What are our thoughts? October 11th, 2024

Three on Thursday – Still a Sellers’ Market

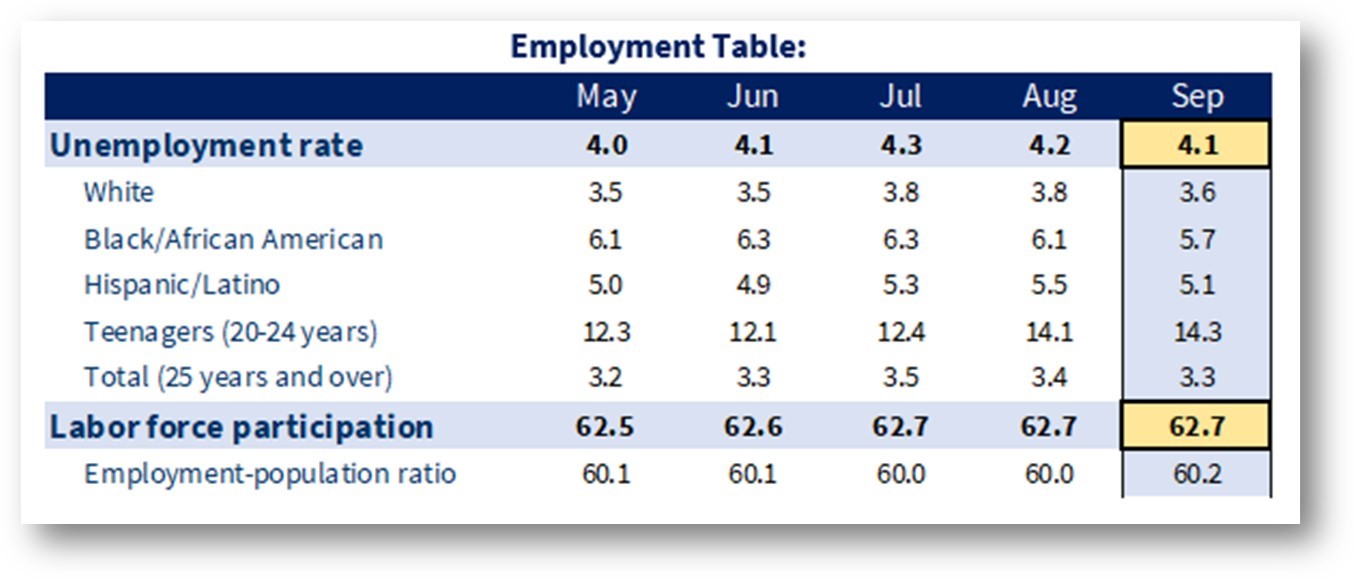

Wow, what a surprise this week to the Non-Farm Payroll number. We had a surprise beat of 100,000 jobs, and the Unemployment Rate dropped to 4.1%. This sent bond yields up, along with the overall stock market. We typically see a pull back this time of year, in October, yet the market continues to grind higher on strong economic news. This also changed increased the chances of a 25 basis point cut at the November Fed meeting to a near 100%.

Three on Thursday – First Trust

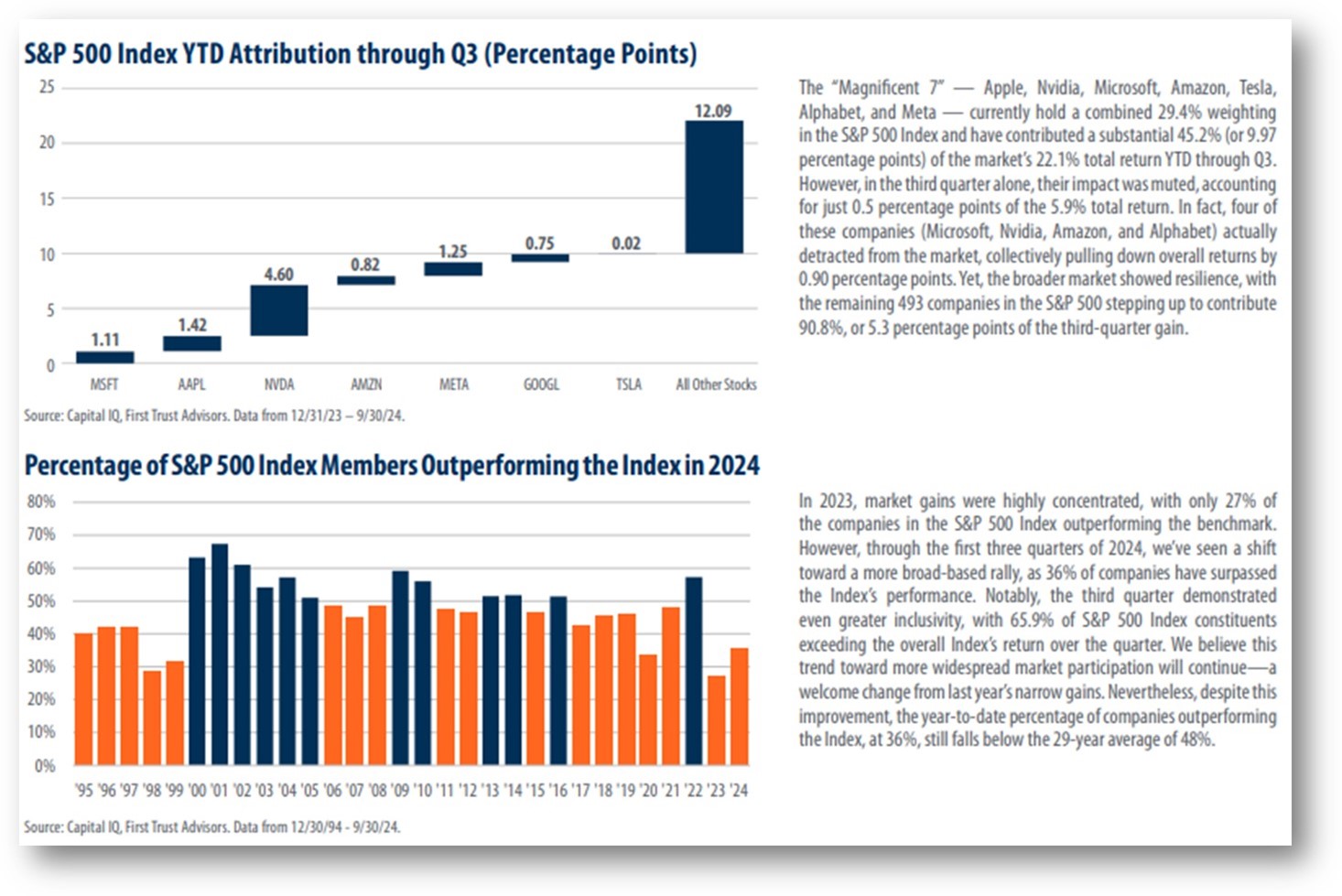

First Trust explored the performance of the S&P 500 index in the third quarter of 2024. The index posted an impressive total return of 5.9% bringing the YTD total return to 22.1%. Below are a few charts that offer a deeper understanding of the events that unfolded.

The Politics of Limits – Economist Brian Westbury.

Attached to this email is Brian Westbury’s latest take on the National Debt of the U.S. He reviews the recent surge in the national financing of the debt, due to higher interest rates.

Information was developed by First Trust, an independent third party. The opinions of Brian S. Wesbury, Robert Stein and Strider Elass are independent from and not necessarily those of RJFS or Raymond James.