The U.S. economy is on track for a soft landing

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The U.S. economy is on track for a soft landing

- Bonds are back to being bonds again

- The equity bull market is still intact

Time For A Road Trip! Road trips have been an American staple for decades. While their popularity went through a multi-decade decline as air travel become more convenient and affordable, road trips are making a comeback! And for good reason – what’s not to love about hitting the road with family or friends? Whether your road trip takes you to the beach, mountains, our national parks or anywhere in between – the journey to your bucket list destination is sure to be an experience you will remember. And just like road trips can bring unexpected detours, the economy and financial markets are at their own crossroads: recession or soft landing? who will win the election? can the strong market performance continue? For more insights on what to expect from the economy and the financial markets in the months ahead, join our Quarterly Coordinates webinar on Monday, October 7 at 4 PM. In the meantime, here’s a sneak peek:

- Our GPS on the economy keeps ‘recalculating’ | The sun continues to shine on the U.S. economy. Some of the traditional metrics that we follow (e.g., ISM manufacturing, the Fed’s aggressive tightening cycle, and leading indicators) suggest that the economy should have succumbed to a recession by now. However, growth has proven more resilient than expected. Just like the GPS ‘recalculates’ when a road trip takes an unexpected detour, our growth forecasts have had to ‘recalculate’ as the economy has proven more resilient than expected. The reasons: healthy job growth, government stimulus, travel spending, fiscal support (IRA, CHIPS, Infrastructure Act) and AI investments. We have revised our 2024 GDP forecast higher to 2.6% and expect 2.0% growth in 2025. The important point: slowing, but still positive job growth, healthy levels of business capex, and unspent fiscal stimulus should keep the economy on a path to a soft landing.

- The Fed’s easing cycle is just beginning | After holding the fed funds rate at an elevated level for 14 months – its second longest ‘on pause’ period in history – the Federal Reserve (Fed) kicked off its easing cycle with a jumbo-sized 50 bps rate cut in September. Cooling inflation and softer labor market conditions have given policymakers the confidence they need to start dialing back some of the policy restraint put in place when the economy and inflation were much stronger than they are today. With inflation steadily declining, the Fed’s focus has shifted to protecting the labor side of its mandate. We expect rate cuts to continue through 2025 – with the fed funds rate settling at 3.4% by year-end 2025. The main difference in this easing cycle from previous ones: the Fed is cutting rates pre-emptively, rather than responding to recessionary conditions. With the economy still on solid ground, these ‘insurance cuts’ should help prolong the economic expansion.

- The election remains too close to call | The polls suggest this unprecedented election remains a toss-up. With 32 days to go, Harris has a slight advantage in the national polls – but remember, it’s the Electoral College that matters. One swing state in particular – Pennsylvania – will likely decide the presidential race. We expect Congress to remain divided, with the Senate flipping to Republicans and the House flipping to Democrats. Key policy decisions on our radar, regardless of who wins, are tariffs, the national debt, and the expiration of the 2017 Tax Cuts at year-end 2025. While election uncertainty may weigh on the equity market in the near term, remember that other fundamental factors – the economy, Fed policy, earnings growth, and investor sentiment – matter more for investors in the long term.

- Bonds are back to being bonds again | After a brief ‘detour’ during the Fed’s historic tightening cycle, bonds have resumed their traditional role of providing consistent income and stability in a portfolio context. Case in point: high-quality fixed income yields remain above their 20-year average and correlations have flipped negative again (suggesting bonds can provide a modest adequate hedge against equity risk). While the early innings of a Fed easing cycle tend to usher in lower rates (higher prices), this cycle may be different. With debt/deficit dynamics a key focus, the scope for a meaningful decline in longer-maturity yields is limited as we expect the 10-year Treasury yield to stay relatively stable over the next 12 months. Our favored sectors within fixed income are investment grade and municipals.

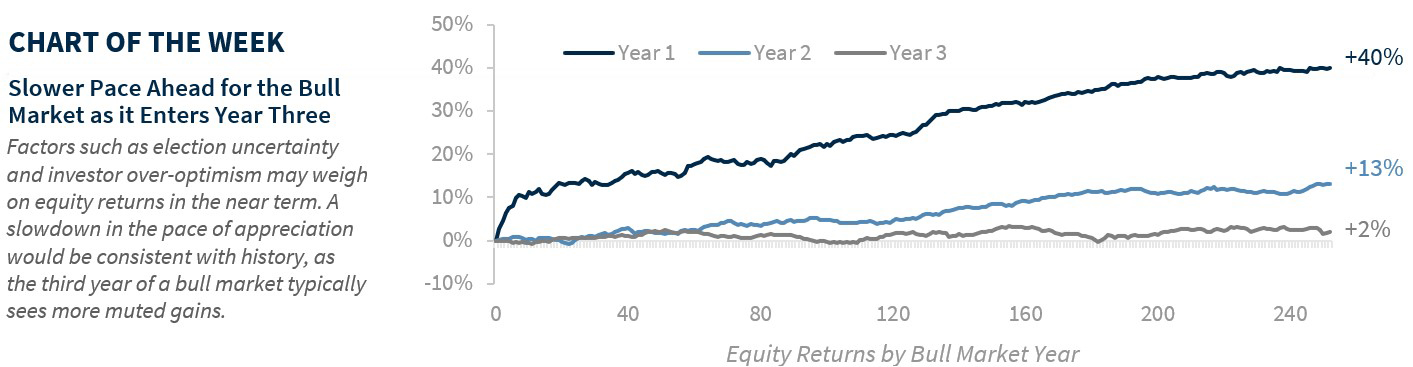

- The equity bull market is still intact | The macro environment – slow, but steady growth, decelerating inflation, Fed rate cuts, shareholder-friendly activity—remains supportive for the equity market. Our 12-month forecast for the S&P 500 is 5,850. But beware of ‘traffic patterns’ – election uncertainty, overly optimistic investors, and the potential for another growth scare – that can temper the gains near term. Our favorite sectors are Info Tech (AI boom still in its early stages), Health Care (aging demographics), and Industrials (beneficiary of government spending). Fed rate cuts and our soft landing outlook should also be supportive for small caps. We maintain our preference for U.S. over international as it has more exposure to our favored sectors (i.e.,Tech). The global backdrop is also supportive for emerging market equities, but selectivity remains important. India, in particular, remains on our radar screen.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.