Regardless of feelings toward the economy, whether we go into a recession or avoid one, a very high percentage of people make the case for lower interest rates. This matters to the extent of propping up fixed income allocations. Yields in general, are higher than they have consistently been in 15+ years. Take advantage of this window of opportunity and lock into higher income for as long as your own risk tolerance will allow. Your financial advisor can illustrate the most favorable fixed income product for your desired target maturity range.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.