The Week in Review 1/9/23

“Yesterday's home runs don't win today's games.”

–Babe Ruth

Good Morning,

What a way to finish the first week of 2023!!

The S&P 500 briefly dipped below 3,800 on Tuesday before pushing above 3,900 on Friday.

With Wednesday's higher finish, the market logged a net gain over the Santa Claus rally period (the last five trading sessions of the year and the first two trading sessions of the new year), which, historically has been regarded as a positive sign for the start of the new year. And we can use all the positives we can find these days…

The major indices experienced some choppy action last week, though, driven by expectations surrounding the Fed's rate hike path. Those expectations were influenced by notable economic releases last week.

A stronger-than-expected ADP Employment Change Report for December and initial jobless claims for the week ending December 31, which hit their lowest level since September, indicated that the labor market remains tight. Simultaneously, a sharp narrowing in the November trade deficit that was led by declines in both exports and imports reflected weakening global demand.

Investors are aware that the Fed considers a weakening of the labor market to be an integral step in bringing down inflation, so strong labor data left market participants fearful about the Fed continuing to raise rates and not entertaining a pivot to a rate cut cycle anytime soon.

Minneapolis Fed President Kashkari (a 2023 FOMC voter) said that he sees the Fed pausing its rate hikes at 5.40% before cautioning that rates could be taken potentially much higher from wherever the Fed pauses if there is slow progress in lowering inflation after the Fed pauses.

The FOMC Minutes from the December 13-14 meeting, which were released on Wednesday following Mr. Kashkari's remarks, indicated "No participants anticipated that it would be appropriate to begin reducing the federal funds rate target in 2023."

Kansas City Fed President George (not an FOMC voter), meanwhile, told CNBC in an interview on Thursday that she sees the fed funds rate reaching 5.0% and staying there "well into 2024." The same day, St. Louis Fed President Bullard (not an FOMC voter) said, "While the policy rate is not yet in a zone that may be considered sufficiently restrictive, it is getting closer."

The market languished on Thursday following the ADP and initial claims numbers, leaving participants fearful about the December Employment Situation Report being stronger than expected.

It turned out that the employment report was not as strong as feared, but it also was not weak. Nonetheless, the market took a liking to the understanding that average hourly earnings growth moderated to 4.6% year-over-year in December versus a downwardly revised 4.8% in November.

That report was subsequently followed by the December ISM Non-Manufacturing Index, which fell into contraction territory (i.e. a sub-50 reading) for the first time since May 2020. The downturn reflected a clear slowdown in economic activity that is a byproduct of rising interest rates and weakening demand.

The takeaway for the Treasury and stock markets in the wake of this softer data was that the Fed won't be able to take the target range for the fed funds rate much higher before it decides to hit the pause button. Accordingly, both markets enjoyed handsome rallies to finish the week.

The 2-yr note yield fell 15 basis points for the week to 4.27% and the 10-yr note yield fell 32 basis points for the week to 3.56%.

The bulk of the weekly gains came in Friday's rally. Nine of the 11 S&P 500 sectors closed with a gain led by communication services (+3.7%), materials (+3.5%), and financials (+3.3%). Meanwhile, the energy sector closed flat and health care fell 0.2%.

|

Index |

Started Week |

Ended Week |

Change |

% Change |

YTD % |

|

DJIA |

33147 |

33631 |

483.4 |

1.5 |

1.46 |

|

Nasdaq |

10466 |

10569 |

102.8 |

1 |

0.98 |

|

S&P 500 |

3839.5 |

3895.1 |

55.58 |

1.4 |

1.45 |

|

Russell 2000 |

1761.3 |

1792.8 |

31.55 |

1.8 |

1.79 |

The mega cap stock had a roller-coaster week fueled by notable news catalysts. Tesla disappointed with Q4 deliveries and reportedly cut prices again in China for its Model Y and Model 3 vehicles. Apple reportedly told suppliers to build fewer components for several devices in Q1 due to weakening demand. Amazon.com announced plans to cut ~18,000 positions.

Another story stock of note was Dow component Salesforce, which announced it will be pursuing a restructuring effort that will include the elimination of roughly 10% of its staff and select real estate exits and office space reductions.

Hello Federal Reserve… are you listening?

Market Snapshot…

- Oil Prices – Both crude benchmarks ended the first week of the year lower due to global recession concerns. West Texas Intermediate crude rose 10 cents, or 0.1%, to $73.77/barrel, while Brent futures fell 12 cents, or 0.2%, to trade at $78.57/barrel.

- Gold – Gold prices shot up over 1% Friday to seven-month highs. Spot gold rose 1.9% to $1,867.18 per ounce, while U.S. gold futures settled up 1.6% to $1,869.7 per ounce. Silver closed out the week at $23.982.

- U.S. Dollar – The dollar index fell 1.17% to close at 105.63. The current Euro/US$ exchange rate is now 1.076.

- U.S. Treasury Rates – The 10-year Treasury yield was down about 16 basis points to 3.567%.

- Asian shares were up in overnight trading.

- European Markets are trading mostly higher.

- Domestic markets are indicated to open in the green this morning.

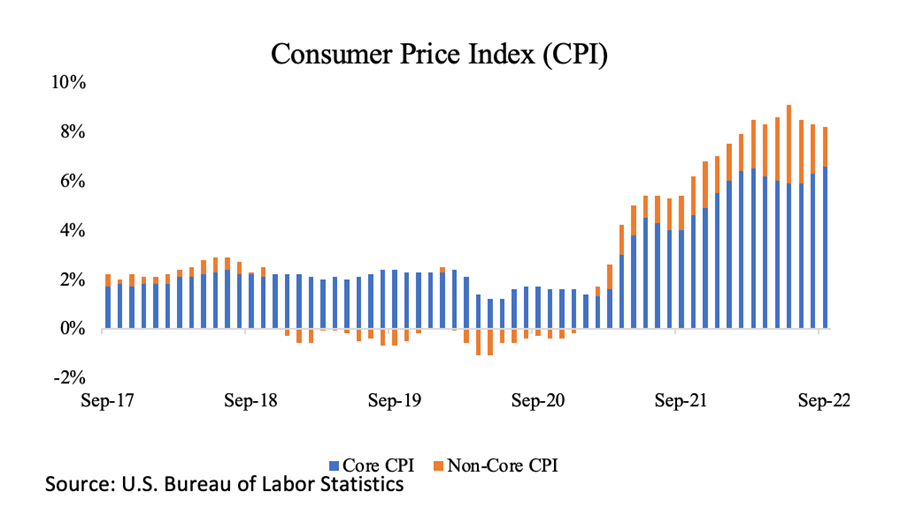

Inflation was the biggest headwind to the markets in 2022. It drove Fed policy, affected consumers’ spending habits, and weighed on companies’ profitability. Through November, inflation increased 6.5% in 2022, but that is expected to eclipse 7% when

December’s report is released later this week. This was the second straight year of inflation near 7%, and cumulatively, the CPI is up 16.6% since June 2020, coming out of the pandemic.

In order to combat inflation, the Fed started its most aggressive hiking cycles since the 1980s. It accomplished this by raising the federal funds rate seven times over 10 months to a range of 4.25-4.50%.

Our markets are resilient and we are expecting a much better year in 2023!

Have a wonderful week!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.