The Week in Review: 04/29/2024

“The most confident critics are generally those who know the least about the matter criticized.”

Ulysses S. Grant

Good Morning,

Our stock markets exhibited some impressive rebound action after a soft start to the month. It was a busy week, featuring earnings results from nearly 40% of the S&P 500 and some key economic releases.

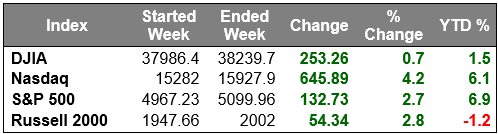

The Dow Jones Industrial Average rose 0.7%, the S&P 500 gained 2.7%, and the Nasdaq Composite settled 4.2% higher last week.

The upside bias was fueled by favorable responses to earnings from some influential names, calm price action in Treasuries, and carryover momentum as gains built up this week.

Broad buying activity left the equal-weighted S&P 500 up 1.6% this week and all 11 S&P 500 sectors finished higher. Mega cap gains had an outsized impact on index performance, though, and drove gains in the information technology (+5.1%), consumer discretionary (+3.5%), and communication services (+2.7%) sectors.

Meta Platforms was an exception from the mega cap space, dropping 7.9% this week after reporting earnings. Microsoft and Alphabet, which hit new all-time highs, and Tesla gained 1.8%, 11.5%, and 14.4%, respectively, in response to their earnings news.

The quarterly reports from some of the names fueled more positive buzz around AI, benefitting stocks in the chipmaker space.

Market participants were also digesting the Advance Q1 GDP report, which showed weaker growth and higher inflation, and the weekly jobless claims report, which showed ongoing strength in the labor market, and the March Personal Income and Spending report, which that showed solid spending activity, but stalled progress on inflation.

Treasuries had a relatively calm response to the data, contributing to the upside bias in stocks. The 10-yr note yield was five up basis points at 4.67% and the 2-yr note yield rose three basis points to 5.00%.

Market Snapshot:

- Oil Prices – Oil prices rose to snap a two-week losing streak. West Texas Intermediate crude rose 28 cents, or 0.34%, to settle at $83.85 a barrel, while Brent futures rose 49 cents, or 0.55%, to settle at $89.50 a barrel.

- Gold – Gold prices held gains on Friday after data showed that U.S. inflation rose in line with expectations, but the safe-haven metal was on track for a weekly fall. Spot Gold was 0.3% higher at $2,339.70 per ounce. U.S. gold futures rose 0.4% to $2,351.60. Silver finished the week at $27.539.

- U.S. Dollar – The dollar surged to a fresh 34-year high on Friday, bolstered in part by U.S. inflation data that showed no signs of easing. The dollar index was up 0.3% at 105.93. Euro/US$ exchange rate is now 1.072.

- U.S. Treasury Rates – The 10-year Treasury yield fell Friday as traders parsed the closely watched inflation data released earlier in the day. The 10-year Treasury yield slipped around 4 points to 4.667%.

- Asian shares were up in overnight trading.

- European markets are trading higher.

- Domestic markets are in the green this morning.

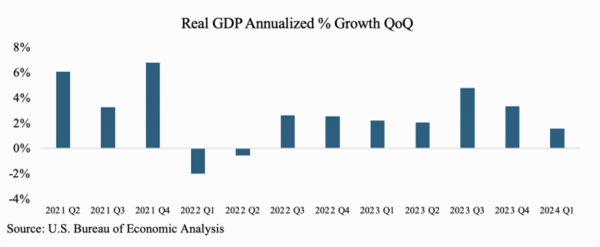

Real GDP growth for the first quarter slowed significantly and came in well short of expectations. The measure of economic growth, which excludes the effects of inflation, rose at an annualized rate of 1.6% during the quarter. This marks the lowest quarterly growth rate since 2022 Q2.

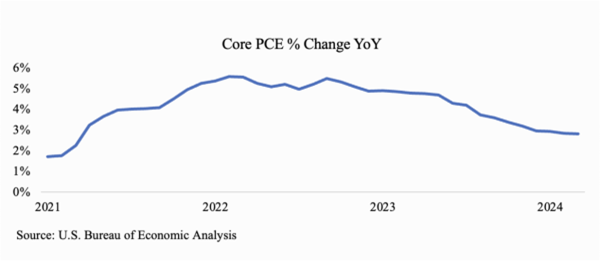

The Fed’s preferred inflation measure, the core PCE index, rose 0.3% in the month of March and 2.8% year-over-year. Annualized out, that is a 3.7% inflation rate, well above the Fed’s 2% target.

The combination of slowing growth and rising inflation isn’t the recipe for a healthy economy and these reports could further push back any potential rate cuts this year.

According to CME’s FedWatch tool, the futures market is now pricing in a rate cut in September at the earliest. Before these reports, June was widely believed to be the kickoff point, but those hopes are now diminished.

We now believe September could be a possibility for the first rate cut, but the Fed will be watching further data points, including how inflation reacts over the summer months, and whether economic growth will be slowing in the second quarter.

Investors are focusing on earnings however…

With 46% of S&P 500 companies reporting, results have generally been better than expected. Of those companies, 77% have reported a positive EPS surprise returning a blended earnings growth rate of 3.5% year-over-year (Source: Factset). Last week two big names, Microsoft and Google, had great results amid several others.

This week will feature the Fed’s May meeting and press conference from Chairman Powell. It is widely believed that interest rates will be held steady, but we will be watching to see if the latest economic reports have altered the Fed’s thinking at all.

The first-quarter pickup in inflation was driven by a 5.1% jump in service-sector inflation that excludes housing and energy; nearly double the prior quarter’s pace. March figures on inflation, consumer spending and income are due Friday.

We will also receive April’s ISM manufacturing report on Wednesday, ISM non-manufacturing report on Friday, and Nonfarm Payrolls report on Friday.

Have a wonderful week!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.