Ballast of the portfolio

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

For many investors, the fixed income portion of their portfolio is intended to be the ballast of the portfolio. Fixed income investments are well-suited to fill the capital preservation-focused portion of a portfolio for several reasons. First, the general nature of what a bond essentially represents: a loan that the issuer is legally obligated to pay back (both principal and interest) barring the unlikely event of a default when investing in investment-grade bonds. Fixed income compensates investors and carries less risk than other, more growth-oriented investments like equities (for example, a company’s dividend can be cut or eliminated at any time at the discretion of the company). Second, the known aspects of a bond (income, cash flow, redemption date, redemption value) mean that it will provide its many benefits regardless of what the market or interest rates do. Upon purchasing a bond, and investor locks in these terms.

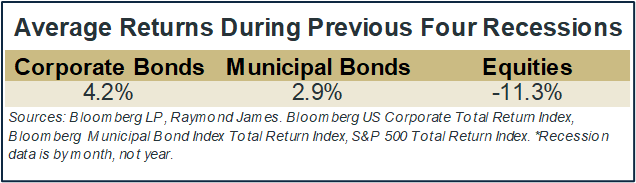

The FOMC cut the Fed Funds rate for the first time in over four years a few weeks ago. Cutting cycles historically preceded a recession, therefore it is a good time to remind ourselves of the importance of appropriate asset allocation. While past performance is no guarantee of future results, looking at how things have played out in the past can help dictate an appropriate asset allocation given an investor’s individual risk tolerance. The below chart looks at total returns for corporate bonds, municipal bonds, and equities during the last four recessions.

While the performance difference between stocks and bonds is rather substantial, it hopefully does not come as a surprise. A recession means the economy is not performing well and is in a downturn. As expected in this type of economic environment, riskier assets that rely on growth have historically not performed well while the more conservative, ballast of the portfolio tends to perform relatively much better. This emphasizes the importance of maintaining a balanced portfolio that is aligned with your personal goals and tolerance for volatility. A financial plan is ideally designed to perform and persist through multiple economic cycles, ignoring short-term swings and keeping a focus on long-term goals. While most of us are investing with an eye years or decades into the future, short-term market swings can still trigger strong emotional reactions and sometimes push investors to (inadvisedly) become short-term traders rather than long-term investors. A properly allocated portfolio can help to mitigate an emotional response that might derail a long-term plan. Is your portfolio appropriately positioned to weather the next economic downturn? Contact your financial advisor to ensure that you have an appropriate ballast constructed for your portfolio.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.