529 Plans, Volatility, and Teaching your Child about Money

The Kritikos Wealth Management Guide on 529 Plans

Attached is our personal guide on 529 Accounts. This guide will soon be made available to the public and found on our website. Attached is an electronic PDF file for your viewing. If you’d like a hard copy, let us know, and we’ll send one right over.

There were a lot of updates made to this account by the Biden Administration during the Secure 2.0 Act. Now these accounts can set up your beneficiary for retirement, through a ROTH IRA! Look through it and let us know if you have any questions.

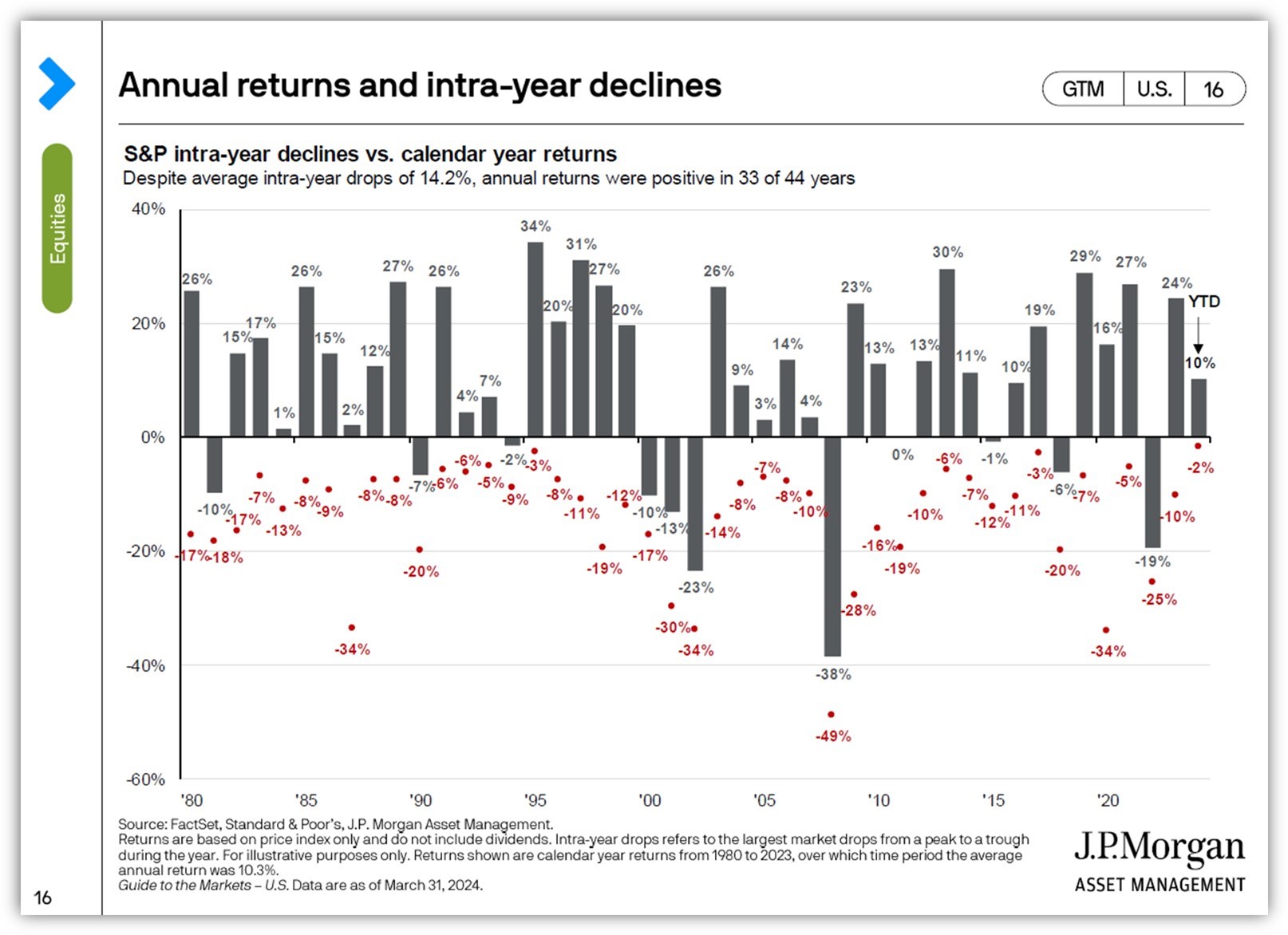

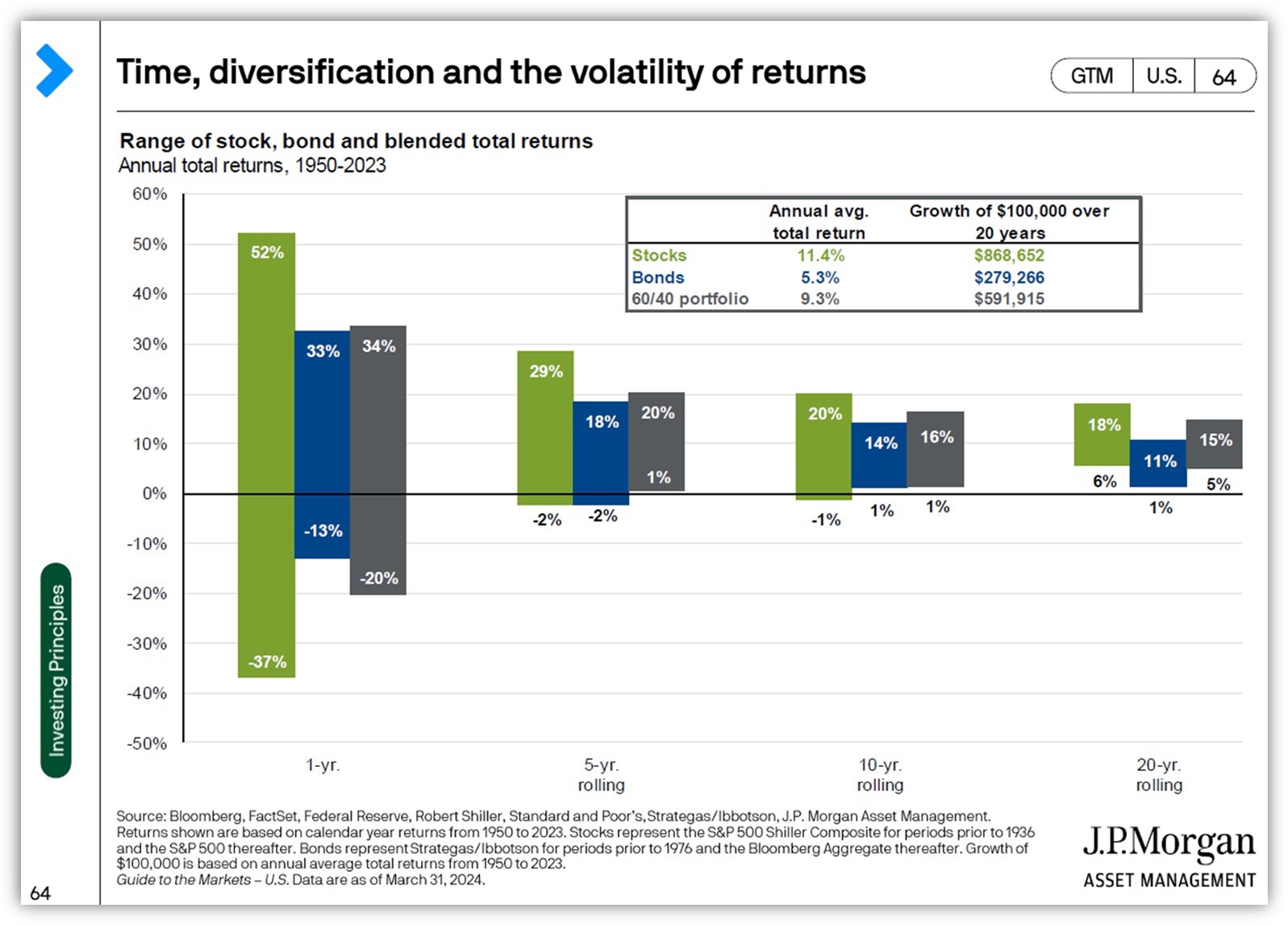

Volatility is the Norm

The markets move up and then down; The narrative is positive and then negative; At times economic data supports a strong market and then in the blink of an eye, economic data shifts to the downside. Volatility in markets are just a part of an ever evolving narrative in the investing process, and taking any single data point and changing your investing philosophy or objective will run your portfolio and net worth into the ground. Do not let volatility scare you from what your future holds.

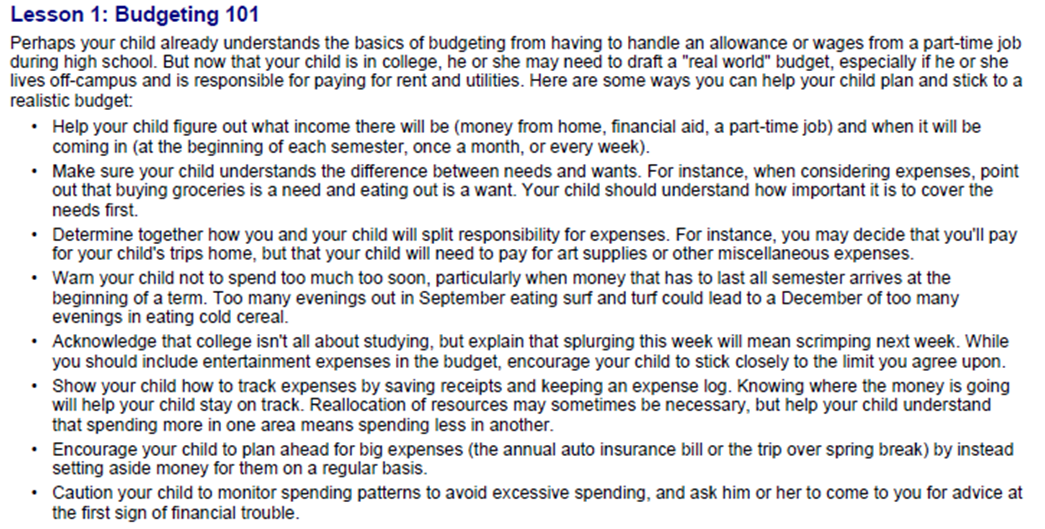

Teaching Your College-Age Child about Money

Full article attached for you!

Andrew M. B. Kritikos

Financial Advisor, CFP©

Kritikos Wealth Management of Raymond James

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.