Investing During Election Years: Will it Hurt or Help Your Portfolio?

It's that time again—the buzz of politics is in the air, and since we’re in an election year, it's not just a buzz—it's a full-on racket. Candidates are rallying supporters, debates are sparking controversies, and news cycles are consumed with election fever. As the campaign heats up, it looks like Georgia will get extra attention from all parties for being a “swing state.”

For investors, the question always looms large: Does the election result significantly affect your investment strategy, or is it just another hype cycle like the latest viral video?

Let's wade through the partisan noise and campaign hyperbole to clarify how election years may impact or, more likely, not affect your investments. Spoiler alert: history tells us to buckle down and stick to long-term strategies, regardless of the revolving door at the Oval Office.

Understanding the Political Pendulum

Markets rarely thrive on uncertainty, and the run-up to the election is fertile ground for high levels of financial jitters. Primary elections typically cause unease in markets, although we didn't see that as much this year (the S&P 500 index is up 5ish% YTD). As the rematch of the 2020 race between Donald Trump and Joe Biden approaches, the market may experience increasing volatility.

While headlines often tie market corrections and surges to political events, the broader picture shows otherwise. Studies and data analysis consistently underscore that market returns are driven over the long term by economic and corporate performance rather than the party in power.

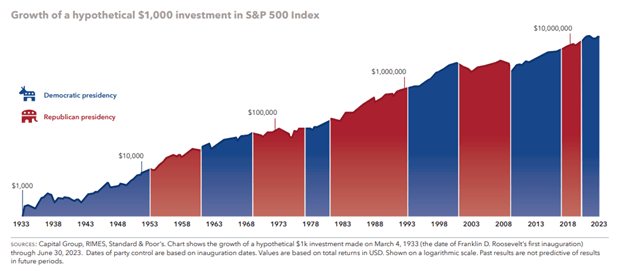

For example, the graph below shows a hypothetical investment of $1000 made when Franklin Roosevelt took office. That $1000 would be worth about $19 Million today and that growth happens during both Red & Blue presidencies.

Sitting Out Election Years Could Cost You

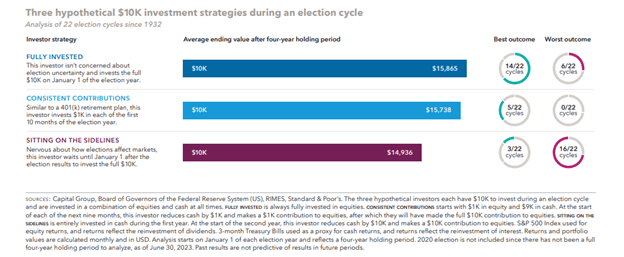

Election years lead some investors to make drastic moves, either pulling out of the market altogether to avoid impending doom or trying to catch the perfect swell of growth. However, timing markets is a losing proposition, especially in the short term and particularly during elections, where market movements can be as unpredictable as exit polls.

By attempting to time the market based on elections, investors not only increase the probability of selling low and buying high but also incur significant opportunity costs. The best days for market returns often follow the worst days, which means that staying the course with a robust investment portfolio is a surer path to long-term success than yielding to election-related fears or fancies.

The below chart shows three different potential outcomes. Compared with sitting it out, the first option of $10,000 investing on January 1st of election year was the best option 14/22 times in the election cycles dating back to 1932.

Final Ballot on the Election's Economic Impact

When we look at how the stock market has performed in the past, it's may seem surprising to notice that it doesn't really matter who the president is or which party controls Congress. The ups and downs of the market aren't consistently tied to political leaders. That's because the economy and the market are influenced by a lot of factors, and politics is just one piece of the puzzle.

Instead of making investment choices just because of an impending election, it's smarter to manage your portfolio with a strong, long term strategy. This involves spreading your investments across different types of assets, adjusting your portfolio regularly, and following a plan that takes into account your comfort with risk.

One caveat: even though elections don't necessarily change market trends, it's still important not to ignore how new policies could impact certain industries or areas of the market. It's good for investors to keep up with what candidates are saying and understand how their policies could influence their investments. But, even with this in mind, sticking to solid investment rules is more important than getting caught up in short-term worries about policies.

What Matters in Election Year Investing

The political machinery will continue to spin, campaigns will come and go, and elections will be won and lost. What remains constant is the enduring truth that steady, long-term financial planning, investment in quality assets, and disciplined market participation stand the test of elections and time.

When it comes to elections, pay attention to how the market moves as a whole, not just the loud political noise. The market is really good at taking in what's happening and showing what's real, way better than all the drama that comes with elections. In the big picture of your investment plan, elections are just one small part of everything else going on.

As an investor the key is to stay attuned, diversified, and composed, realizing that the value in your portfolio increasingly lies in your commitment to a sound, non-partisan, and patient investment strategy.

The S&P 500 is an unmangaged index of 500 widely held stocks that is generally considered representative of the U.S. stock Market. Keep in mind that individuals cannot invest directly in any index, and performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

Investing involves risk and you may incur a profit or loss regardless of strategy selected, including a long term holding period, diversification, and asset allocation.