When markets react, consider a broader historical perspective before changing your financial course.

Market volatility can often trigger emotional responses in investors, responses that can impact judgment and potentially affect long-term plans.

These periods of volatility are an opportunity to connect with your advisor, enabling them to act as a sounding board for your concerns. By talking about current events in light of your overall financial plan, your advisor can provide reassuring perspective to help you stay the course or readjust if needed.

Pullbacks can make you want to pull up stakes and run – a reaction that’s often a mistake, especially for long-term investors. The right knowledge and historical perspective can help us avoid making investment decisions based on emotion rather than strategy.

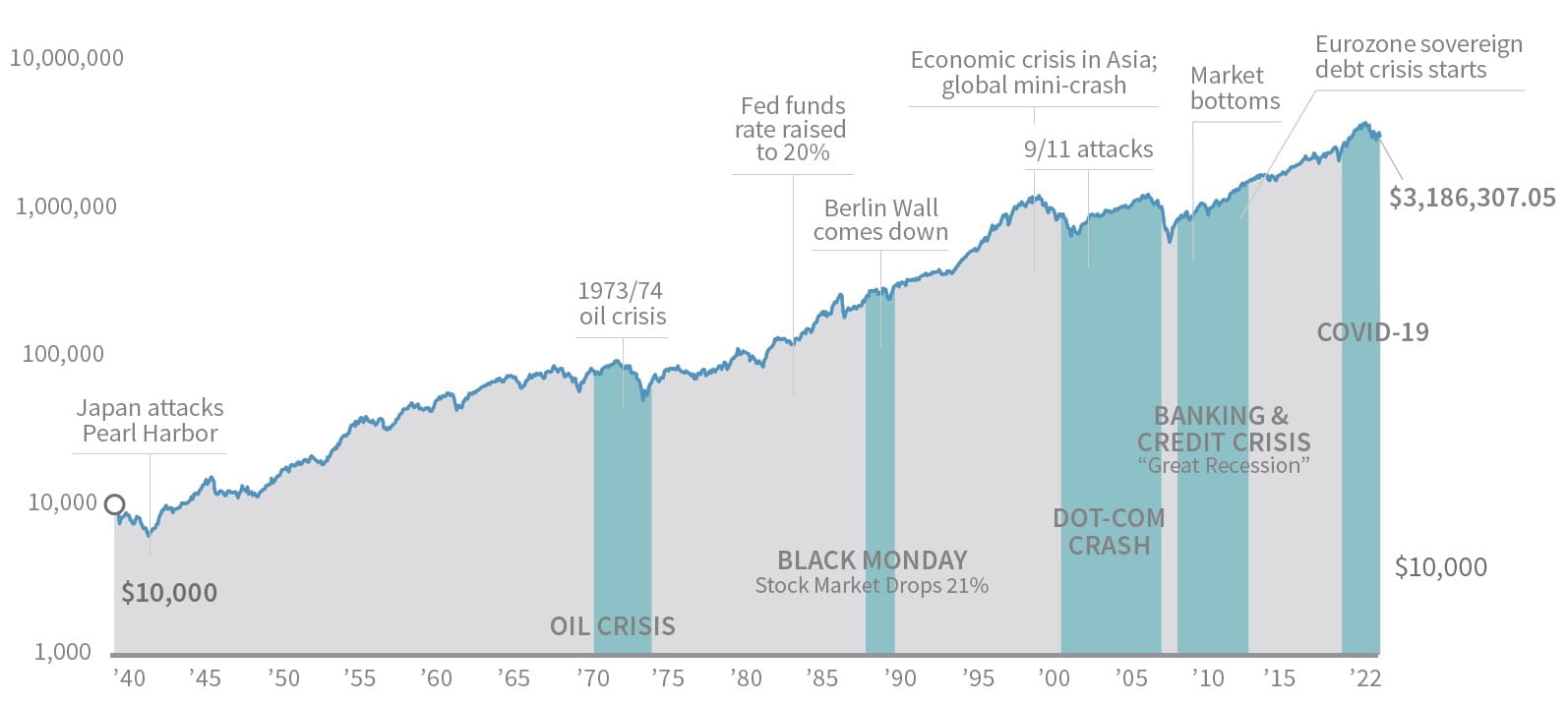

By looking at the market over a long period of time, we’re provided with a true testament of resiliency. Each decline along the way felt terrible, and declines today feel just as uncomfortable. But when we track the overall growth the market has achieved, it’s clear that there are benefits to persistence, patience and commitment.

Remember:

Stocks overcome bumps in the road

Growth of $10,000 in the S&P 500

Source: Morningstar. This chart is for illustrative purposes only. This analysis does not include transaction costs, which could reduce an investor’s return. Growth of $10,000 in the S&P 500 1/31/40 – 12/31/22.

Timing the market is a near-impossible task. By staying invested, even through periods of volatility, investors can increase their chances of achieving higher returns.

Take a look at the chart below illustrating how missing even a few market days can impact overall returns. Over the past 15 years, the S&P 500 has grown at an annualized rate of 6.9%. However, removing only the five best trading days over that 15-year period would bring the index’s total growth down to 3.7%, and missing the 20 best trading days pulls its return to -1.8%.

As of 12/31/22. Source: Raymond James Investment Strategy research. This example is for illustrative purposes only and is not indicative of the performance of any investment. It does not reflect the impact of taxes, management fees or sales charges.

Don’t inadvertently miss out on important recovery days by trying to time the market’s every movement. Instead, speak with your advisor about how your long-term plan is positioned to weather short-term volatility – and discuss whether temporary pullbacks are actually an opportunity to strategically add to your portfolio.

Remember:

Especially during declines, your advisor can act as a sounding board for your concerns. By talking about current events in light of your overall financial plan, your advisor can help provide reassuring perspective to help you stay the course and take advantage of any opportunities that tumultuous markets can present.

Read the full

Weathering Market Volatility brochure

Past performance may not be indicative of future results. There is no assurance these trends will continue. The market value of securities fluctuates and you may incur a profit or a loss. Investing involves risk including the possible loss of capital. The S&P is a weighted, unmanaged index composed of 500 stocks believed to be a broad indicator of stock price movements. Investors cannot buy or invest directly in market indexes or averages. Past performance is no guarantee of future results. Dollar-cost averaging does not assure a profit and does not protect against loss. It involves continuous investment regardless of fluctuating price levels of such securities. Investors should consider their financial ability to continue purchases through periods of low price levels.