The S&P 500 Gained Over 20% Last Year. Now What? | 2025 Pros & Cons | Dogs of the Dow

The S&P 500 Gained over 20% Last Year. Now What?

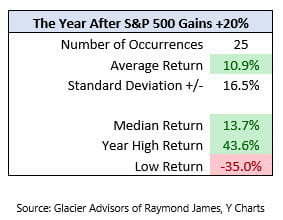

You will hear a ton of opinions on this matter over the next few weeks. Instead of inserting our opinion, let’s look at the facts. We pulled the historical returns for the S&P 500 (including dividends) since 1926. Then we asked, “After the market was up 20% or more, what did the next year look like?” For those who like data over opinions, here’s the results:

The average return is 10.9%. A great number! And for you stat nerds like us, using standard deviation, we can say that there is a 68% chance market returns will fall between -5.6% and 27.4%. We like our odds heading into the new year.

The year ahead will not be perfect. We expect greater volatility and moderated returns compared to 2024. Like the previous Trump presidency, there will be a lot of noise from the media. For that reason, we encourage our investors to look past the immediate and look long-term. Wealth isn’t built overnight. Create a plan. Stick to the plan.

2025 Pros & Cons

Here’s our pros and cons list. Just a list. Interpret it however you’d like.

Pros:

- American Exceptionalism – the US remains the most resilient and attractive economy.

- History is on our side (see table above).

- Expected deregulation and tax cuts across industries.

- M&A activity expected to increase as new FTC chair is ushered in.

- Large pockets of the market are undervalued.

Cons:

- Policy uncertainty – What parts of the Trump agenda will become law?

- High market concentration – Fewer stocks make up a larger % of the S&P 500.

- Mega-Cap Valuations – the famous tech and AI stocks are overvalued.

- Interest rates are still high and look to remain so.

- Inflation moving up again.

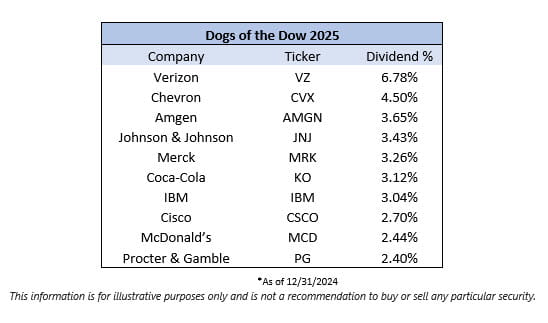

Looking to Buy Low? Check out the Dogs of the Dow

The Dogs of the Dow is an investment approach where investors pick the ten highest dividend-yielding stocks from the Dow Jones Industrial Average (DJIA) at the start of each year. This method gained popularity through Michael B. O'Higgins' 1991 book, "Beating the Dow." The concept is that these high-yield stocks, often labeled as "dogs" due to their lower prices, are undervalued and have the potential for price increases. By targeting these blue-chip companies, investors aim to gain from both substantial dividend payouts and potential stock price appreciation.

One key to the strategy's success is its straightforward and systematic nature. Investors don't need to perform complex analyses or time the market; they simply rebalance their portfolio by selecting the top ten dividend-yielding stocks from the DJIA. This strategy takes advantage of the stability and reliability of blue-chip companies, which are less likely to reduce dividends even during economic downturns. The strategy has historically delivered competitive returns compared to the broader market. By focusing on high-yield stocks, investors often purchase shares in companies that are temporarily undervalued, providing significant upside potential as these companies recover.

Here's the official list for 2025:

Before buying any of these, understand how it fits into your broader investment picture. Work with trusted advisors to build out an investment plan.

Happy New Year!

- Brett Miller, CFA, CFP® - Financial Advisor

- Scott Miller – Senior VP, Investments

Any opinions are those of the authors and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained in this material does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. It is not possible to invest directly in an index.