The Week in Review: 04/08/2024

"Individuals who cannot master their emotions are ill-suited to profit from the investment process."

Benjamin Graham

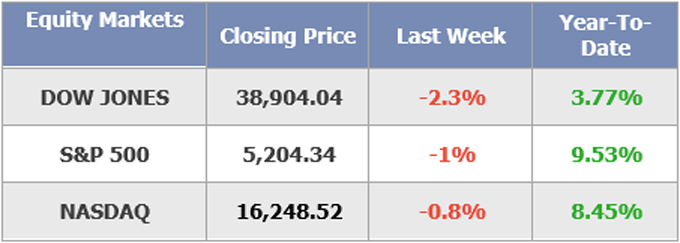

The stock market started the second quarter with volatile price action following a strong start to the year. Ultimately, the major indices settled with decent losses.

The Dow Jones Industrial Average (-2.3%) and Russell 2000 (-2.9%) each fell more than 2.0% and the S&P 500 and Nasdaq Composite declined 1.0% and 0.8%, respectively.

The downward bias was related to a sharp increase in market rates amid some solid economic data and sticky inflation figures. The 10-yr note yield jumped 12 basis points to 4.33% and the 2-yr note yield rose 10 basis points to 4.72%.

The February Personal Spending and Income report, released Friday before last when markets were closed, showed some sticky inflation figures in the form of the PCE Price Indexes.

Some of this week's data, which included the March ISM Manufacturing Index and the March employment report, reflected ongoing strength in the economy. The March ISM Non-Manufacturing PMI and weekly jobless claims report showed some softening, though.

Market participants were recalibrating rate cut expectations following this week's data and some commentary from Fed officials.

Minneapolis Fed President Kashkari (not an FOMC voter) was among the Fed officials to draw attention, saying it's possible the Fed might not cut rates this year if progress on inflation stalls. The implied likelihood of a rate cut in June is now essentially a toss-up, having fallen to just 52.4% from 60.4% one week ago.

Increased geopolitical tensions in the Middle East related to a potential retaliation by Iran against Israel also contributed to the negative bias this week, in addition to some normal consolidation efforts after the strong start to the year.

Just about everything participated in this week's losses. Nine of the 11 S&P 500 sectors finished lower.

The health care sector (-3.1%) saw the steepest decline after the CMS left its originally proposed payment rate increase for Medicare Advantage plans for 2024-2025 unchanged at 3.70% against expectations for an increase.

Real estate (-3.0%) and consumer staples (-2.7%) sectors were also notable laggards.

Another reason for the sloppiness to begin 2Q24 was Fedspeak… several Fed Members came out last week stating that it was too soon to start cutting rates.

Federal Reserve Bank of Dallas President Lorie Logan believes that high inflation and high borrowing costs may not be holding back the economy as much as expected.

Richmond Fed President Thomas Barkin said the central bank has “time for the clouds to clear” on inflation before starting to cut rates.

And Neel Kashkari, the president of the Federal Reserve Bank of Minneapolis, said it's possible there will be no rate cuts this year. "If we continue to see inflation moving sideways, then that would make me question whether we need to do those rate cuts at all," he said in an interview with Pensions & Investments, a trade publication.

Chairman Powell reinforced this with his continually “wait and see” remarks at Stanford’s 2024 Business, Government, and Society forum.

Fed Governor Bowman took a more hawkish approach, stating that it’s possible interest rates may need to move higher to control inflation. The question of if, and when, rates will be cut centers on the Fed's federal fund rate, which has been 5.25% to 5.5% since July 2023.

Wall Street has a slightly better than even bet that the Fed will trim rates at its June meeting, according to CME's FedWatch Tool. That's down from 65.9% on Thursday and 72% a month ago.

Meanwhile, the energy (+3.9%) and communication services (+2.5%) sectors were alone with gains at the end of the week.

Market Snapshot…

- Oil Prices - Oil prices reached a five-month high as tensions in the Middle East boil over. West Texas Intermediate crude futures (WTI) rose 32 cents, or 0.37% to $86.91 a barrel, while Brent crude futures gained 52 cents, or 0.57% to settle at $91.17 a barrel.

- Gold - Gold prices rose to hit a record high and third straight weekly gain. Spot Gold was up 1.5% at $2,323.23 per ounce. U.S. gold futures settled 1.5% higher at $2,342.7. Silver finished the week at $27.503.

- U.S. Dollar - The dollar posted a weekly loss after the job growth announcement. The dollar index, a measure of U.S. currency against six major trading partners, was up 0.16% at 104.29, falling to a two-week low. The Euro/US$ exchange rate is now 1.087.

- U.S. Treasury Rates - U.S. Treasury yields jumped after a better-than-expected March jobs report. The 10-year Treasury yield jumped more than 9 basis points to 4.4%.

- Asian shares were up in overnight trading.

- European markets are trading higher.

- Domestic markets are trading higher this morning.

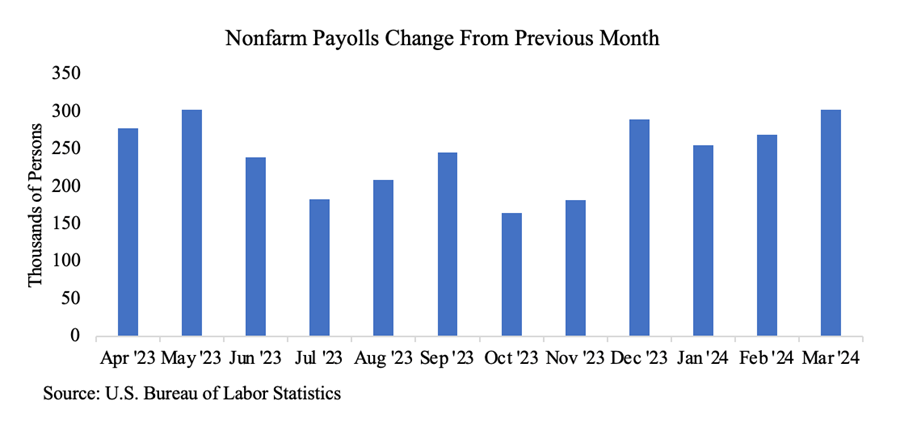

The labor market continues to chug along, adding 303,000 jobs in the month of March, exceeding economist estimates of 212,000. Reports from the Bureau of Labor Statistics for the prior two months were also revised upward by 22,000. For the quarter, 829,000 jobs were added, the most since Q1 2023.

This week will feature March’s CPI and PPI reports. In recent months, focus has been placed on sticky core inflation. However, with rising oil prices, consumers have been suffering at the pump.

According to AAA, the national average is $3.58/gallon, up from $3.10/gallon to start the year. As a result, we are expecting a potentially higher headline number, while core inflation, which excludes food and energy items, could remain a little sticky.

Have a great week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.