This Week in Review 3/7/2022

“Failure is simply the opportunity to begin again, this time more intelligently.”

Henry Ford

Good Morning,

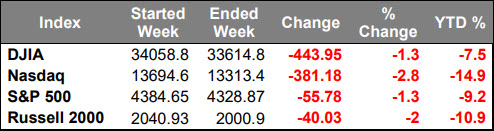

The stock market was pummeled again last week by a 25% pop in oil prices, which was driven by worsening developments surrounding Russia's invasion of Ukraine. The Nasdaq Composite dropped 2.8%, followed by losses in the Russell 2000 (-2.0%), Dow Jones Industrial Average (-1.3%), and S&P 500 (-1.3%).

WTI crude futures finished the week at $115.27 per barrel, which was responsible for the 9.3% gain in the S&P 500 energy sector. The utilities (+4.8%), real estate (+1.7%), and health care (+1.2%) sectors also closed higher amid some defensive positioning.

The biggest laggards were found in the financials (-4.9%), information technology (- 3.0%), communication services (-2.7%), and consumer discretionary (-2.6%) sectors, which dropped between 2-5%.

Last week, Russian forces attacked civilian areas and seized Europe's largest nuclear power plant in Ukraine. Russia was undeterred by an expansion of sanctions, which blocked select Russian banks from the SWIFT financial transactions system and prevented Russia's central bank from accessing its foreign currency reserves.

Two rounds of ceasefire talks produced only an agreement to designate humanitarian corridors to safely evacuate civilians from the country. The threat of nuclear conflict (President Putin also put his nuclear forces on high alert) worsened the market's already low spirits.

Fed Chair Powell said the central bank would "proceed carefully" because of the geopolitical uncertainty and that he would support hiking rates by 25 basis points later this month. He acknowledged though, that a 50-bps hike is still possible in the future if inflation is higher than expected.

On a related note, Russia's central bank hiked its key rate to 20.0% from 9.5% to protect the ruble, which plunged against the dollar. The U.S. Dollar Index rallied 1.9% to 98.50 amid weakness in the euro.

The Treasury market was a billboard sign for growth concerns, which were exacerbated by disappointing guidance from some high-growth story stocks, a relatively disappointing ISM Non-Manufacturing Index for February, and stagnant wage growth for February in an escalating inflationary environment.

The 10-yr yield dropped 27 basis points to 1.72%, and the 2-yr yield dropped 10 basis points to 1.49% amid expectations for the Fed to be less aggressive when it comes to removing policy accommodation.

Providing more color on the move in oil, prices received little relief from an agreement among 31 IEA (International Energy Agency) member countries to release 60 million barrels of oil from their reserves. Crude futures leveled off amid speculation that a nuclear deal with Iran could be signed soon, then rallied back to the highs on news that the White House is considering a ban on Russian oil imports.

Market Update:

- Oil Prices - U.S. West Texas Intermediate (WTI) crude rose $8.01, or 7.4%, to settle at $115.68 — the highest close since September 2008. During the week, WTI rose to its highest intraday since September 2008.

- Gold - Spot gold prices jumped 1% to $1,954.53 per ounce and was up about 3.5% for the week so far. U.S. gold futures climbed 1.1% to $1,956.70. Silver finished the week at $25.789.

- U.S. Dollar - The dollar rallied, pushing the greenback up 2% on the week. Euro/US$ exchange rate is now 1.106.

- U.S. Treasury Rates - The yield on the benchmark 10-year Treasury note dropped more than 10 bps to around 1.73%. The yield on the 30-year Treasury bond fell 7 bps to roughly 2.15%.

- Asian shares were lower.

- European markets are trading in the red.

- Domestic markets are again trading lower..

We continue to proceed with caution. There are plenty of good companies out there that will overcome supply issues and continue to protect their margins, others (like the oil sector) that actually benefit from the inflationary environment, and others that may not do as well in a rising rate scenario. But, ultimately in a post pandemic economy, there is value to be discovered.

As the market discounts prices, we are putting our cash to work buying rising dividends which we expect to prevail beyond this crisis.

We are committed to the discovery of value in the search for underpriced strong balance sheets with proven dividend-paying track records. While uncertainty is always unsettling, we can overcome what lies ahead and invest for the long term by finding the value. In our view, priceless are very attractive!

Have a good week!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all avaliable data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.