KWM - Stagflation, Interest Rates, and 529 Plans. May 3rd, 2024

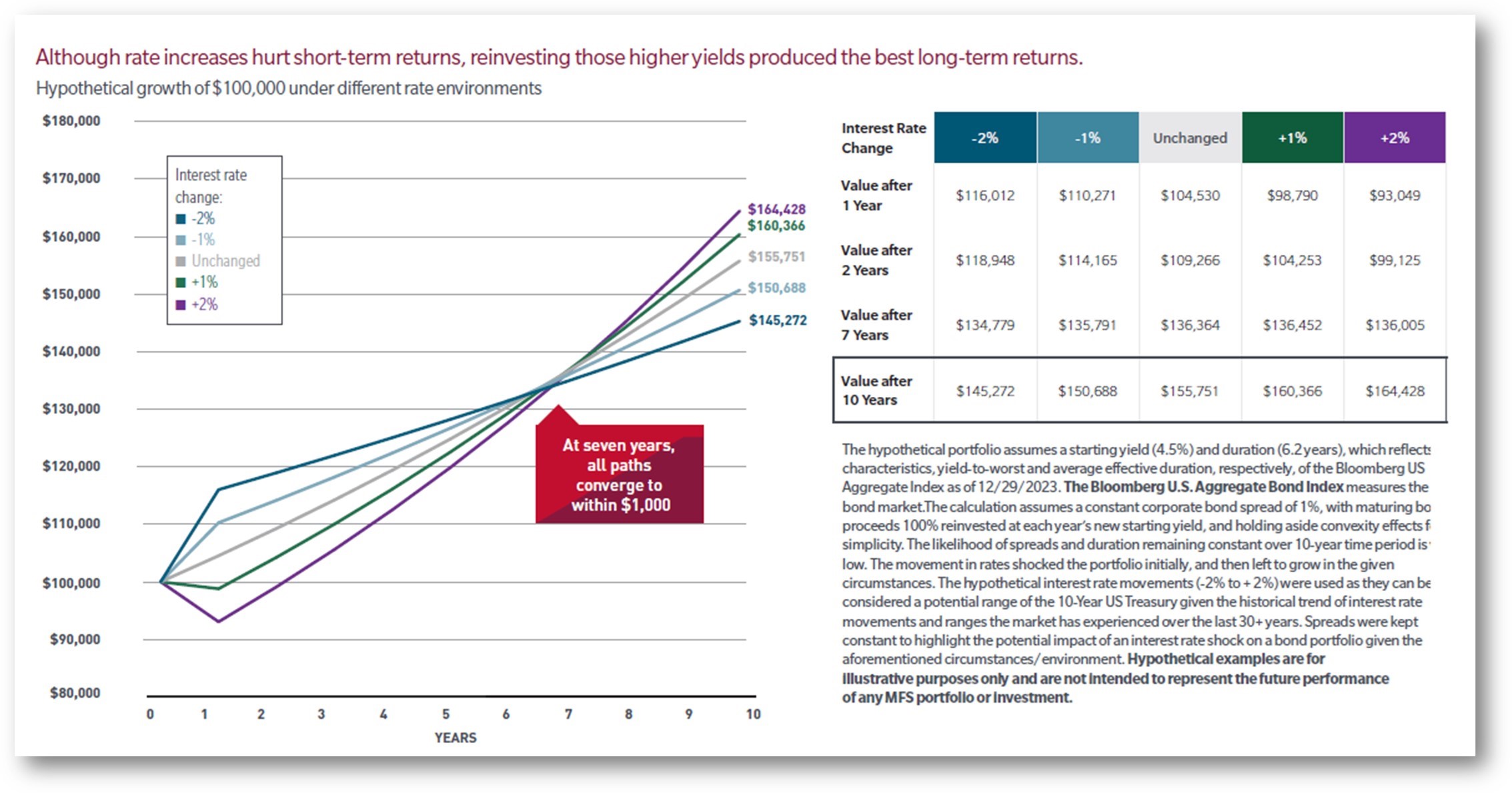

Take the Worry out of Changing Interest Rates.

MFS has a market snapshot on the rate environment and how the change in interest rates effect bond prices. “Although rate increases hurt short-term returns, reinvesting those higher yield bond coupon payments produced the best long term returns. You’ll find that all paths converge at 7 years.

GDP, Inflation, and the Fed: Keep Calm and Carry On!

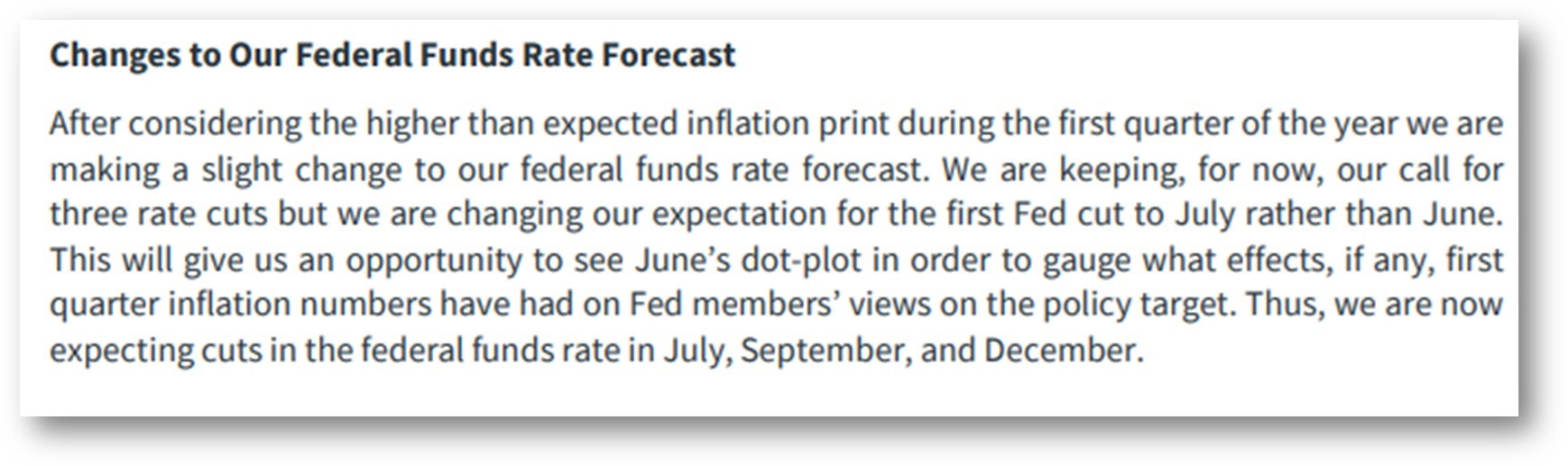

Our Economist Eugenio J. Aleman released a piece last week about all things concerning the market; GDP, Inflation, and the Fed. This is a fantastic read if your concerned about the new buzz word on CNBC, “Stagflation”. Eugenio also touches up on their small changed in their rate forecast, which I have for you below.

The Kritikos Wealth Management Guide on 529 Plans

Attached is our personal guide on 529 Accounts. This guide will soon be made available to the public and found on our website. Attached is an electronic PDF file for your viewing. If you’d like a hard copy, let us know, and we’ll send one right over.

There were a lot of updates made to this account by the Biden Administration during the Secure 2.0 Act. Now these accounts can set up your beneficiary for retirement, through a ROTH IRA! Look through it and let us know if you have any questions.

ANDREW M. B. KRITIKOS, CFP®

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.