Getting specific – A working strategy

- 10.07.24

- Markets & Investing

- Commentary

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Fixed income portfolios utilizing individual bonds allow investors to create tailor made strategies based on individual goals and situations. As such, commentaries usually comprise broad tactics and over-arching themes in an effort to educate, expose, discuss, debate, or consider various fixed income strategies or uncover market conditions that potentially can have an effect. I am diverting from this “norm” to deliberate on a working strategy to consider.

Cash Flow Enhancement with Increased Duration

We have openly promoted increasing duration over the last several months. Duration is a measurement of price volatility. An increase may seem like an odd “wish” as it implies taking on greater price risk. Rarely does an action stand isolated. Increased duration goes hand in hand with extending maturities. The longer a bond is exposed to market conditions, the more likely its’ price can be affected. In bond language, interest rate risk is increased. However, this simultaneously suggests that reinvestment risk is decreased. By extending, an investor lowers the risk of having to reinvest maturing dollars but trades that off for potentially increasing price movement.

Why would an investor do this? Many investors and financial experts believe interest rates are heading down. If this happens, the risk of having to reinvest maturing assets at lower rates may be perceived as more uncertain than holding bonds exposed to greater potential price movements. After all, most fixed income allocations are bought with the intention of holding the asset until it matures. If this is the case, market price movements over the holding period may change the way a monthly statement looks but have no effect on a bond’s cash flow, income earned, or future maturity when its face value will be returned. Therefore, barring an outright default, price movements are, in some respect, rendered irrelevant.

Perhaps more importantly, today’s extensions are likely locking into higher levels of income for longer. Interest rates have started to decline but remain at high levels not seen in well over a decade. Many extension swaps permit investors to lock into more income during a high-interest rate environment and for longer periods.

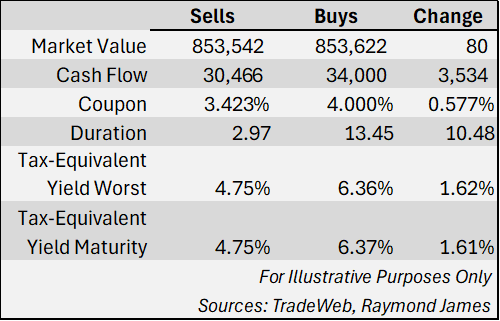

The example portfolio to the left is based on a live trade and highlights many of these changes. In this portfolio, short, lower-coupon corporate bonds, many of which were maturing within 12 months, were exchanged for longer, tax-exempt, 4% coupon municipal bonds. The swap exchanged close to dollar for dollar with only $80 additional cash required. Cash flow was increased annually by $3,534. The duration increased significantly from 2.97 to 13.45. By locking into higher coupons and income for longer, the investor stands to pick up 161 basis points in annual income. Another way to look at this is that instead of waiting for lower coupon, lower yielding bonds to mature and then reinvest, the bonds were sold and pre-invested during a period of time when it is known that interest rates are elevated.

Cash flow enhancement is a sort of side bar. Portfolios strapped with lower coupon bonds, many purchased during the long low-interest rate cycle, now have an opportunity to swap into higher coupons producing higher levels of cash flow. This somewhat hedges the outright extension of maturities by increasing the cash flow in the interim. If short-term liquidity is not needed (used/consumed by the investor), receiving more cash flow may be undesirable versus keeping the asset locked into higher earnings. The advantage of an individual bond investment is that coupon (thus cash flow) structure can be selected to match an individual’s personal goal.

Staying or investing in short-term securities is often erroneously considered conservative. It is not. Investing short-term is taking on a call for rising interest rates. If one absolutely could guarantee that interest rates were going to be lower, it would be sensible to make sure none of your investments mature at that time. Conversely, if one absolutely could guarantee that interest rates were going higher, it would be sensible to make sure all of your investments mature at that time. Since we don’t ever absolutely know either way, it seems sensible to ladder (space) maturities so reinvestment is spread out but also listen to strong consensus for near term interest rate moves and act strategically to optimize the income and cash flow of your assets.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.