The Week in Review 7/18/22

"Let me assert my firm belief that the only thing we have to fear is fear itself" –Franklin D. Roosevelt

Good Morning,

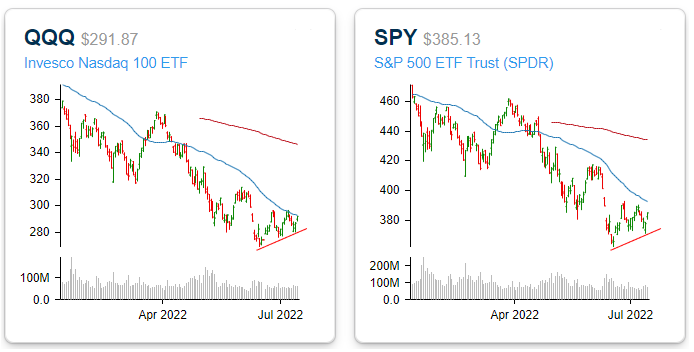

It was another volatile week… we began with three days of selling and ended with a rebound that lifted the S&P 500 off its lowest level in nearly four weeks.

Still, the benchmark index surrendered 0.9% for the week, while the Nasdaq (-1.6%) underperformed and the Dow (-0.2%) finished with a slimmer loss for the week. The Russell lost 1.4%.

|

Index |

Started Week |

Ended Week |

Change |

% Change |

YTD % |

|

DJIA |

31338.2 |

31288.3 |

-49.89 |

-0.2 |

-13.9 |

|

Nasdaq |

11635.3 |

11452.4 |

-182.89 |

-1.6 |

-26.8 |

|

S&P 500 |

3899.38 |

3863.16 |

-36.22 |

-0.9 |

-18.9 |

|

Russell 2000 |

1769.36 |

1744.37 |

-24.99 |

-1.4 |

-22.3 |

The market began the week on an apprehensive note, due in part to hesitation ahead of Wednesday's release of June CPI. In addition, concerns about global growth continued weighing on sentiment.

Spain's Prime Minister Sanchez warned that his country is likely to see lower than expected growth in the coming months, Shell CEO warned that Europe may have to ration energy in the winter, and there were reports of a growing number of people in China boycotting their mortgage payments.

Renewed political turmoil in Italy after Prime Minister Draghi lost support of a major coalition partner which briefly drove the euro below parity against the dollar, helping the U.S. Dollar Index secure its third consecutive weekly gain with the Index reaching its highest level since September 2002.

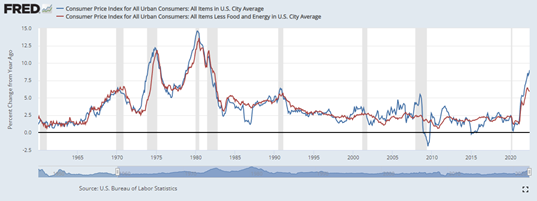

Wednesday saw the release of the June CPI report, which showed a 1.3% month-over-month increase that lifted the yr/yr growth rate to 9.1%, a level not seen since late 1981.

The food index was up 9.1% year-over-year while the energy index was up a stunning 41.6% year-over-year. Thursday's release of the June PPI report did little to soothe fears about inflation as headline PPI increased 1.1% month-over-month, lifting the yr/yr PPI rate to 11.3%, just shy of the March peak (11.5%).

Bank earnings for Q2 began coming in during the latter part of the week, starting with disappointing reports from JPMorgan Chase and Morgan Stanley.

Comments from JPM CEO Dimon received a lot of attention after he expressed worries about unprecedented tightening in the face of significant global turmoil.

Equities finished their down week on a positive note, drawing some support from the preliminary University of Michigan Consumer Sentiment survey for July, which showed an improvement in sentiment due to a dip in inflation expectations after the recent drop in energy prices.

This was a positive development, but it could be reversed in a flash if energy prices continue rebounding. WTI crude fell past its 200-day moving average (93.57) to a level not seen since late February on Thursday but bounced to finish Friday's session up $7.38, or 8.2%, above its low from Thursday.

Energy prices have fallen from $123.70 in March to $93.67 last week… that is a decline from the highs of over 20%, which would define one of the shortest Bear Markets in history. Not quite 4 months… this volatility is unprecedented.

With everyone focusing on the Fed, we are watching the markets and are impressed with their behavior of late… very constructive, but we have much work to do to turn this battleship around.

We remain positive and constructive on 2H… and are hoping for the Fed to make responsible comments after the next rate hike, about waiting to see results of these hikes to determine policy moving forward. That could go a long way to rebuilding confidence in the markets!

Market Snapshot…

- Oil Prices –West Texas Intermediate crude rose $2.38 or 2.5% to $98.16/barrel while Brent crude futures were up $2.50, or 2.5%, to settle at $101.60/barrel.

- Gold – Gold declined a fifth straight week as the dollar strengthened. Spot gold lost 2% to $1,705.39 per ounce, while U.S. gold futures eased 0.13% to $1,703.6 per ounce. Silver finished the week at $18.594.

- U.S. Dollar – The dollar index was at $108.04 as investors evaluated how high the Fed is likely to raise interest rates later this month. Euro/US$ exchange rate is now 1.026.

- U.S. Treasury Rates – The yield on 10-year Treasury note fell 3 basis points to roughly 2.926%.

- Asian shares were up in overnight trading.

- European Markets are trading in the green.

- Domestic markets are trading higher this morning.

Despite some negative announcements from the major banks as they build up their reserves for a possible recession, 60% of S&P 500 companies who have reported so far have positively surprised on both top and bottom lines. So far, the earnings growth rate for the quarter is 4.2%, in line with projections (Source: Factset).

This is just a sliver of the broad market, but these results could indicate that analyst estimates may be too pessimistic.

In addition to earnings, there are a few other key data releases due, mostly around housing. The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index will post on today. Housing starts are out Tuesday, and existing home sales are due Wednesday. On Thursday, there is the Philadelphia Fed manufacturing survey. Finally, both manufacturing and services PMI are released on Friday.

Have a wonderful week!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.