New All Time Highs - Nov. 8th, 2024

Weekly Economics

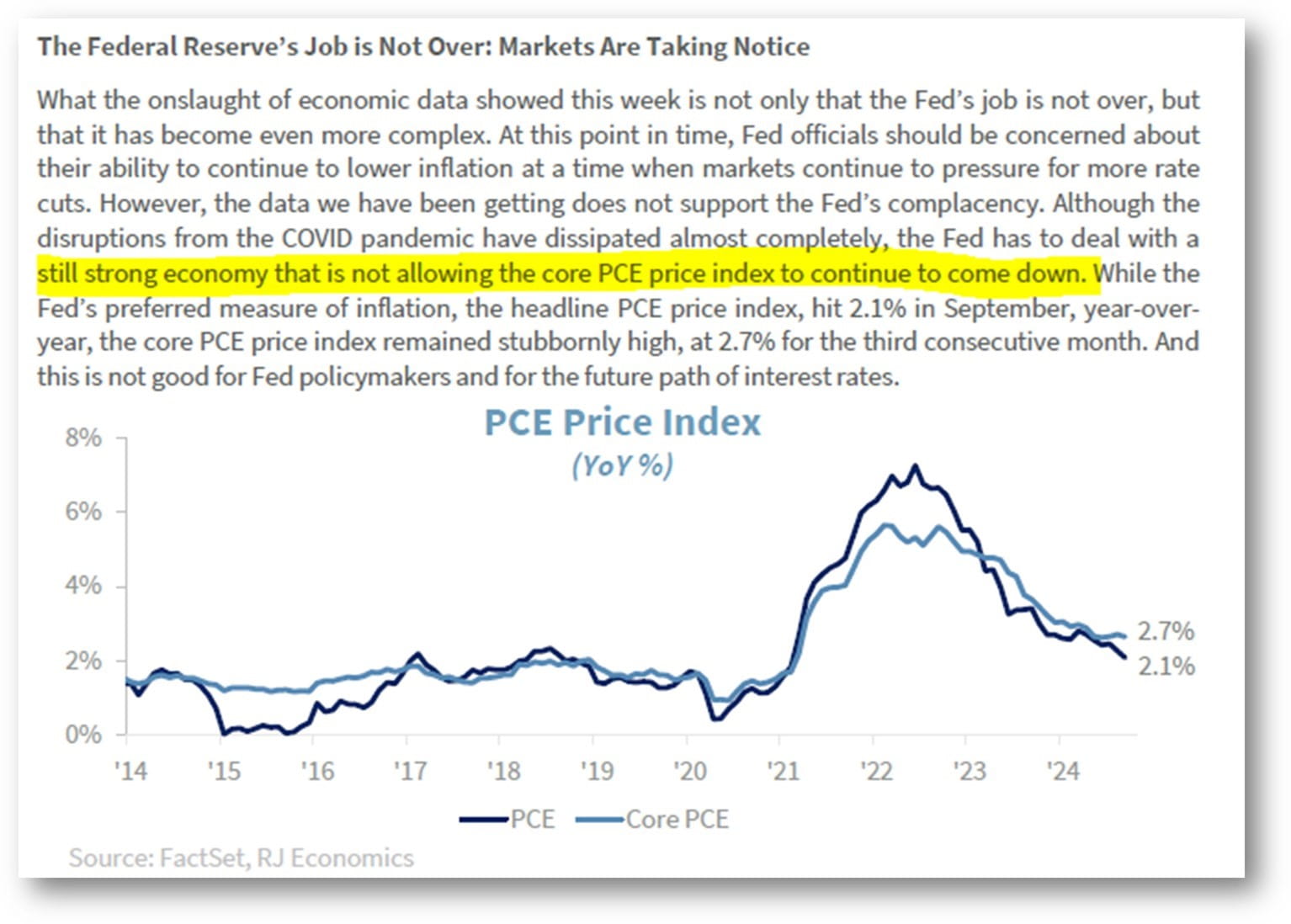

There was a lot of good information in Eugenio’s piece this week, but the important draw I took was about the economy continuing to show strength. The Federal Reserve has to deal with a strengthening economy that is not allowing the Core PCE inflation metric to get to their target. I still believe we will receive the 25 basis point cut in November and again in December, but next year we may not continue to get rate cuts. All in all, I believe rates will stay higher for longer, due to such a strong U.S. economy.

Three on Thursday – Inflation Simplified

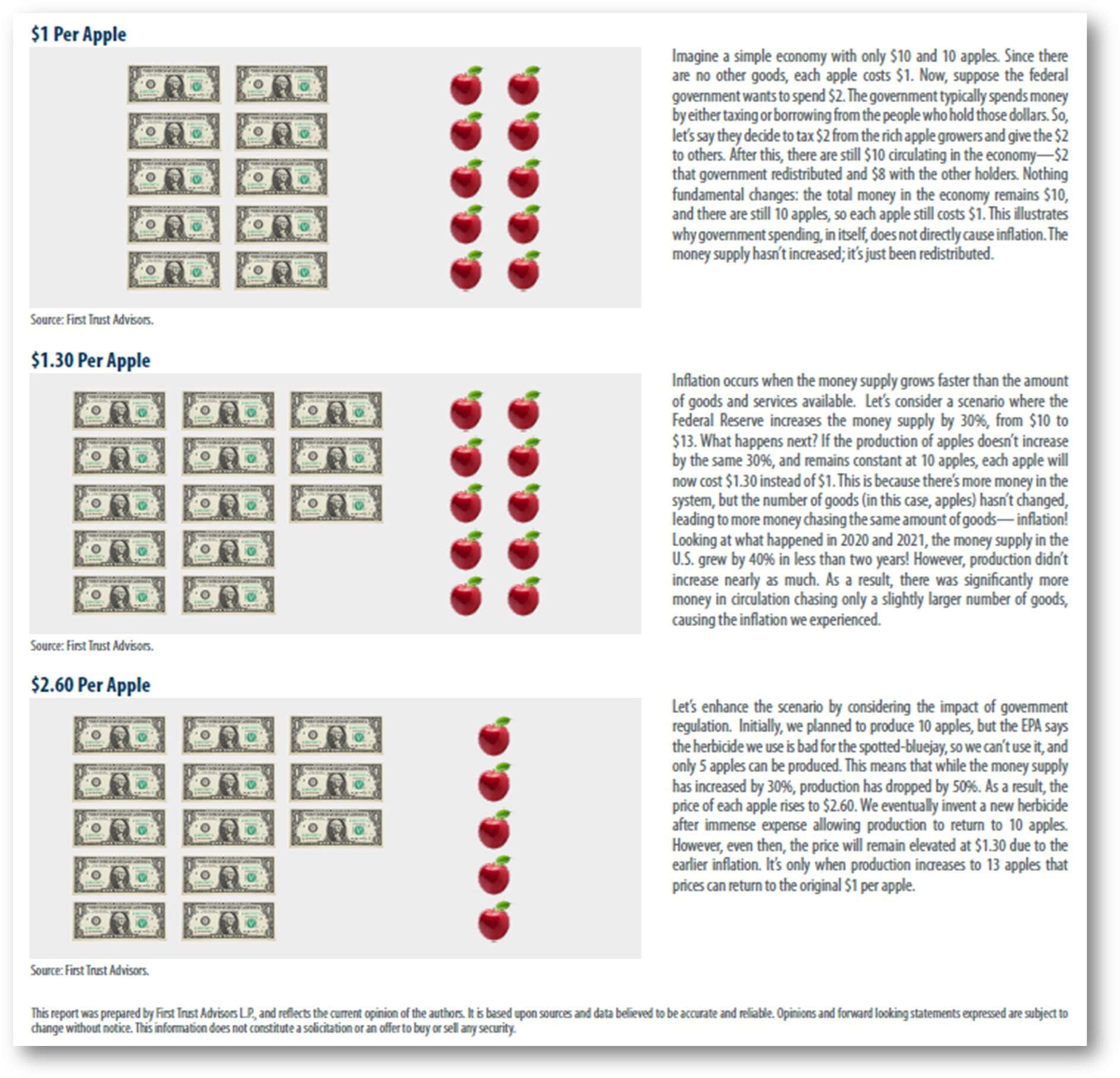

On the topic of inflation and growth, attached is a great piece on inflation by first trust. It speaks to the great economist Milton Friedman. “inflation is always and everywhere a monetary phenomenon, in the sense that is and can only be caused by a more rapid increase in the quantity of money than in output” Contrary to popular belief, inflation doesn’t stem from raising wages, greedy businesses, government deficits, or even rapid economic growth – it results from the excessive printing of money.

Markets make new highs – Charts of the Week.

Wow, after the election was settled with a winner the Nasdaq 100, DOW JONES, and S&P 500 broke out to new all time highs.

S&P 500 ; 2024