Beyond the Noise: The Impact of the Fed’s Monetary Policy and the U.S. Presidential Election

As we enter the final quarter of 2024, two pivotal developments have emerged as focal points for the markets: the Federal Reserve’s decision to cut interest rates and the anticipation surrounding the upcoming U.S. Presidential election. As these situations continue to evolve, it's essential to understand how they may shape the financial landscape, while keeping in mind that the long-term implications for your portfolio may be less direct than immediate market reactions suggest.

The Fed's move to lower interest rates by 0.50%, to a target range of 4.75%-5.00%, marks a significant shift in the Central Bank’s monetary policy. This downward revision, the first cut in over four years, aims to engineer a soft landing. The Fed’s announcement cited slowing job gains, rising unemployment, and continued progress towards the target 2% annual inflation rate as reasons for this shift in policy. Additionally, the Fed set expectations for further rate cuts of 0.50% by the end of 2024.

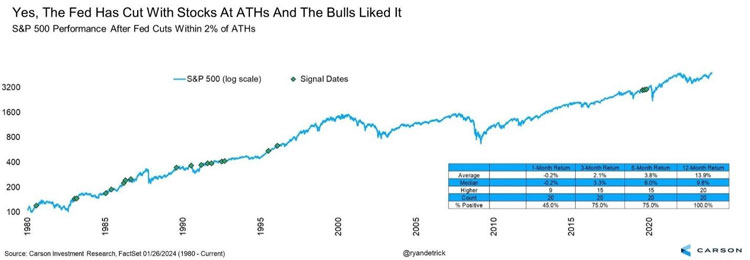

History doesn’t repeat itself, but it often rhymes. Historically, such interest rate reductions have bolstered equities, even when the stock market was brushing up against all-time highs. According to Carson Investment Research, since 1980, there have been 20 instances where the Fed cut rates with the S&P 500 within 2% of its peak. In every instance, the index was higher 12 months later, with an average return of 13.9%. We anticipate this instance of more accommodative monetary policy will, like past instances, serve as a tailwind to corporate earnings and be supportive of higher stock prices in the future.

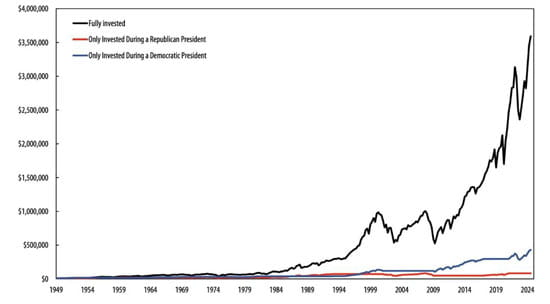

Transitioning from monetary policy to the political arena, there has been a lot more noise lately regarding the U.S. Presidential election. It’s important to keep in mind that while the outcome of this election is significant in many respects, it has limited long-term implications for your portfolio. Despite the short-term market volatility that often accompanies political cycles, historical data shows that the stock market has prospered under a variety of administrations, a point highlighted by the accompanying chart from First Trust.

Staying fully invested throughout changes in Presidential administrations has significantly outperformed partisan market timing. This perspective is crucial as we navigate through the election season, where sensational headlines and personal biases can often distract from the fundamental principles of long-term investing. The reality is that the effects of election outcomes on the markets are generally short-lived and overemphasized. Ultimately, America prevails.

While we expect short-term market fluctuations spurred by new economic data, interest rate changes, and the election, our overarching philosophy is to look beyond the immediate horizon and maintain a long-term perspective. We encourage you not to let pundit predictions or market noise sway your investment decisions. They will not sway ours. We will continue to prioritize diversification and disciplined rebalancing, irrespective of transient political events. In addition, we remain committed to guiding you through these fluctuations and ensuring that your investments are aligned not just with current conditions but with your future goals.

As we approach the end of the year, we wish you and your families good health and happiness. Your continued trust in our team is our greatest asset and we are deeply grateful for the opportunity to support you. We look forward to navigating the future together, through many more interest rate and election cycles.

S&P 500 is an unmanaged index that represents 400 industrial, 20 transportation, 40 utilities and 40 financial companies that is generally considered representative of the U.S. market.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of the author and not necessarily those of Raymond James. Diversification does not ensure a profit or guarantee against a loss. Rebalancing a non-retirement account could be a taxable event that may increase your tax liability.