The Week In Review 8/15/22

“Being on the tightrope is living; everything else is waiting.”~ Karl Wallenda

The inflation numbers we saw last week were “better than feared” and hinted that inflation may have peaked, and the buyers came around. The S&P 500 scored its fourth straight weekly advance and crossed an important level (4,231) that some will interpret as a telltale signal that the low in June was the low for the bear market.

Notably, the week's gains were made almost entirely over two trading sessions (Wednesday and Friday). Prior to Wednesday, which is when the CPI report was released, the major indices were all sporting losses for the week.

The negative start was attributed to reservations about the market being due for a pullback after the big run off the mid-June lows, some caustic revenue warnings from NVIDIA and Micron, and some nervousness in front of the CPI report.

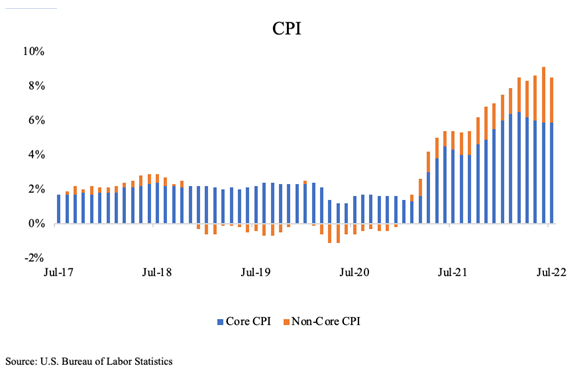

The CPI number proved to be a major turning point for sentiment. Total CPI was unchanged month-over-month and core CPI, which excludes food and energy, was up a smaller-than-expected 0.3%. Importantly, the annual pace of total CPI moderated to 8.5% from 9.1% while the annual pace of core CPI held steady at 5.9%, meaning it did not move higher as had been feared.

This understanding triggered a huge upswing in the major indices, as investors relished the idea that inflation might have peaked, that the Fed might be able to temper the pace of its rate hikes, and that the U.S. economy, which learned last week that 528,000 positions had been added to nonfarm payrolls in July, might be able to enjoy a soft landing. Goldilocks is in the house!

Various Fed officials attempted to downplay the idea of the Fed being ready to take its foot off the rate-hike pedal, not to mention pivoting in 2023 to a rate-cut cycle, yet equity market participants seemed to disregard the warnings.

Notwithstanding such warnings, the prevailing view in the stock market was that inflation rates will continue to moderate in coming months and that Fed officials will ultimately be convinced to soften their hawkish-minded tone as a result. It only helped the stock market's mood to see the PPI data and Import-Export price data move in the same direction as the CPI data.

Granted stocks were unable to hold a rally effort in the wake of the PPI report on Thursday, but by Friday morning, that move had been written off as just a case of taking some money off the table after a big move. By Friday buyers were back in action while sellers were hard to find.

The major indices all went out on a high note in an impressive rally effort on Friday that wasn't matched with heavy volume but which was impressively resilient nonetheless. The S&P 500, which was flirting with 3,600 in mid-June, settled Friday at 4,280. The close above 4,231 will be seen by some as an important technical and psychological development. That level marked a 50% retracement of the losses suffered between the January 3 closing level (4,796.56) and the June 16 closing level (3,666.77).

|

Index |

Started Week |

Ended Week |

Change |

% Change |

YTD % |

|

DJIA |

32803.5 |

33761.1 |

957.58 |

2.9 |

-7.1 |

|

Nasdaq |

12657.6 |

13047.2 |

389.64 |

3.1 |

-16.6 |

|

S&P 500 |

4145.19 |

4280.15 |

134.96 |

3.3 |

-10.2 |

|

Russell 2000 |

1921.15 |

2016.62 |

95.47 |

5 |

-10.2 |

Last week, BTIG technical analyst, Jonathan Krinsky, informed CNBC that "Since 1950 there has never been a bear market rally that exceeded the 50% retracement and then gone on to make new cycle lows." That doesn't mean it is off to the races from here nor does it mean the market is immune from another selloff of some size, but it does serve as a reassuring historical precedent.

All 11 S&P 500 sectors closed higher for the week. Gains ranged from 1.2% (consumer staples) to 7.1% (energy). Cyclical sectors saw some of the biggest gains and value stocks out-performed growth stocks in a move that showed reduced fears about the economy suffering a hard landing.

There was also a revival last week of speculative activity that translated into huge percentage gains for many of the so-called “meme stocks”, as well as the SPAC and profitless story stocks that were all the rage last year. Their moves were clear reflections of a “risk-on” mindset driven by the hope that the Fed won't have to go as far as it thinks into restrictive rate-hike territory.

The Treasury market wasn't as convinced of that point as the stock market seemed to be. The 2-yr note yield, which is sensitive to changes in the fed funds rate, ended the week up two basis points at 3.25%, virtually unchanged from where it was when the CPI report was released on Wednesday. The 10-yr note yield settled the week up one basis point at 2.84%, up about five basis points from where it was trading before the release of the CPI report.

To be sure, inflation moderating is a welcome development, but it is still unacceptably high. The Fed's inflation target is 2.0%, whereas CPI is up 8.5% year-over-year and PPI is up 9.8% year-over-year. There is a lot more room for inflation improvement and there needs to be a lot more improvement to convince the Federal Reserve that inflation is back under control.

That will be an ongoing war, but there was no doubt that the stock market won the mental battle last week in seeing what it wanted to see, which was a lower inflation rate in July than it saw in June.

Market Snapshot…

- Oil Prices– West Texas Intermediate crude fell 2.2% to settle at $92.96/barrel while Brent crude futures were down 1.5% to trade at $98.13/barrel.

- Gold – Gold prices drifted higher last Friday with gold futures up 0.54% at $1817.00. Spot gold rose 0.6% to $1,800.196 per ounce. Silver closed out the week at $20.698.

- U.S. Dollar – The dollar index was up 0.57% at 105.69. Euro/US$ exchange rate is now 1.031.

- U.S. Treasury Rates – The yield on the benchmark 10-year Treasury note dipped 5 basis points to 2.84%.

- Asian shares were mixed in overnight trading.

- European Markets are trading in the red.

- Domestic markets are indicated to open lower this morning.

This week, we will receive reports on housing sales as well as manufacturing and industrial production data. On top of that, we will hear from several FOMC members who will likely be discussing how their viewpoints have changed (if at all) after last week’s CPI report and other economic data. We have already heard from The Fed’s Neel Kashkari who raised the ante— wanting rates to reach 3.9% by year’s end.

The Federal Funds Rate currently stands at 2.25-2.50%, meaning Kashkari is calling for at least two more 75 bps. hikes in the next three meetings. While we think this course of action is unlikely, it is always a possibility. Hearing from additional FOMC members will paint a better picture, as we get closer to the next meeting. However, it’s likely August’s report will hold more weight as it will be reported the week before FOMC’s next meeting in September.

Have a fantastic week!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.