The Week in Review 2/6/23

“Sometimes when you innovate, you make mistakes. It is best to admit them quickly, and get on with improving your other innovations.” – Steve Jobs

Good Morning ,

February started on a softer note as investors took some money off the table following a strong showing in January. As of Monday, the Nasdaq and S&P 500 were up 11.0% and 6.0% respectively, to begin 2023.

The early weakness last week was precipitated by an article in The Wall Street Journal by Nick Timiraos indicating that Fed officials were concerned that inflation could reaccelerate due to tight labor markets. Mr. Timiraos has come to become a sort of unofficial media spokesman for the Fed to the markets and added in a Monday article that the Fed's interest rate strategy could depend on how much members believe the economy will slow.

There was also an element of trepidation behind Monday's weak showing ahead of several market-moving data releases, including the Q4 Employment Cost Index, the January ISM releases, and the January Employment Situation Report.

In addition, market participants were anticipating more than 100 S&P 500 companies would be reporting earnings last week, headlined by Meta Platforms, Apple, Alphabet, and Amazon.com. All but Meta would disappoint.

Sentiment started to shift on Tuesday as investors looked intent on closing out a strong month on an upbeat note. Participants were also driven by a sense that the Fed may be compelled to pause its rate hikes in the near future following a pleasing Q4 Employment Cost Index and some weaker-than-expected January Chicago PMI and Consumer Confidence data.

The latter point was corroborated in a Wall Street Journal article by Nick Timiraos that suggested the Employment Cost Index report could increase the possibility of Fed officials agreeing to pause the rate hikes sooner rather than later.

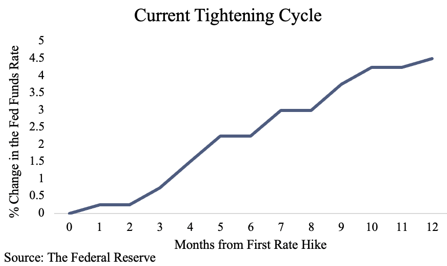

A strong rebound effort took place on Wednesday. This followed the FOMC's unanimous decision to raise the target range for the fed funds rate by 25 basis points to 4.50-4.75%, as expected, and Fed Chair Powell's press conference, where he did not go out of his way to rein in the market's recovery enthusiasm.

Mr. Powell acknowledged that the "Full effects of rapid tightening so far have yet to be felt and we have more work to do." He indicated that core services inflation is still running too high, which creates a basis for ongoing rate hikes. Overall, though, Mr. Powell was generally encouraging about the emerging signs of disinflation.

Importantly for market participants, he did not condemn loosening financial conditions and maintained that he thinks there is a path to getting inflation back down to 2.0% without a really significant economic decline or significant increase in unemployment, otherwise referred to as the hoped for “soft landing”.

A huge earnings-driven gain in Meta Platforms fueled a continuation of the rally effort at the start of Thursday's session. Meta's pleasing results on the heels of Fed Chair Powell's press conference, where he took a less aggressive tone, fueled a sense that earnings growth and monetary policy may be better than feared this year.

Positive reactions to some data releases Thursday morning also helped along the upside bias. A pleasing Q4 Productivity report, which featured a moderation in unit labor costs, left the market feeling good about inflation trends. Separately, weekly initial jobless claims hit their lowest level (183,000) since April 2022, but that did not deter the rally effort, as it was understood as another good encouragement for a possible soft landing.

The rally did hit an air pocket, though, when the S&P 500 failed to clear the 4,200 level.

The pullback was likely driven by a feeling that the market had gotten overbought/overextended and was due for some consolidation. The downturn did not last long, however, and the main indices were able to climb back towards session highs ahead of Thursday's closing bell.

To be fair, a sizable loss in Merck following its quarterly results kept the price-weighted Dow Jones Industrial Average in negative territory for most of Thursday's session.

The final session of the week turned out to be a losing session with disappointing earnings and/or guidance from Alphabet, Amazon.com, Starbucks, and Ford dictating the action along with a surprisingly strong gain in January nonfarm payrolls (+517,000) and a stronger than expected January ISM Services PMI (55.2%) that marked a return to growth mode.

The strong data created some doubts as to whether the Fed will pause its rate hikes soon and cut rates at all before the end of the year.

Treasuries sold off sharply in response to the data releases. The 2-yr note yield rose 21 basis points to 4.29% and the 10-yr note yield rose 14 basis points to 3.53%. The U.S. Dollar Index rose 1.2% to 102.96.

Separately, the fed funds futures market is now accounting for the prospect of a third 25 basis point rate hike in May. According to the CME FedWatch Tool, the probability of a rate hike in May, in addition to the one that is fully priced in for March, increased to 61.8% from 30.0% yesterday.

Many stocks pulled back on profit-taking efforts following the earnings and economic news. Apple, however, which also came up shy of earnings estimates for the December quarter, was not among them. Granted Apple declined 2.0% off the open but quickly rebounded and finished the day up 2.4% as investors seemingly believed its shortcomings would be short lived.

Only three S&P 500 sectors registered losses this week -- energy (-5.9%), health care (-0.1%), and utilities (-1.5%) -- while the communication services (+5.3%), information technology (+3.8%), and consumer discretionary (+2.3%) sectors logged the biggest gains.

|

Index |

Started Week |

Ended Week |

Change |

% Change |

YTD % |

|

DJIA |

33978 |

33926 |

-52 |

-0.2 |

2.3 |

|

Nasdaq |

11622 |

12007 |

385.2 |

3.3 |

14.7 |

|

S&P 500 |

4070.6 |

4136.5 |

65.92 |

1.6 |

7.7 |

|

Russell 2000 |

1911.5 |

1985.5 |

74.07 |

3.9 |

12.7 |

Market Snapshot…

- Oil Prices – Oil prices fell on Friday. West Texas Intermediate crude futures were down $2.66, or 3.4%, to settle at $73.22/barrel. Brent futures fell $2.43, or 3%, to $79.74/barrel.

- Gold – Gold prices dropped to a three-week low on the jobs report. Spot gold was down 2.5% to $1,864.79 per ounce, while U.S. gold futures fell 2.7% to $1,878.10 per ounce. Silver finished the week at $22.365.

- U.S. Dollar – The dollar index was up 1.2% at 103. Euro/US$ exchange rate is now 1.078.

- U.S. Treasury Rates – The yield on the 10-year Treasury topped 3.5% after jumping more than 12 basis points following the jobs report.

- Asian shares were mostly lower in overnight trading.

- European Markets are trading in the red.

- Domestic markets are trading down this morning.

For more than a year now we have “fought the Fed” on interest rates and the markets last year had their worst year since 2008.

But there is an excellent chance with the smaller hikes and the possibility that the Fed pauses mid-summer that we can keep the momentum we have enjoyed thus far this year and perhaps turn in a decent 2023. With any help from the Fed, it could be a very nice year!

We continue to be cautiously optimistic!

Compared to last week’s whirlwind of prominent events and announcements, this week will be relatively tame. We will hear from several Fed speakers, including Chairman Powell, and we will receive the University of Michigan’s consumer sentiment report for February.

Have a great week!!

Michael D. Hilger, CEP®Managing Director

Senior Vice President, Wealth Management

5956 Sherry Lane, Suite 1900 / Dallas, TX 75225Private Line: 214-365-5579 / Cell: 214-202-2540Private Toll Free: 877-208-7474 / Fax 214-691-5588

PRUDENT STEWARDSHIP

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.