The Week in Review: 11/04/2024

"People never lie so much as after a hunt, during a war or before an election." - Otto von Bismarck

Good Morning ,

Last was a huge week in terms of earnings and economic news and the major indices closed mostly lower.

|

Index |

Started Week |

Ended Week |

Change |

% Change |

YTD % |

|

DJIA |

42114.4 |

42052.2 |

-62.21 |

-0.2 |

11.6 |

|

Nasdaq |

18518.6 |

18239.9 |

-278.69 |

-1.5 |

21.5 |

|

S&P 500 |

5808.12 |

5728.8 |

-79.32 |

-1.4 |

20.1 |

|

Russell 2000 |

2207.99 |

2210.13 |

2.14 |

0.1 |

9 |

The S&P 500 declined 1.4%, the Nasdaq Composite declined 1.5%, and the Dow Jones Industrial Average settled 0.2% lower.

The Russell 2000 managed to eke out a 0.1% gain on the week.

Mega cap names that reported earnings garnered mixed responses from investors. Alphabet and Amazon.com closed 3.4% and 5.4% higher, respectively, on the week after their quarterly reports.

Apple, Meta Platforms, and Microsoft closed with losses ranging from 1.1% to 4.2% following their earnings reports. Forward guidance was somewhat lacking.

Chipmakers also showed weakness through the week.

Advanced Micro Devices was an influential loser, dropping 9.2% after reporting earnings and soft Q4 revenue guidance.

The PHLX Semiconductor Index settled 4.1% lower than the previous Friday.

In terms of economic news, market participants were digesting…

- Initial jobless claims that were a low 216,000, the Q3 Employment Cost Index that was up 0.8%, personal income that was up 0.3% month-over-month in September, personal spending that increased 0.5%, and the core-PCE Price Index was stuck at 2.7% year-over-year for the third straight month.

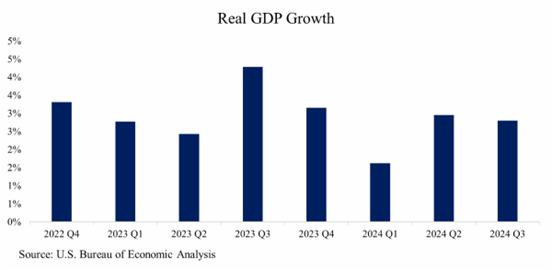

- Private-sector payrolls, which increased by 233,000 in October (consensus), according to ADP, real GDP, which increased at an annual rate of 2.8% in the third quarter (consensus 3.0%), bolstered by a 3.7% increase in consumer spending, and pending home sales that jumped 7.4% in September (consensus 2.5%).

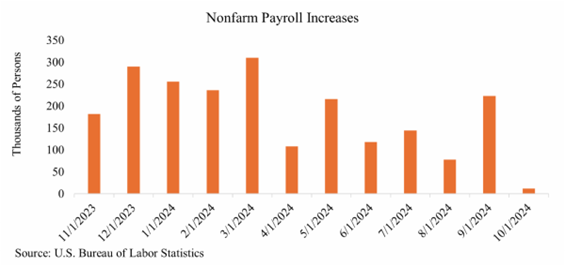

- Nonfarm payrolls increased by just 12,000 (consensus 120,000) while nonfarm private payrolls decreased by 28,000 (consensus 105,000). This news was followed by a report of tepid construction activity in September and a dip in the October ISM Manufacturing PMI to 46.5% (consensus 47.6%) -- the lowest reading in 2024 -- from 47.2% in the previous month.

- The jobs data were depressed by the Boeing strike and likely by the effects of Hurricanes Helene and Milton, yet with forecasts suggesting those influences could lop off something on the order of 100,000 positions, the view to October, coupled with sizable downward revisions to the August and September payroll figures, connote softness in hiring activity.

According to the Bureau of Economic Analysis, preliminary readings show the U.S. economy grew at an annual rate of 2.8% for the third quarter, as measured by growth in real GDP. Real GDP strips out the effects of inflation on growth. This figure is roughly in line with the second quarter’s reading.

Treasury yields settled sharply higher last week. The 10-yr yield jumped 13 basis points to 4.36% and the 2-yr yield settled ten basis points higher at 4.20%.

This week will have two main events: the Presidential election and the Fed’s interest rate decision. Either event, or both, could bring volatility depending on the outcomes.

According to CME’s FedWatch tool, traders believe it to be a near certainty that the Fed will cut rates by 0.25% this week followed by a strong chance of a consecutive 0.25% cut at its next policy meeting in December.

With the election tomorrow, traders and investors are likely on pause as we watch and wait for the results.

Please be sure to make your voice heard and vote!!

Have a wonderful week!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks. U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government. The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification. Dividends are not guaranteed and must be authorized by the company's board of directors. Diversification does not ensure a profit or guarantee against a loss. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence. Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated. The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Charts are reprinted with permission, further reproduction is strictly prohibited. If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.