With election day over, how will the results impact the markets?

By Morgan Weil, CFP®

Senior Wealth Manager & Financial Advisor, RJFS

How will the election results impact your financial future?

Now that Election Day has passed, many are considering what the new leadership could mean for both their financial future and the country as a whole. While elections often evoke strong emotions, it's important to keep in mind that, historically, markets are driven more by economic fundamentals than by the party in power.

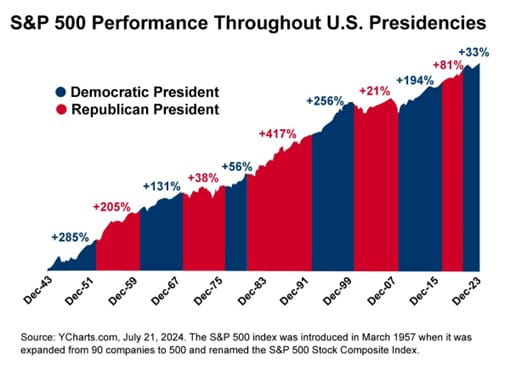

As this chart demonstrates, although the stock market has experienced fluctuations under presidents from both parties, the S&P 500 has generally trended upward over the long term, regardless of who occupies the Oval Office.1

- The stock market, as represented by the S&P 500, has generally trended higher over the long term, regardless of which party holds the presidency.

- The dynamic U.S. economy has consistently produced successful companies, contributing to economic strength under various administrations.

- Factors like earnings growth, economic conditions, and technological advancements can have more influence on market performance than political changes.

- Your investment strategy should align with your goals, time horizon, and risk tolerance—not the outcome of a single election.

While elections certainly have consequences, it’s important to maintain perspective. In the coming months, we’ll be closely watching how the new administration’s agenda could affect areas like tax policy, regulations, and corporate competitiveness. While market reactions to political changes can cause short-term volatility, these fluctuations are often temporary.

As always, the key is to stay focused on your long-term financial goals. Reacting impulsively to short-term events can often do more harm than good. We’re here to guide you through any uncertainty while helping you stay on track with your overall financial strategy.

If you have questions about how current events might impact your investments or would like to review your financial plan, don’t hesitate to reach out.

Regards,

JEFFREY HENDEL, CRPC®, AAMS®, CFS®, AIF®

President & CEO, HWMG

Senior Financial Advisor, RJFS

O 631-239-3000

F 631-337-8900

95 Smithtown Blvd

Smithtown, NY 11787

The highest compliment we can receive is a referral of your family, friends and business associates.

Jeffrey Hendel of Hendel Wealth Management Group was named on the 2024 Forbes Best-in-State Wealth Advisor list. Check out the most recent Forbes Best-in-State list here.

2024 Forbes Best-In-State Wealth Advisors, developed by Shook Research, is based on the period from 6/30/2022 to 6/30/2023 and was released on 4/3/2024. 42,108 nominations were received and 8,500 advisors won. Neither Raymond James nor any of its advisors pay a fee in exchange for this award. More: https://bit.ly/43DMgjX. Please see https://www.forbes.com/best-in-state-wealth-advisors for more info.

Hendel Wealth Management Group is not a registered broker/dealer and is independent of Raymond James Financial Services. Investment advisory services offered through Raymond James Financial Services Advisors, Inc.

Stocks are measured by the Standard & Poor's 500 Composite Index, an unmanaged index considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. Stock price returns and principal values will fluctuate as market conditions change. Shares, when sold, may be worth more or less than their original cost.

1. Chart https://go.ycharts.com/hubfs/How_Do_Presidential_Elections_Impact_the_Market/Election_Guide.pdf

Any opinions are those of Jeffrey Hendel and not necessarily those of Raymond James.