The Week In Review 10/16/2023

“The difference between winning and losing is most often not quitting.” – Walt Disney

Last week was a week full of news… first we got news that Israel declared war on Hamas after a surprise attack launched by Hamas the previous weekend. The potential for a wider regional clash weighed on sentiment last week but reports so far give the impression that the Israel-Hamas war is still a two-party conflict.

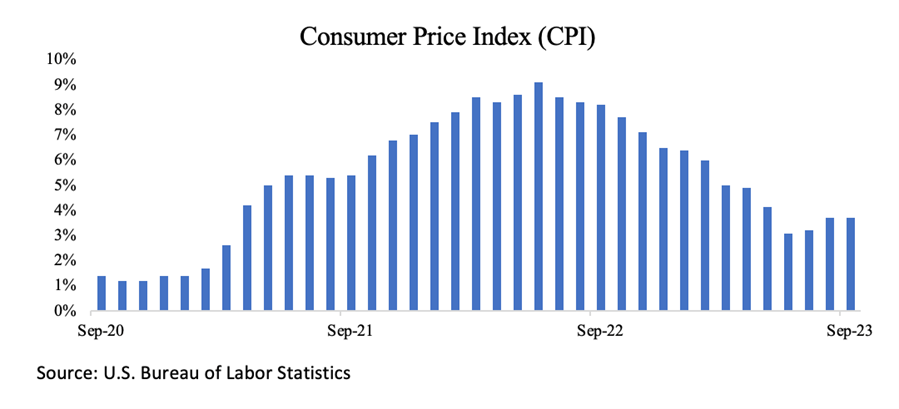

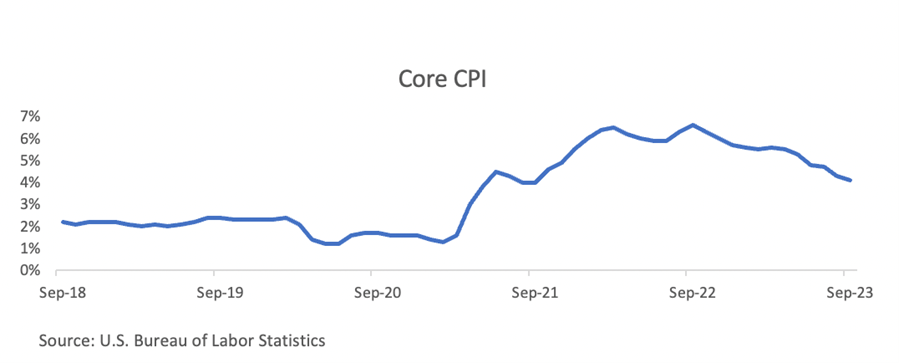

Then we got more inflation news… last week’s CPI report and Fed-speak led to positive movements in the broad indices the first part of the week, with volatility taking over as the week progressed. The CPI report contained favorable data, which could persuade the Fed to leave the federal funds rate at its current level at its November meeting.

Core CPI, which strips food and energy prices from the index, rose 4.1% year-over-year, continuing its deceleration. The producer price index (PPI) saw a rise, climbing 2.2% from a year earlier.

Geopolitical angst mounted on Friday following news that Israel warned 1.1 million residents in the northern Gaza Strip to evacuate within 24 hours, which was presumably a pretense to a ground attack in Gaza that could escalate the war. That created some nervousness in the markets, which also heard Iran's foreign minister say that Israel's continued siege of Gaza "will face reactions in other areas."

The stock market still fared okay last week, aided by a decline in Treasury yields and some technical buying interest related to the idea that the market was oversold and due for a bounce. Gains were registered in the first half of the week, but buyer conviction fell by the wayside as it got closer to the weekend.

While this week's Producer Price Index and Consumer Price Index reports were not as friendly as investors hoped, the 10-yr note still did well with the help of safe-haven flows and expectations that inflation rates will improve in coming months as higher rates work into slowing the economy. The 2-yr note yield fell one basis point this week to 5.05%, but the 10-yr note yield declined 15 basis points to 4.63%.

The Treasury market also weathered some relatively disappointing auction results last week for the 3-yr note, 10-yr note, and 30-yr bond. Each was met with relatively soft demand, which came to a head on Thursday following the 30-yr bond auction, prompting a noticeable back up in rates. When geopolitical angst picked up on Friday, however, a rush of safe-haven flows repaired a lot of the weakness following Thursday's sell off.

Treasuries were also digesting comments from several Fed officials this week who spoke to the idea that the rise in long term rates had tightened financial conditions and may give them leeway to precede carefully on future policy.

Oil prices climbed this week in another manifestation of geopolitical worries. WTI crude oil futures jumped 6.0% to $87.80/bbl.

Eight of the S&P 500 sectors registered a gain with energy (+4.5%) leading by a wide margin. The consumer discretionary sector (-0.7%) saw the largest decline.

Earnings season kicked off last week with generally good results, highlighted by JPMorgan Chase (JPM), Wells Fargo (WFC), Citigroup (C), and UnitedHealth (UNH).

In other news, the House failed to elect a new Speaker last week. Rep. Steve Scalise (R-LA) prevailed in the GOP conference vote but withdrew his name after failing to get enough support. This leadership void is a reminder that the House can't conduct business, which raises the uncertainty about Congress reaching a budget agreement before the Nov. 17 deadline.

Market Snapshot…

- Oil Prices – Oil prices turned in one of their best days last Friday. West Texas Intermediate crude futures (WTI) surged 5.77% to close at $87.69 barrel. Brent crude climbed 5.69% to close at $90.89 a barrel.

- Gold– Gold prices turned in the strongest one-day advance since December 2022 with a 3% gain, the most since mid-March. Spot Gold was up 3.24% at $1,929.21, while U.S. gold futures settled 3.1% higher to $1,941.60. Silver closed at $22.895.

- S. Dollar– The dollar index ticked up 0.8% to 106.69, its biggest one-day rise since March 15. Euro/US$ exchange rate is now 1.057.

- S. Treasury Rates– Treasury yields fell as investors weighed the interest rate outlook. The yield on the 10-year Treasury note was down by nearly 9 basis points at 4.625%.

- Asian shares were down in overnight trading.

- European markets are trading higher.

- Domestic markets are also trading higher this morning.

Earnings reports will pick up their stride this week with 54 S&P 500 companies reporting. We will hear from more financials: Charles Schwab, Goldman Sachs, Bank of America; as well as companies in other sectors: Proctor & Gamble, Philip Morris, AT&T, and Netflix, among others.

This week will be relatively light in economic news… we will receive retail sales and industrial production on Tuesday, and new housing starts and existing home sales data on Wednesday and Thursday.

Have a great week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.