The Week in Review 6/13/22

“The only thing you can be sure of is that there are times when large numbers of stocks are priced too high and other times when they're priced too low.” - Benjamin Graham

Good Morning ,

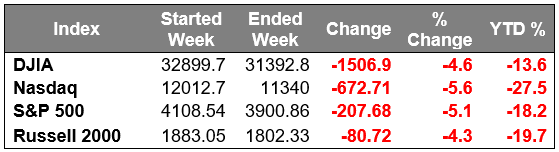

The major indices pushed higher on Monday and Tuesday, but from Wednesday to Friday it was all downhill. It was a steep decline, too.

After Tuesday's session, the S&P 500 was up 1.3% for the week. By the close on Friday, the S&P 500 was down 5.1% for the week and sitting at 3,900.

A succinct summation of this week's action boils down to a contention that growth concerns were at the heart of it. There were multiple developments contributing to those concerns:

- Target cut its Q2 operating margin guidance to around 2%, only three weeks after saying it would be 5.3%, citing a need to clear excess inventory.

- Intel said the macro environment has been weaker and that circumstances at this point are much worse than it had anticipated coming into the quarter.

- Scotts Miracle-Gro slashed its FY22 EPS outlook well below the consensus estimate, noting its fixed cost structure has seen significantly greater pressure due to replenishment orders from retail partners not being what it expected since mid-May

- WTI crude futures went as high as $123.18/bbl while natural gas futures hit $9.66/mmbtu.

- The OECD (Organization for Economic Cooperation and Development) cut its 2022 global GDP view to 3.0% from 4.5% and the Atlanta Fed's GDPNow model estimate for Q2 was reduced to 0.9% from 1.3%.

- The Reserve Bank of Australia and the Reserve Bank of India both raised their key policy rates more than expected.

- The ECB said it intends to raise its key interest rates by 25 basis points at the July meeting and that it will follow suit with more rate hikes in September and beyond. It also announced the end of its net asset purchase program on July 1 and raised its 2022 annual inflation forecast to 6.8% from 5.1% and its 2023 annual inflation forecast to 3.5% from 2.1%.

- Several Shanghai districts were back in lockdown for COVID testing and entertainment venues in a Beijing district were closed amid COVID concerns.

- The Index of Consumer Sentiment for June hit the lowest level on record (50.2) dating back to 1978.

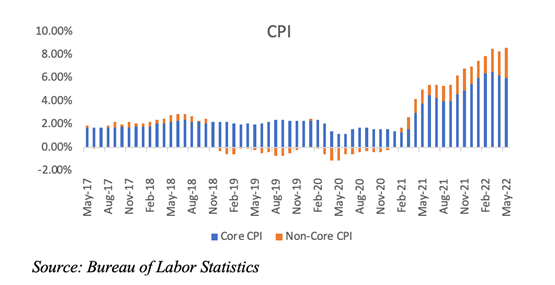

- Total CPI increased 8.6% year-over-year in May, marking its largest increase since December 1981. Core CPI was up 6.0% year-over-year, down from 6.2% in April but still a long way from the Fed's longer-run inflation goal of 2.0%.

Whew… the latter was the punctuating factor in an otherwise lousy week, as it sparked concerns about the Fed pursuing more aggressive policy actions to get inflation under control. Those concerns showed up in the Treasury market on Friday, as well as in the stock market.

The 2-yr note yield spiked 22 basis points to 3.04% following the CPI report while the 10-yr note yield jumped 11 basis points to 3.16%. That left the 2s10s spread at just 12 basis points versus 27 basis points when the week began.

The S&P 500 for its part fell nearly 3.0% on Friday (the Nasdaq dropped 3.5%) on broad-based selling interest. The main issue for market participants wasn't just the worrisome inflation news.

Rather, it was the recognition that the Fed is apt to be more aggressive with its policy actions, which will crimp economic growth prospects and, in turn, crimp earnings prospects.

Accordingly, there were pressing doubts that the market provided true value at current levels because forward earnings estimates have yet to come down in any meaningful fashion despite a lot of writing on the wall that suggests the economic climate ahead is going to be much more challenging.

The selling, therefore, was widespread, finishing off a week that featured losses for all 11 S&P 500 sectors ranging from 0.9% to 6.8%.

The best-performing sector of the week of course was energy. It declined 0.9%, having been insulated somewhat from the selling that hit hard elsewhere on account of the rise in energy prices. The next best-performing sector was consumer staples, which fell "only" 2.6%.

The hardest-hit sectors this week were financials (-6.8%), information technology (-6.4%), real estate (-6.2%), consumer discretionary (-6.1%), and materials (-5.8%). Separately, the Dow Jones Transportation Average declined 7.5%.

Market Snapshot

- Oil Prices–West Texas Intermediate crude fell 0.7% to $120.61/barrel while Brent crude fell $1.19, or 1%, to $121.88/barrel.

- Gold – Spot gold rose 1.4% to $1,873.58 per ounce, while U.S. gold futures rose 1.3% to $1,876.50 per ounce. Gold’s fate next week may hinge on the Fed meeting. Silver finished the week at $21.931.

- U.S. Dollar – The dollar index was 0.8% higher at $104.16, its highest since May 17, and within sight of $105.01, the two-decade high touched in mid-May. Euro/US$ exchange rate is now 1.06.

- U.S. Treasury Rates – Treasury yields spiked higher after an unexpectedly hot reading in consumer prices. The yield on 10-year Treasury note advanced 11 basis points to 3.15%.

- Asian shares were much lower in overnight trading.

- European Markets are trading in the red.

- Domestic markets are trading down sharply again this morning.

This week will give us May’s PPI report on Tuesday, Retail Sales on Wednesday, and housing data on Thursday. These reports will give more clarity on how consumers are handling inflation and which goods/services are likely to see pass-through in the coming months.

The most important event this week will be Wednesday’s FOMC meeting when the Fed will make its decision on interest rates. The market expects a 50 basis points hike.

As we have mentioned recently, we may need to test the recent lows to get some investor confidence and a meaningful bottom… the low for the S&P 500 for 2022 is 3,810 which we will test on the open today.

We still believe that we will avert a recession, but it will be up to the Fed to not over-react… and that can be dicey, as we all know.

Have a good week, this too shall pass…

Michael D. Hilger, CEP®

Managing Director

Senior Vice President, Wealth Management

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.