Are You Worried About the Election? Your Investments Are Not.

With every election cycle the same phrases come up: “I’ll wait until after the election to invest.” “I’m worried that the candidate I don’t like will ruin the economy.” … and the list goes on.

Given the click-bait headline era in which we live, it’s important to take a step back from the noise and consider the facts. Numbers can tell us a story absent from opinion. So, we compiled some interesting charts from our research partners about the market and presidential elections. We hope the results speak loudly and help you understand the importance of sticking to a long-term investment ideology when putting your money to work.

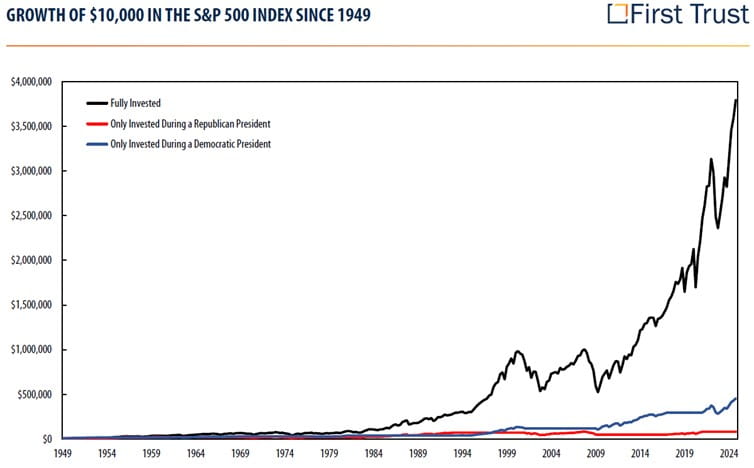

To start, the focus of this blog is to show, with data, that politics don’t matter with regards to S&P 500 investment results. Having your money on the sidelines for political reasons destroys long-term returns. The first chart from First Trust shows the outcome if you only invested during one party’s presidency vs. remaining fully invested. Simple conclusion: Sitting it out for politics is punishing.

Source: First Trust, Standard & Poor’s

Next, what about congress? Below we see returns during the congressional control of presidencies.

Source: First Trust, Morningstar, Bloomberg

Please note that all periods produced positive returns. But what we find more interesting is that of the best returns come from a split government. A split government means more compromise when passing legislation. When our law makers are compromising and working together for solutions, it’s win-win for investors and Americans. Markets performed best under a Democratic President and a Republican Congress – again, pointing to the benefit of cooperation, deliberation, and compromise in law-making. The next chart drives home the same point but focused on solely congressional control.

Source: Carson Investment Research, CNBC.com

It’s hard to ignore what we are emotionally attached to, like elections, when making our investment decisions. Two things can help: 1. Partner with a financial advisor to look at the big picture. Removing emotions from your money can lead to the best long-term outcomes. 2. Understand the data. Data can help us remove emotion from our decision making and support our views with facts.

Brett Miller, CFA, CFP® Financial Advisor

Scott Miller Senior VP, Investments

Any opinions are those of Brett Miller, CFA, CFP® and Scott Miller and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained in this material does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.