The Week in Review: 5/20/2024

“The best way to predict the future is to invent it.”

Alan Kay

Good Morning,

Fran & I were in Park City, Utah last week attending our Raymond James President’s Club trip at the Montage, Deer Valley. Temps were in the 30s in the morning and mid 60s in the afternoons.

The weather was breathtaking, and RJ always goes over the top on these annual trips!!

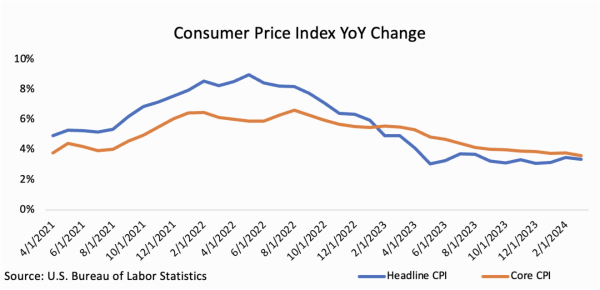

Last week gave us some “cooler” inflation numbers and subsequently new all-time highs in most of the indices.

CPI came in at 3.6% YoY, down from 3.8%, and there were buyers!

Most importantly, these CPI numbers suggest a resumption of the inflationary decline.

Now market participants are looking at an 80% probability of a September rate cut by the Fed.

Of course, we have been looking for a rate cut all year.

We find ourselves in a conundrum… as we want a “soft landing” and lower inflation, but we also don’t want to destroy the economy, which has remained robust. This is being referred to as “Goldilocks”.

Not too hot, and not too cold.

Inflation is absolutely receding (remember 9.1% not too long ago?) … and this CPI report shows that the downtrend has resumed after a pause, yet inflation remains considerably above the Fed target of 2%.

Market momentum is also robust… and it seems the path of least resistance is up, because earnings are good.

This earnings season will soon be ending with 93% of S&P 500 companies reporting so far. Of those companies, the blended year-over-year earnings growth rate is 5.7% (Source: Factset).

Market Snapshot…

- Oil Prices - Oil prices notched their first weekly gain as demands from China and the U.S. bolstered hopes for higher demand. West Texas Intermediate crude added 83 cents, 1.05%, to $80.06 a barrel, while Brent crude futures gained 71 cents, or 0.85%, to $83.98 a barrel.

- Gold - Gold prices aided by China’s stimulus measures, looked poised to clock their second consecutive weekly gain on Friday on renewed hopes for U.S. interest rate cuts. Spot Gold rose 1.3% to $2,407.65 per ounce. U.S. gold futures settled up 1.2% to $2,412.10. Silver finished the week at $31.259.

- U.S. Dollar - The dollar traded little changed against major currencies on Friday as market speculation continues to swirl about the timing of Federal Reserve rate cuts. The dollar index, fell 0.03% at 104.46. Euro/US$ exchange rate is now 1.088.

- U.S. Treasury Rates - U.S. Treasury yields rose on Friday as investors considered the state of the economy after digesting the week’s economic data. The U.S. 10-year Treasury yield was up more than 4 basis points at 4.42%.

- Asian shares were up in overnight trading.

- European markets are trading higher.

- Domestic markets are trading higher again this morning.

Quite a bit of Fedspeak today with Governors Bostic, Barr/Waller, Jefferson, and Mester all sharing prepared comments. We don’t anticipate anything dynamic or concerning, but one never knows?

This week will be relatively light on the economic front. Aside from the plethora of FOMC member speeches, we'll also receive April’s New and Existing Home Sales on Wednesday and Thursday, respectively, and preliminary Manufacturing and Services PMI also on Thursday.

We have a 3-day weekend coming so activity could lighten as the week goes by. Next Monday the markets are closed for Memorial Day.

Have a great week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.