The Week in Review 9/20/22

“The sea is dangerous and its storms terrible, but these obstacles have never been sufficient reason to remain ashore." - Ferdinand Magellan

We have just returned from 9 days in Iceland with our sons… a country that is completely desolate in most places, and yet so very beautiful in many places.

I highly recommend you consider going, it is one of the most breathtaking places on the planet!

As we try to shake off a significant case of jet lag (we returned just last night), we will try to put this all into perspective, briefly…

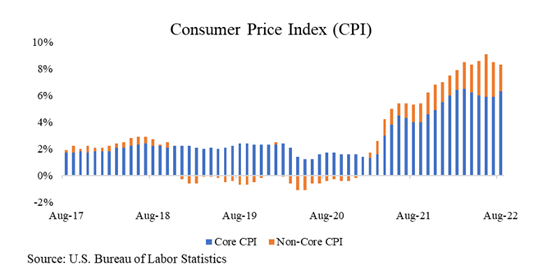

Scene two, inflation numbers come in “hotter than expected” and stocks are for sale again. Haven’t we seen this movie before?

As we can see by the chart there could be a top forming, yet “Fedspeak” could not be more aggressive… suggesting even a 100 basis point hike this week?

We will know soon enough, but much is already baked into the markets.

Will the Fed begin to look through the windshield, rather than the rear view mirror?

Their history doesn’t speak well for itself… they have messed this up before and thus investor confidence is low. And it is September, notoriously the worst month of the year, historically.

October however historically begins the best 6 calendar months of the year, perhaps we can hope to see some more rational Fedspeak, and the markets should calm.

We are glad to return to the US and all of its many comforts… we have so very much to be thankful for!!

Have a good week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.